- United States

- /

- Consumer Durables

- /

- NYSE:BLD

Is Strong Guidance and Progressive Roofing Deal Shifting TopBuild's Revenue Model (BLD)?

Reviewed by Simply Wall St

- TopBuild recently reported strong quarterly results with full-year EBITDA guidance exceeding analyst expectations and completed the acquisition of Progressive Roofing, expanding its foothold in roofing services.

- This combination of operational outperformance and increased exposure to the commercial roofing market marks a significant step in diversifying TopBuild’s revenue streams.

- We’ll explore how the Progressive Roofing acquisition may accelerate TopBuild’s shift toward greater revenue stability and long-term growth.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

TopBuild Investment Narrative Recap

For those considering TopBuild, the investment case centers on believing in the company's ability to expand beyond the cyclical U.S. residential construction market, especially through acquisitions like Progressive Roofing. The recent quarterly results and guidance were strong, which supports the near-term narrative, but the most important catalyst remains successful diversification, while the biggest immediate risk is ongoing macroeconomic challenges, especially housing affordability and construction starts. The Progressive Roofing acquisition improves diversification but does not fully offset the sector’s exposure to economic headwinds.

Among the recent updates, the completion of the Progressive Roofing acquisition is the most connected to TopBuild’s growth outlook. By expanding into the commercial roofing market, TopBuild aims to reduce earnings volatility tied to residential cycles and broaden its access to recurring, non-discretionary revenues, an important shift that directly addresses the company’s most pressing risk and primary catalyst.

In contrast, investors should be mindful that despite these steps toward diversification, TopBuild’s heavy reliance on U.S. construction cycles still exposes it to risks if…

Read the full narrative on TopBuild (it's free!)

TopBuild's outlook anticipates $5.8 billion in revenue and $602.8 million in earnings by 2028. This is based on a projected annual revenue growth rate of 3.7% and a modest earnings increase of $8.3 million from current earnings of $594.5 million.

Uncover how TopBuild's forecasts yield a $446.83 fair value, a 3% upside to its current price.

Exploring Other Perspectives

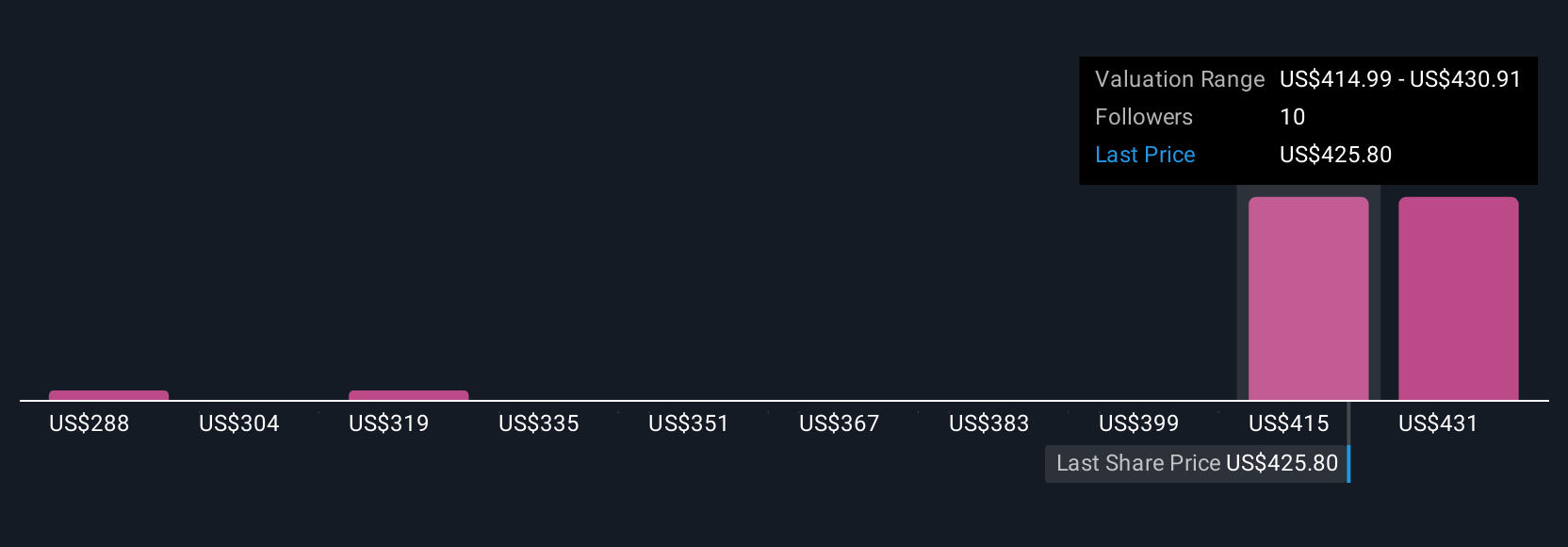

Simply Wall St Community members set fair value estimates for TopBuild between US$287.60 and US$446.83, based on four unique analyses. While views vary, important to keep in mind are ongoing cost inflation and integration risks, which could affect future earnings and the company's ability to deliver on diversification goals.

Explore 4 other fair value estimates on TopBuild - why the stock might be worth 34% less than the current price!

Build Your Own TopBuild Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TopBuild research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free TopBuild research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TopBuild's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TopBuild might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLD

TopBuild

Engages in the installation and distribution of insulation and other building material products to the construction industry.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives