- United States

- /

- Consumer Durables

- /

- NYSE:COOK

Traeger, Inc.'s (NYSE:COOK) 25% Jump Shows Its Popularity With Investors

Traeger, Inc. (NYSE:COOK) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

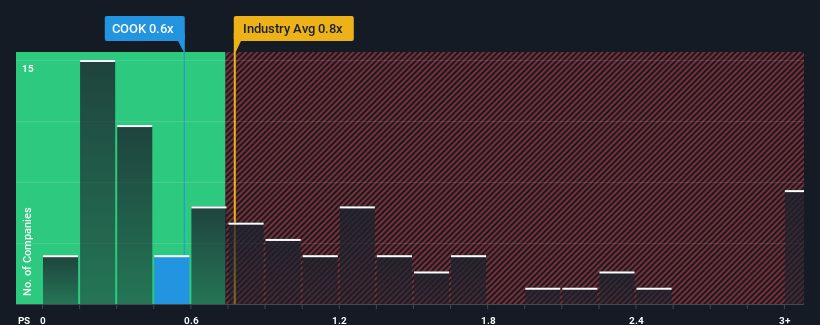

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Traeger's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in the United States is also close to 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Traeger

What Does Traeger's P/S Mean For Shareholders?

Recent revenue growth for Traeger has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Traeger.How Is Traeger's Revenue Growth Trending?

In order to justify its P/S ratio, Traeger would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 10% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 6.5% each year during the coming three years according to the ten analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 6.1% each year, which is not materially different.

In light of this, it's understandable that Traeger's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Traeger's P/S

Traeger appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Traeger maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Having said that, be aware Traeger is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Traeger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:COOK

Traeger

Designs, sources, sells, and supports wood pellet fueled barbecue grills and pellet fueled barbecue grills for retailers, distributors, and direct to consumers in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives