- United States

- /

- Consumer Durables

- /

- NYSE:DHI

D.R. Horton (DHI) Valuation: Is There Still Upside After a Strong Year-to-Date Gain?

Reviewed by Simply Wall St

D.R. Horton (DHI) has been on the radar for investors recently, showing a mix of stock performance across different timeframes. With a year-to-date gain of 15%, it stands out even as the past month shows a slight dip.

See our latest analysis for D.R. Horton.

Even after a slight pullback recently, D.R. Horton’s year-to-date share price gain underscores momentum that has built steadily over time. While short-term price moves hint at shifting sentiment, the long-term total shareholder return, up 108% over three years, really highlights the company’s enduring growth story.

If you’re curious to see which other companies have quietly outperformed and attracted strong insider interest, now is a perfect moment to broaden your search with our fast growing stocks with high insider ownership

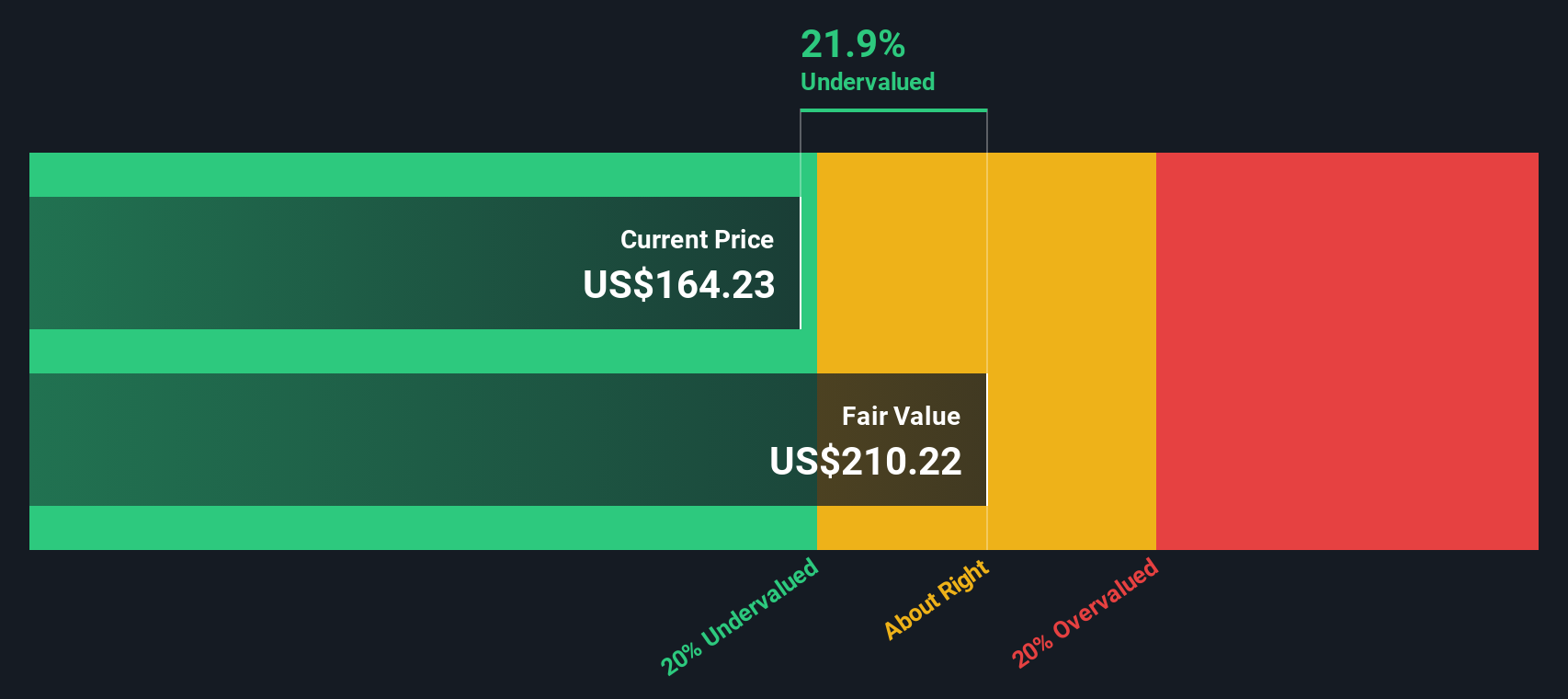

With recent gains offset by a short-term dip and estimates suggesting the stock trades close to analyst targets, the question now is whether there is still value left for investors or if future growth is already factored in.

Most Popular Narrative: 4.2% Undervalued

Analyst consensus now values D.R. Horton above its recent close, signaling room for upside if the forecast holds. The updated fair value incorporates fresh sector optimism and stronger recent earnings results.

Vertical integration, efficient operations, industry consolidation, and disciplined financial management enable cost control, margin protection, and consistent market share gains.

Is the secret behind this valuation a future earnings surge, aggressive share buybacks, or stubbornly resilient profit margins? The narrative leans into several upward financial assumptions but leaves one crucial variable as the linchpin of the whole thesis. Want to see which? Dive in to unpack the logic and surprises behind this price target.

Result: Fair Value of $164.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability pressures and elevated incentives could squeeze margins and reduce revenue if market volatility continues or consumer sentiment declines.

Find out about the key risks to this D.R. Horton narrative.

Another View: Our DCF Model Suggests Fair Value Is Lower

Looking at D.R. Horton through the lens of the Simply Wall St DCF model tells a different story. This approach puts fair value at $111.15, which is well below both the market price and analyst targets. Could the market be too optimistic, or is the DCF missing something essential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out D.R. Horton for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own D.R. Horton Narrative

If you see things differently or would rather develop your perspective, you can quickly craft your own narrative in just a few minutes. Do it your way

A great starting point for your D.R. Horton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let other high-potential opportunities slip by. Use the Simply Wall Street Screener to confidently spot investments that match your unique goals and strategy.

- Turbocharge your watchlist and uncover the fastest-growing artificial intelligence companies with these 27 AI penny stocks positioned for strong, tech-driven gains.

- Maximize returns by targeting reliable income. Check out these 17 dividend stocks with yields > 3% delivering consistent yields above 3% for dependable payouts.

- Seize groundbreaking trends in digital finance by evaluating these 80 cryptocurrency and blockchain stocks influencing blockchain, payment platforms, and global transactions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHI

D.R. Horton

Operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives