- United States

- /

- Leisure

- /

- NYSE:GOLF

Here's What To Make Of Acushnet Holdings' (NYSE:GOLF) Decelerating Rates Of Return

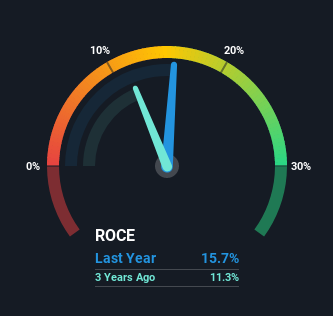

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, the ROCE of Acushnet Holdings (NYSE:GOLF) looks decent, right now, so lets see what the trend of returns can tell us.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Acushnet Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = US$246m ÷ (US$2.0b - US$399m) (Based on the trailing twelve months to March 2021).

Thus, Acushnet Holdings has an ROCE of 16%. That's a relatively normal return on capital, and it's around the 20% generated by the Leisure industry.

View our latest analysis for Acushnet Holdings

In the above chart we have measured Acushnet Holdings' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Does the ROCE Trend For Acushnet Holdings Tell Us?

While the returns on capital are good, they haven't moved much. The company has consistently earned 16% for the last five years, and the capital employed within the business has risen 78% in that time. Since 16% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

On a side note, Acushnet Holdings has done well to reduce current liabilities to 20% of total assets over the last five years. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

The Bottom Line

The main thing to remember is that Acushnet Holdings has proven its ability to continually reinvest at respectable rates of return. And the stock has done incredibly well with a 114% return over the last three years, so long term investors are no doubt ecstatic with that result. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

If you're still interested in Acushnet Holdings it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

While Acushnet Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you decide to trade Acushnet Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:GOLF

Acushnet Holdings

Designs, develops, manufactures, and distributes golf products in the United States, Europe, the Middle East, Africa, Japan, Korea, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives