- United States

- /

- Consumer Durables

- /

- NYSE:GRBK

A Fresh Look at Green Brick Partners (GRBK) Valuation After Earnings Upgrades and Analyst Optimism

Reviewed by Simply Wall St

Green Brick Partners (GRBK) has just been elevated to a #2 (Buy) ranking from Zacks, as consensus earnings estimates jumped 8% in the past quarter. This shift reflects analysts’ growing optimism about the company’s trajectory.

See our latest analysis for Green Brick Partners.

Green Brick Partners’ share price has rallied 22.7% year-to-date to $67.95, supported by renewed optimism and positive earnings sentiment from analysts. While recent momentum is clear, the 1-year total shareholder return remains slightly negative, indicating the company is still regaining its stride after prior volatility and outsized multi-year gains.

If Green Brick’s renewed momentum has you reconsidering where growth and leadership intersect, now is the perfect moment to discover fast growing stocks with high insider ownership.

The company’s recent surge and upbeat sentiment set the stage for a key question: Is Green Brick still trading at a bargain, or has the market already priced in its next wave of growth?

Most Popular Narrative: 9.6% Overvalued

With Green Brick Partners closing at $67.95 and the consensus narrative pegging fair value at $62.00, the stock trades at a premium in the eyes of most analysts. This sets a key expectation mismatch for investors to scrutinize.

Elevated interest rates and persistent affordability headwinds are prompting Green Brick to increase price concessions and incentives, now 7.7% of unit revenue, up from 4.5% year over year. This has led to declining average sales prices and compressing homebuilding gross margins. Further margin deterioration or stagnant revenue could result if rates remain high or rise further.

Wondering what assumptions make this valuation tick? One major pillar in this narrative is the expectation that profit margins and earnings will shift in a dramatic, industry-defining way. The calculations rely on projections many would call ambitious. Do you want to see what numbers get baked in and why?

Result: Fair Value of $62.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, record home closings in key markets and the potential for strong margins could offset bearish forecasts if demand remains resilient.

Find out about the key risks to this Green Brick Partners narrative.

Another View: A Different Angle on Value

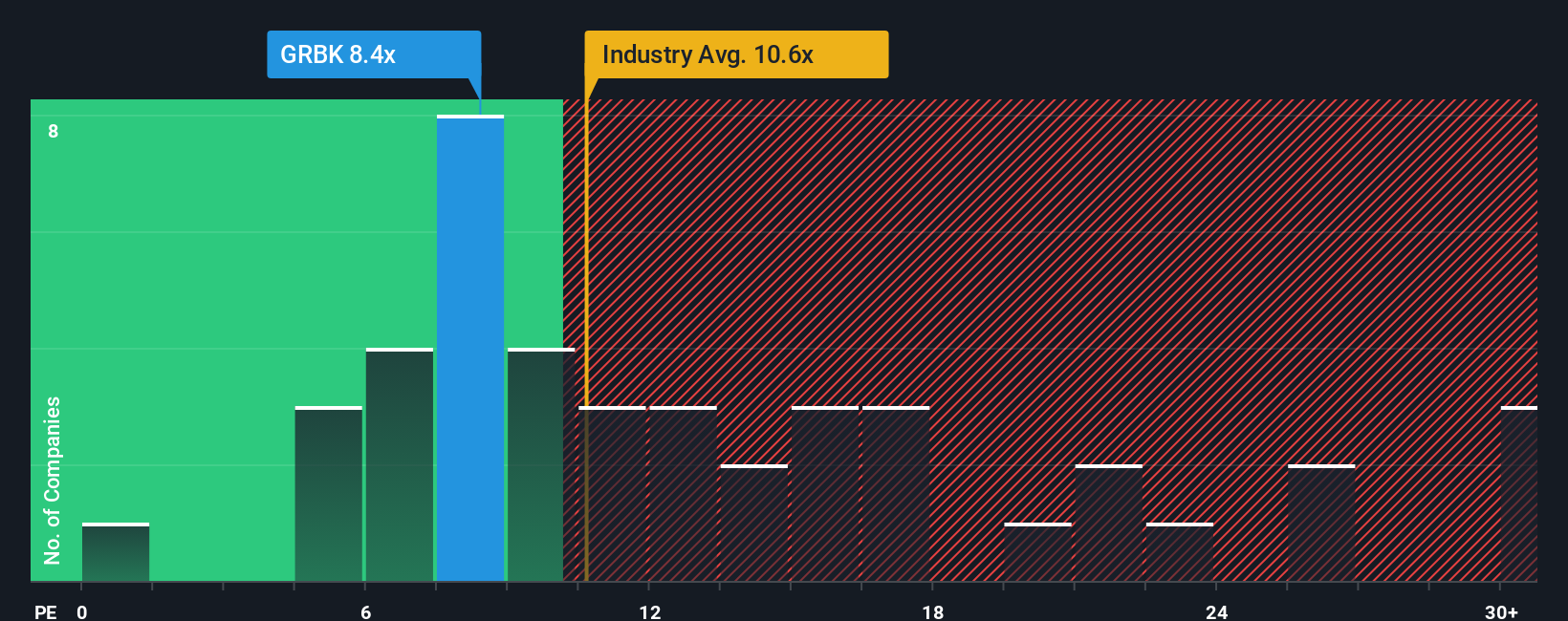

While analyst narratives peg Green Brick Partners as overvalued, a look at the company’s price-to-earnings ratio tells a more nuanced story. At 8.8 times earnings, Green Brick trades below the U.S. Consumer Durables industry average of 11.8, and also under its fair ratio of 9.2. This suggests the market might not be pricing in as much risk or opportunity as it could. Is there hidden value, or is caution still warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Green Brick Partners Narrative

Not convinced by the consensus or want to dive deeper into the numbers yourself? You can construct a personalized view backed by the data in just a few minutes, so why not Do it your way?

A great starting point for your Green Brick Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You’re just a few clicks away from finding your next big opportunity, so don’t settle for the obvious. Use these unique strategies to get ahead:

- Tap into tomorrow’s winners with these 924 undervalued stocks based on cash flows, which uncovers stocks poised for breakout returns based on undervalued cash flows and strong fundamentals.

- Catch early movers shaking up technology and society by scanning these 26 AI penny stocks to get ahead of trends in artificial intelligence innovation.

- Boost your portfolio’s passive income with these 14 dividend stocks with yields > 3%, featuring companies offering consistently high dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRBK

Green Brick Partners

Green Brick Partners, Inc (NYSE: GRBK), the third largest homebuilder in Dallas-Fort Worth, is a diversified homebuilding and land development company that operates in Texas, Georgia, and Florida.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.