- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Century Communities (CCS): Valuation Perspective Following Lower Revenue, Earnings, and Tightened Guidance

Reviewed by Simply Wall St

Century Communities reported lower revenue and net income for both the latest quarter and the year to date. Earnings per share also came in weaker than last year. The company further tightened its outlook for home deliveries and sales revenue.

See our latest analysis for Century Communities.

Shares of Century Communities have had a rocky ride lately, with a one-year total shareholder return of -34.5% and the year-to-date share price down nearly 18%. While the last quarter saw new product launches and continued share buybacks, persistent revenue headwinds and tightened delivery guidance seem to have weighed on investor sentiment and dampened recent momentum.

If Century’s recent moves have you thinking about the broader housing market, now could be the perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

With the stock still trading at a notable discount to analyst targets after a tough stretch, investors might be wondering if Century Communities is undervalued right now, or if the market is already pricing in a slow growth outlook.

Most Popular Narrative: 9.7% Undervalued

Century Communities’ most popular narrative sets a fair value that is notably higher than the recent closing price, highlighting ongoing optimism despite muted recent performance. The gap raises questions about the forward assumptions driving this outlook.

Ongoing elevated mortgage rates and affordability constraints are dampening homebuyer demand, forcing Century Communities to increase sales incentives and accept lower average selling prices. This is already putting downward pressure on gross margins and is expected to weigh further on both revenues and earnings in the coming quarters.

Want to know the playbook fueling this bullish valuation? The fair value comes from future profit margins and revenue trends that buck the broader market headwinds. Curious which levers analysts expect the company to pull, and which numbers underpin this narrative? The full story reveals why the consensus sees upside, uncertainty and all.

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a persistent housing undersupply or ongoing construction efficiencies could support sales and margins. This could potentially challenge these more cautious forecasts.

Find out about the key risks to this Century Communities narrative.

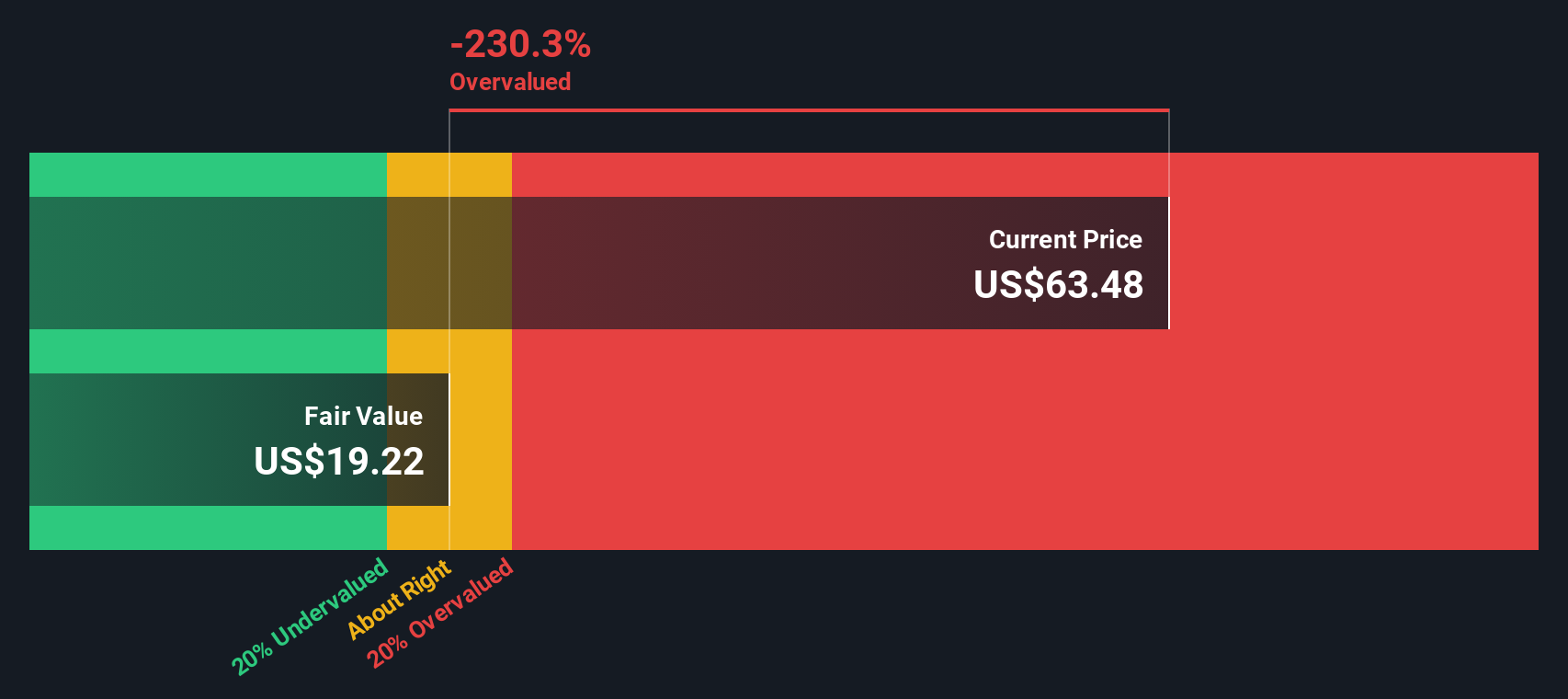

Another View: DCF Model Challenges the Outlook

While CCS looks appealing based on its earnings relative to peers and the market, our SWS DCF model offers a less optimistic perspective. The DCF approach suggests CCS is actually trading above its intrinsic value. This raises the question of whether short-term resilience can offset long-term cash flow concerns.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Century Communities for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Century Communities Narrative

If you think the story looks different through your own lens, dive into the numbers and shape a personal view in just minutes. Do it your way

A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to just one opportunity. Take control of your growth strategy and make confident choices by tapping into these unique stock ideas:

- Explore future healthcare breakthroughs and innovations with these 33 healthcare AI stocks, which spotlights companies harnessing artificial intelligence to transform medicine.

- Strengthen your income strategy and focus on financial stability by reviewing these 20 dividend stocks with yields > 3%, featuring yields above 3% from established, reliable companies.

- Stay ahead in emerging technology by exploring these 28 quantum computing stocks and find businesses pioneering advances in quantum computing and digital infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives