- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Century Communities (CCS): Examining Valuation After Multiple New Home Developments Across Key Growth Markets

Reviewed by Kshitija Bhandaru

Century Communities (NYSE:CCS) is in the spotlight after the company rolled out several new home developments in Texas, California, and Washington. The latest grand openings and sales launches highlight a push into sought-after markets and offer a wide mix of floor plans.

See our latest analysis for Century Communities.

Century Communities’ steady stream of new communities in Texas, California, and Washington has turned heads, but the stock’s performance has been much less celebratory. While the recent launches hint at future growth opportunities, the 1-year total shareholder return still sits at a significant -40.6%. Notably, short-term momentum has been mixed, with a recent rebound of 4.1% over the past week barely offsetting a slide over the past month. This leaves longer-term investors waiting to see if fresh initiatives can spark a more sustainable turnaround.

If you’re watching for stocks with the potential to break out, it’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Century Communities building ambitious new developments across key markets, the question for investors is whether the current depressed share price understates the upside potential or if the market has already factored in the company's future growth prospects.

Most Popular Narrative: Fairly Valued

With Century Communities closing at $60.11 and the most-followed narrative arriving at a fair value estimate of $59.50, market participants are weighing tough fundamentals against longer-term ambitions. Investors have their eyes on execution amidst industry headwinds, with the latest valuation hinting at little room for error.

“Ongoing elevated mortgage rates and affordability constraints are dampening homebuyer demand, forcing Century Communities to increase sales incentives and accept lower average selling prices. This is already putting downward pressure on gross margins and is expected to weigh further on both revenues and earnings in the coming quarters.”

Curious what’s fueling this valuation call? The consensus is built around several bold assumptions about sales, profits, and shrinking margins. Want to see the detailed calculations and the key financial targets behind this precisely balanced outlook? Unpack the full story to see what analysts are betting on.

Result: Fair Value of $59.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent U.S. housing undersupply and Century Communities’ expanding footprint present upside risks that could reshape the current cautious outlook.

Find out about the key risks to this Century Communities narrative.

Another View: What Do The Multiples Say?

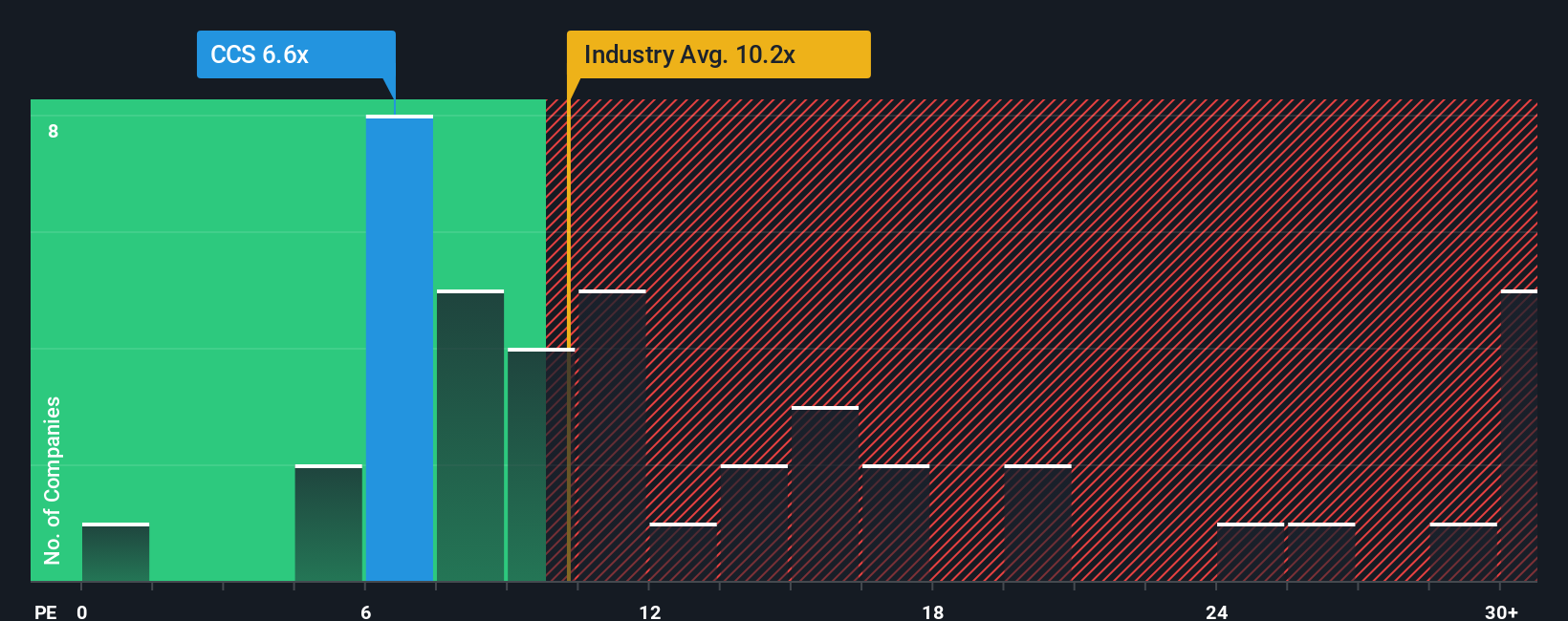

While analyst forecasts suggest little upside, the numbers tell a slightly different story when comparing Century Communities’ price-to-earnings ratio to industry standards. Trading at 6.9x, it is well below both the US Consumer Durables industry average of 10.2x and its peer group’s 7.5x, as well as the fair ratio of 9.1x. This pricing could signal opportunity if the company’s profitability holds up. Is the market justifiably cautious, or overlooking hidden value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Century Communities Narrative

If these takes do not resonate or you would rather dive into the data on your own terms, you can easily build your own view in just minutes, Do it your way

A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why limit your horizons? The market rewards those who spot unique opportunities early. Make sure you check these out or risk missing the next big winner.

- Capture yield by reviewing these 18 dividend stocks with yields > 3% that regularly reward investors with substantial dividends and have a history of solid cash flows.

- Ride the innovation wave and track sector leaders shaping the future with cutting-edge breakthroughs through these 24 AI penny stocks.

- Outsmart the crowd by targeting these 871 undervalued stocks based on cash flows positioned for potential upside based on rigorous cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives