- United States

- /

- Leisure

- /

- NYSE:BC

Brunswick (BC) Valuation Check After 18% Three-Month Share Price Rally

Reviewed by Simply Wall St

Brunswick (BC) has quietly rewarded shareholders, with the stock up about 18% over the past year and more than 21% in the past 3 months. This has prompted a closer look at what is driving sentiment.

See our latest analysis for Brunswick.

With the share price now at $75.76 and a 30 day share price return close to 18%, the recent rally caps a year of positive total shareholder returns. This suggests momentum is building as investors reassess Brunswick’s growth and risk profile.

If this kind of upward momentum has caught your attention, it could be a good moment to see what else is moving and discover auto manufacturers.

Yet with shares now hovering around analyst targets, the key question is whether Brunswick’s solid growth and recent margin recovery still leave the stock undervalued, or whether the market is already pricing in its next leg of expansion.

Most Popular Narrative: 0% Overvalued

Brunswick’s most followed narrative pegs fair value at about $75.50, almost exactly in line with the latest $75.76 close, framing today’s rally in a tight valuation band.

Brunswick's ongoing expansion of high margin, recurring revenue streams such as digital boating services and the Freedom Boat Club strengthens margin stability and earnings quality, reinforced by the successful launch of new franchise locations (e.g., Dubai) and the continued global leadership of the club model.

Curious what kind of growth, margin lift, and future earnings multiple are baked into that near perfect match between price and fair value? The underlying forecast quietly transforms a loss making balance sheet into a very different earnings profile. Want to see which financial swing does the heavy lifting in this narrative?

Result: Fair Value of $75.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in value segment demand and a slower than expected global boat market recovery could quickly undermine these upbeat margin and growth assumptions.

Find out about the key risks to this Brunswick narrative.

Another View: What If The Market Is Overpaying?

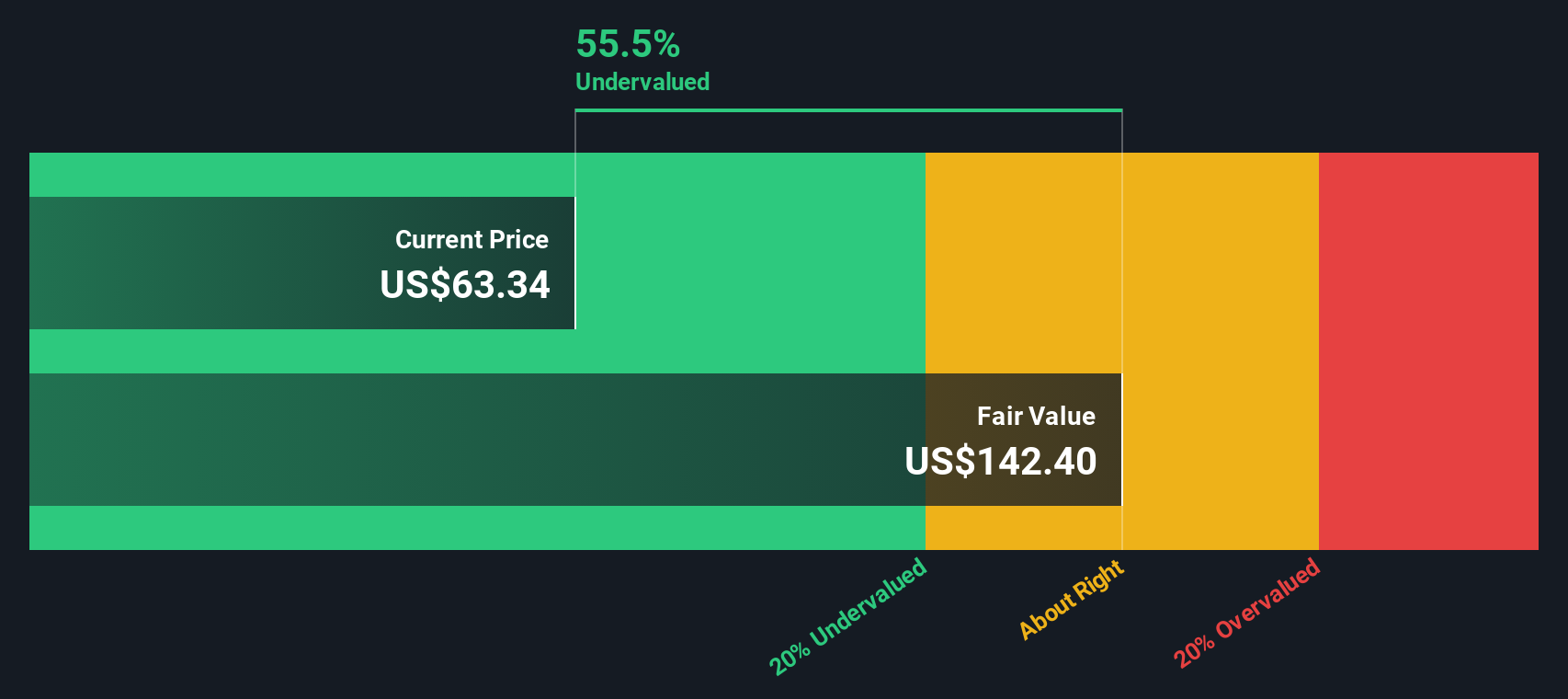

Our DCF model actually sees Brunswick as around 7% undervalued at $75.76, but the most popular narrative now calls it fairly priced, even slightly overvalued. Is the market underestimating future cash flows, or are DCF assumptions too generous about boating demand?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brunswick for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brunswick Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way.

A great starting point for your Brunswick research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock when the market is full of opportunities; use the Simply Wall Street Screener now so you are not late to the next move.

- Capture overlooked potential by scanning these 910 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Capitalize on cutting edge innovation by targeting these 24 AI penny stocks shaping the next wave of intelligent technology.

- Strengthen your income stream by zeroing in on these 12 dividend stocks with yields > 3% that can keep cash flowing into your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Brunswick might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BC

Brunswick

Designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion