- United States

- /

- Consumer Durables

- /

- NYSE:COOK

Traeger, Inc. (NYSE:COOK) Shares Slammed 27% But Getting In Cheap Might Be Difficult Regardless

To the annoyance of some shareholders, Traeger, Inc. (NYSE:COOK) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 68% loss during that time.

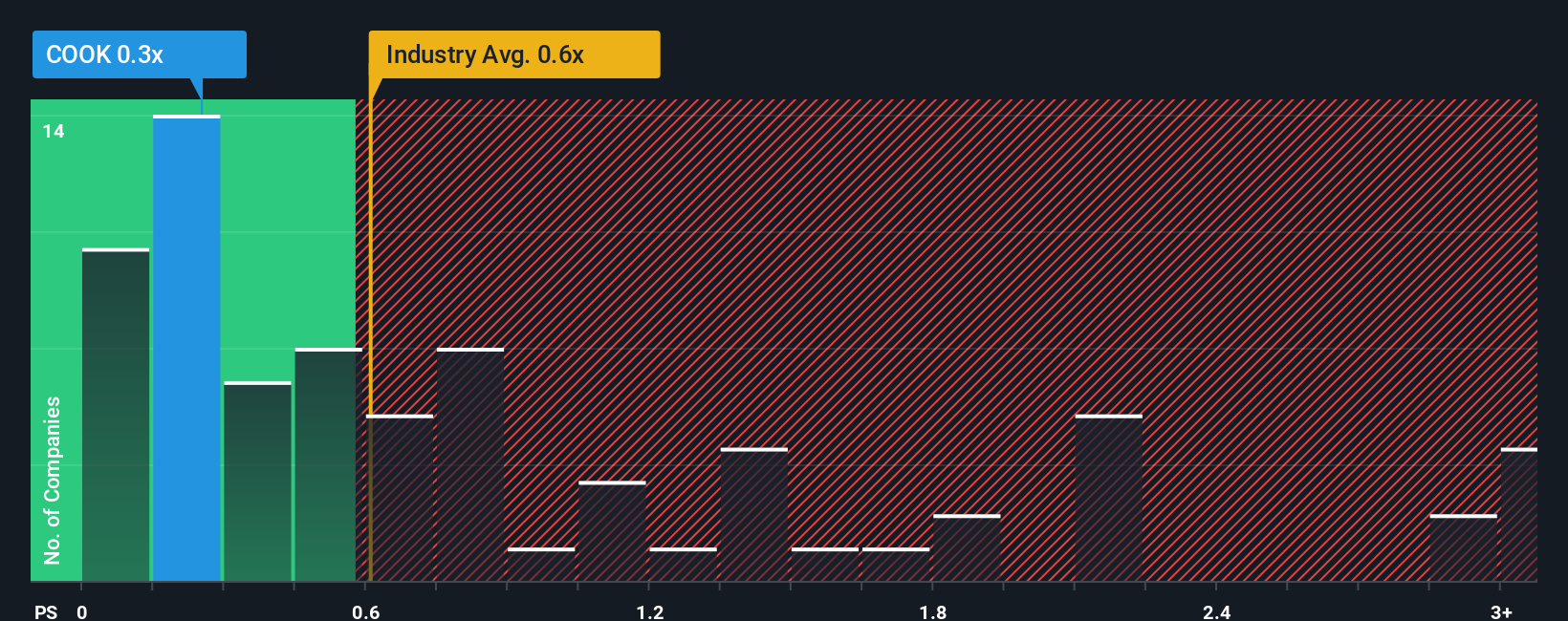

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Traeger's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in the United States is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Traeger

What Does Traeger's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Traeger's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Traeger.Is There Some Revenue Growth Forecasted For Traeger?

Traeger's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.5%. This means it has also seen a slide in revenue over the longer-term as revenue is down 24% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 6.8% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 7.1% per annum, which is not materially different.

With this information, we can see why Traeger is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Traeger's P/S

Traeger's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Traeger's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Traeger with six simple checks on some of these key factors.

If you're unsure about the strength of Traeger's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Traeger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:COOK

Traeger

Designs, sources, sells, and supports wood pellet fueled barbecue grills and pellet fueled barbecue grills for retailers, distributors, and direct to consumers in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success