- United States

- /

- Consumer Durables

- /

- NYSE:GRBK

Green Brick Partners (GRBK): Assessing Valuation After Exclusive James Hardie Deal Renewal Through 2028

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 14.9% Overvalued

The latest and most widely followed narrative points to Green Brick Partners being overvalued by nearly 15 percent compared to analyst fair value estimates, based on fundamental factors and forward-looking metrics.

“Elevated interest rates and persistent affordability headwinds are prompting Green Brick to increase price concessions and incentives, now 7.7% of unit revenue, up from 4.5% year over year, leading to declining average sales prices and compressing homebuilding gross margins. Further margin deterioration or stagnant revenue could result if rates remain high or rise further.”

Is the current price living on borrowed time? Beneath the surface, analysts are betting on powerful forces, such as shrinking profit margins and earnings revaluation, that could reshape the company’s market standing. Want to know what future financial projections and critical profit benchmarks are pushing this value assessment above the Street’s target? Dive in and see what’s got investors on edge.

Result: Fair Value of $62.0 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing strong home closings and robust margins in high-growth Texas and Atlanta markets could offer upside if housing demand picks up again.

Find out about the key risks to this Green Brick Partners narrative.Another View: SWS DCF Model Checks the Fundamentals

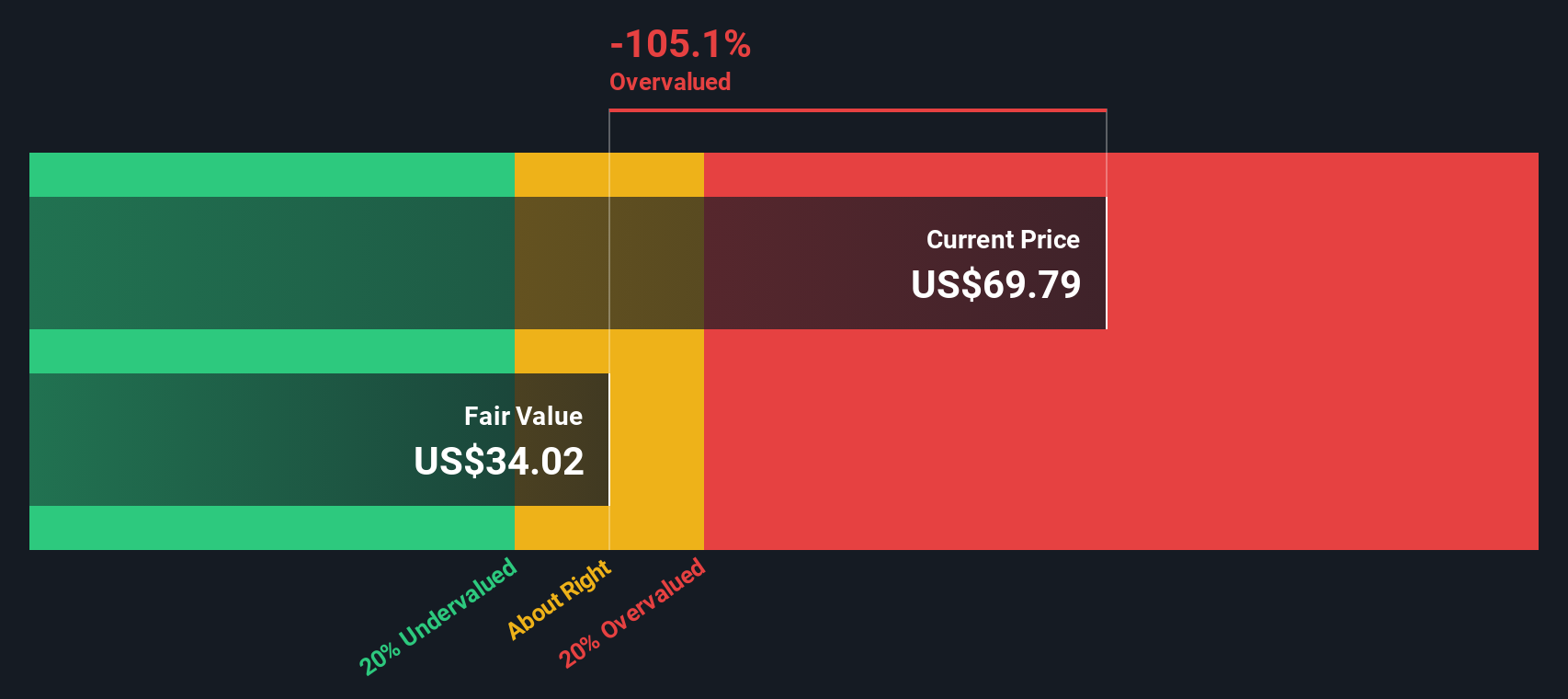

While the popular narrative sees Green Brick Partners as overvalued based on analyst forecasts and typical market ratios, our SWS DCF model takes a different approach by projecting long-term cash flows to test that assumption. Does the DCF result offer a new reason to pause?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Green Brick Partners to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Green Brick Partners Narrative

If you see things differently, or want to dig into the numbers yourself, you can shape a personalized view in just a few minutes. Do it your way

A great starting point for your Green Brick Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on the chance to uncover standout opportunities beyond Green Brick Partners. Let Simply Wall Street help you find companies with the right mix of potential, growth, and reliability.

- Target proven businesses delivering solid income streams by checking out companies boasting dividend stocks with yields > 3% for yields above 3%.

- Catch the next tech wave and see which AI penny stocks are redefining growth potential in the artificial intelligence space.

- Beat the crowd by pinpointing value plays before the market does, with a focus on undervalued stocks based on cash flows rooted in strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRBK

Green Brick Partners

Green Brick Partners, Inc (NYSE: GRBK), the third largest homebuilder in Dallas-Fort Worth, is a diversified homebuilding and land development company that operates in Texas, Georgia, and Florida.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives