- United States

- /

- Luxury

- /

- NYSE:CRI

Carter's, Inc. Just Recorded A 61% EPS Beat: Here's What Analysts Are Forecasting Next

As you might know, Carter's, Inc. (NYSE:CRI) recently reported its quarterly numbers. Revenues were US$564m, approximately in line with whatthe analysts expected, although statutory earnings per share (EPS) crushed expectations, coming in at US$0.76, an impressive 61% ahead of estimates. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Carter's

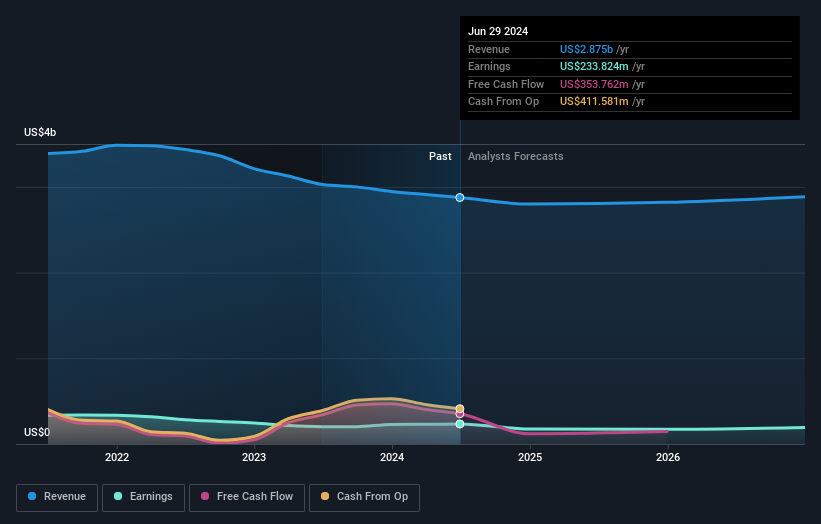

After the latest results, the consensus from Carter's' six analysts is for revenues of US$2.80b in 2024, which would reflect a small 2.7% decline in revenue compared to the last year of performance. Statutory earnings per share are forecast to nosedive 24% to US$4.89 in the same period. In the lead-up to this report, the analysts had been modelling revenues of US$2.92b and earnings per share (EPS) of US$6.19 in 2024. From this we can that sentiment has definitely become more bearish after the latest results, leading to lower revenue forecasts and a large cut to earnings per share estimates.

The consensus price target fell 19% to US$56.17, with the weaker earnings outlook clearly leading valuation estimates. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Carter's at US$60.00 per share, while the most bearish prices it at US$50.00. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Carter's is an easy business to forecast or the the analysts are all using similar assumptions.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. Over the past five years, revenues have declined around 3.0% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 5.2% decline in revenue until the end of 2024. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 5.8% annually. So while a broad number of companies are forecast to grow, unfortunately Carter's is expected to see its revenue affected worse than other companies in the industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Carter's. Long-term earnings power is much more important than next year's profits. We have forecasts for Carter's going out to 2026, and you can see them free on our platform here.

Before you take the next step you should know about the 2 warning signs for Carter's (1 is potentially serious!) that we have uncovered.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear and related products under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives