- United States

- /

- Consumer Durables

- /

- NYSE:DHI

D.R. Horton (DHI) Margin Decline Reinforces Investor Caution Despite Ongoing Growth

Reviewed by Simply Wall St

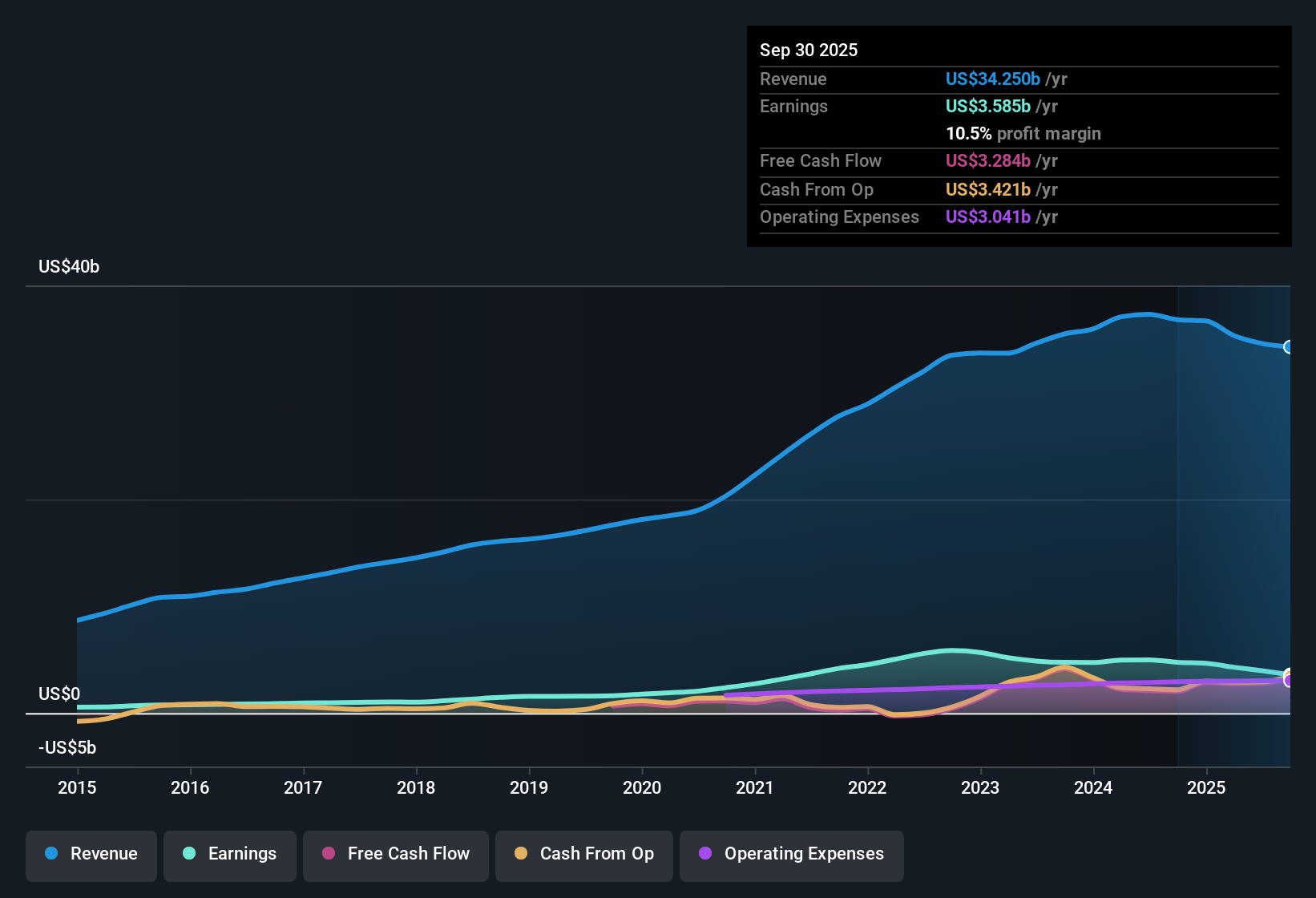

D.R. Horton (DHI) posted net profit margins of 10.5%, down from 12.9% last year. While the builder’s earnings have grown at an annualized 4.5% over the past five years, the latest results reflect negative year-over-year earnings growth, and shares are currently trading at $148.29, a premium to its estimated fair value and above industry average multiples. Investors will be focused on the balance between D.R. Horton’s ongoing profit and revenue growth prospects compared to the caution signaled by compressing margins and slowing growth relative to benchmarks.

See our full analysis for D.R. Horton.Next, we will see how these figures compare to what the community and analysts have been saying about D.R. Horton and the expectations embedded in the current narrative.

See what the community is saying about D.R. Horton

Affordability Pressures and Incentives Squeeze Margins

- Rising sales incentives and flat to declining average selling prices have become a real headwind, with 64% of D.R. Horton’s recent mortgage closings coming from the entry-level market. This directly exposes margins to affordability strains and more cautious buyers.

- Analysts' consensus view highlights that while these affordability pressures threaten gross and net margins, D.R. Horton’s long-term strategy focuses on

- expanding entry-level and affordable homes to tap a wider buyer pool and mitigate the cyclical impact of softer conditions,

- and maintaining high absorption rates to cushion margin compression. However, this means relying on higher incentives and competing on price if volatility or cost inflation persist.

- Consensus opinion points out that the ongoing need for mortgage rate buydowns and related incentives creates tension between top-line growth and sustainable profitability, as price cuts and incentives structurally erode margins if housing market pricing power weakens.

- Sense check this consensus perspective by reviewing the shift in mix and incentives against your own expectations about demand resiliency in a softer environment.

- Curious how analysts balance margin risks with growth ambitions? Dive into the full consensus on what’s really driving D.R. Horton’s forecast strength. 📊 Read the full D.R. Horton Consensus Narrative.

Strong Vertical Integration Protects Profitability

- D.R. Horton leverages its vertical integration. The company manages everything from lot development through mortgage financing, which supports cost control efforts even as gross margins feel pressure from market dynamics.

- Analysts' consensus view argues this level of integration helps mitigate margin volatility, as

- tight relationships with lot development partners and consistent operating efficiencies can limit rising land and construction costs,

- and efficient inventory turnover and disciplined financial management support consistent market share gains, regardless of short-term softness in the market.

Valuation Remains Above DCF Fair Value and Industry Averages

- Shares recently traded at $148.29, which sits above DCF fair value of $116.43 and is paired with a 12.2x price-to-earnings ratio that exceeds both the peer group (11.2x) and broader US Consumer Durables industry (10.7x).

- Analysts' consensus narrative sees this premium as justified if current forecasts pan out, with consensus price target set at $161.6. Yet, this assumes future revenue and earnings growth, alongside a slightly lower PE ratio (~10.5x) by 2028, and leaves little room for further rerating if growth or margins disappoint.

- The relatively small gap between current share price and consensus target signals that D.R. Horton could be fairly priced based on present information, rather than deeply undervalued or overhyped.

- Investors may want to consider these factors when weighing upside versus industry risks going forward.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for D.R. Horton on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the data? Shape your unique perspective into a custom narrative in just minutes and Do it your way.

A great starting point for your D.R. Horton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While D.R. Horton's market position is strong, its shrinking profit margins and premium valuation leave little room for disappointment if growth stumbles or market conditions shift.

If you’re worried about paying too much for growth that may not materialize, find companies with more attractive price tags and greater upside through these 854 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHI

D.R. Horton

Operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives