- United States

- /

- Leisure

- /

- NYSE:GOLF

How Acushnet Holdings' (GOLF) Outperformance Amid Peer Weakness Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this month, Acushnet Holdings reported a 5.4% year-on-year revenue increase and exceeded analysts’ EBITDA expectations, delivering stronger-than-expected quarterly results while its main peers posted mixed or weak outcomes.

- This performance not only spotlights Acushnet’s operational momentum but also distinguishes it within the leisure products sector, where competitors did not meet market forecasts.

- With Acushnet’s solid revenue growth outpacing analyst projections, we’ll explore how this shapes the company’s investment narrative and outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Acushnet Holdings Investment Narrative Recap

To be a shareholder in Acushnet Holdings, you need to believe that the global growth in golf participation and ongoing product innovation will support long-term demand, even as overall revenue and earnings growth are forecast to slow. The latest quarterly results delivered a revenue increase and EBITDA beat, but these positive surprises do not appear to materially alter the main short-term catalyst: continued consumer adoption of premium golf products. The biggest risk remains margin pressure from tariffs and inflation, which could dampen profitability if costs persist.

Of recent company announcements, Acushnet’s steady share repurchase activity stands out, as the company bought back 1,348,369 shares for US$88.37 million last quarter. This ongoing commitment to returning capital to shareholders is relevant context for any discussion about catalysts such as strong brand loyalty and premium positioning, which can underpin both market share and price premium, critical levers for the stock’s short-term and long-term appeal.

By contrast, investors should be especially aware of potential margin headwinds from tariffs and inflation, as...

Read the full narrative on Acushnet Holdings (it's free!)

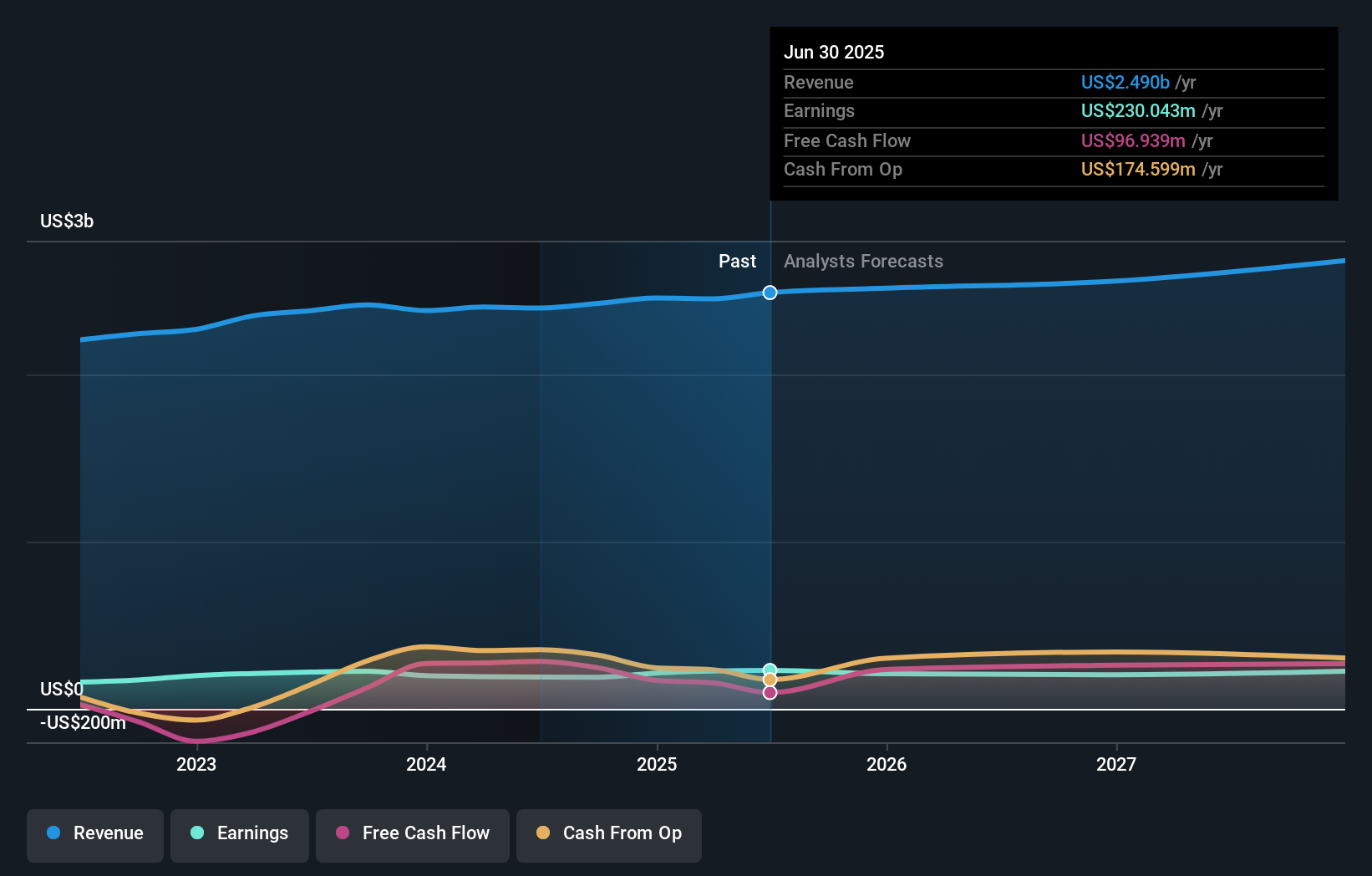

Acushnet Holdings is projected to reach $2.7 billion in revenue and $208.8 million in earnings by 2028. This outlook requires 2.5% annual revenue growth, but earnings are forecast to decrease by $21.2 million from the current $230.0 million.

Uncover how Acushnet Holdings' forecasts yield a $75.86 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates range from US$75.86 to US$103.98, highlighting diverging views. Against this backdrop, current margin pressures remain a focal point for your assessment of Acushnet’s performance and outlook.

Explore 3 other fair value estimates on Acushnet Holdings - why the stock might be worth 7% less than the current price!

Build Your Own Acushnet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Acushnet Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Acushnet Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Acushnet Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GOLF

Acushnet Holdings

Designs, develops, manufactures, and distributes golf products in the United States, Europe, the Middle East, Africa, Japan, Korea, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives