- United States

- /

- Luxury

- /

- NYSE:AS

Amer Sports (NYSE:AS) Valuation: Assessing the Impact of the Atomic Antitrust Probe on Shareholder Value

Reviewed by Simply Wall St

A surge of attention has hit Amer Sports (NYSE:AS) after European regulators launched an antitrust investigation involving its Atomic ski brand. The probe has created uncertainty around the stock, and volatility has followed.

See our latest analysis for Amer Sports.

The antitrust probe has clearly weighed on sentiment, with Amer Sports’ share price dropping 11.96% over the past month and down 15.67% for the last quarter. Still, when you zoom out, the stock has delivered a remarkable 76.22% total shareholder return over the past year. This reflects underlying optimism despite some recent volatility.

If you're eyeing what's next in the sector, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading at a discount to analyst targets but volatility running high, the real question for investors is whether Amer Sports is undervalued at these levels or if the market is already factoring in all the future upside.

Most Popular Narrative: 33% Undervalued

Amer Sports’ most widely followed narrative points to a fair value that is significantly higher than the last close of $31.05, suggesting a notable disconnect between current price and long-term potential. The narrative’s figures, grounded in a discount rate of 8.65%, focus on catalysts such as revenue growth projections, margin expansion, and premium brand strategy.

Ongoing investment in direct-to-consumer channels (both physical stores and e-commerce) is fueling higher full-price sales, reduced markdowns, and enhanced customer engagement, supporting scalable top-line growth and driving adjusted operating margin expansion.

Want to know what drives this bullish narrative? There's a surprising financial lever powering the gap between price and value. This story hinges on the company’s ability to unlock higher profits from its premium brand push and digital sales strategies. Are the analyst projections too bold, or just bold enough? See the full reasoning before making your call.

Result: Fair Value of $46.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Amer Sports’ heavy reliance on Asia-Pacific markets and ambitious direct-to-consumer expansion could pressure margins and expose the company to geopolitical uncertainties.

Find out about the key risks to this Amer Sports narrative.

Another View: The Price-to-Earnings Story

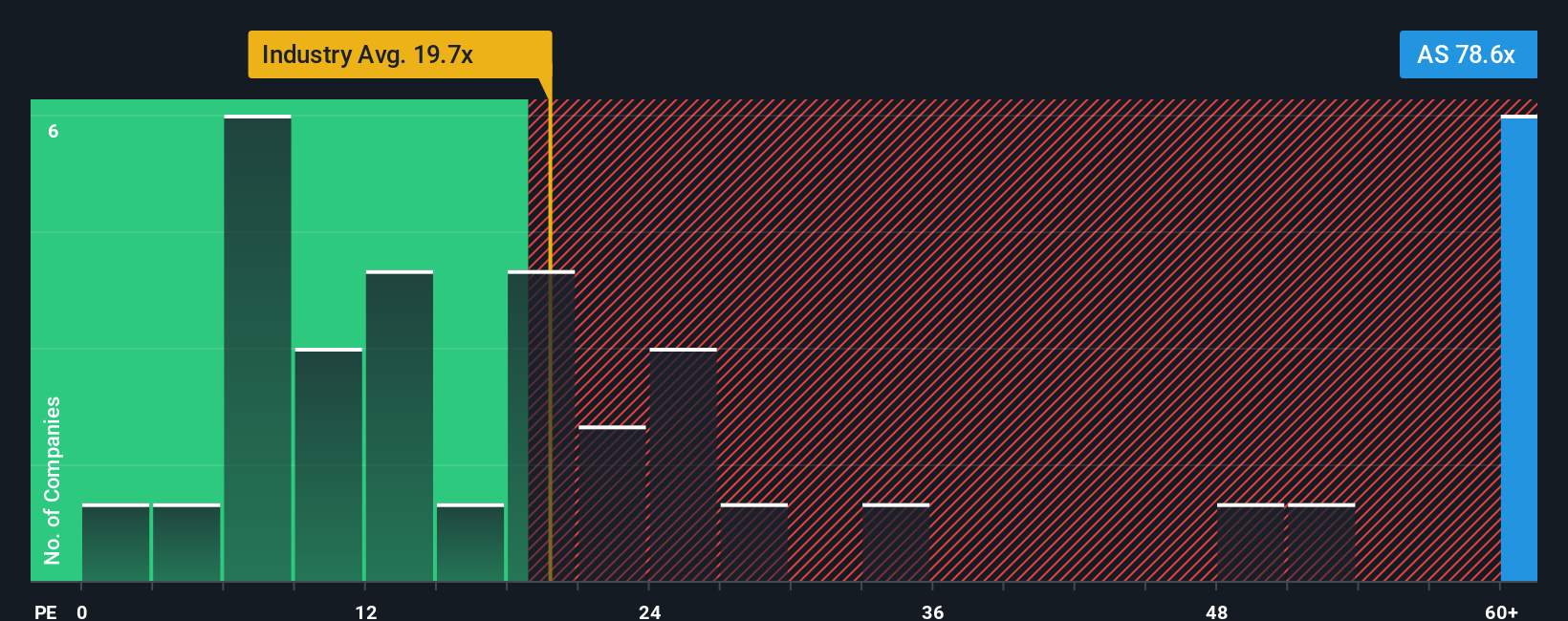

Looking from a different angle, Amer Sports is trading at a lofty price-to-earnings ratio of 76.9x. That is much higher than both the US Luxury industry average (19.8x) and the peer average (45.8x), and well above its estimated fair ratio of 30.4x. This premium suggests investors are pricing in a lot of future growth and potentially taking on extra valuation risk. With such a large gap, is the share price justified or are expectations running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amer Sports Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily craft your own investment thesis in just a few minutes. Do it your way

A great starting point for your Amer Sports research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Why stick to the same names when there are countless unique trends emerging right now? Let Simply Wall Street’s powerful tools introduce you to bold new stocks with the fundamentals to help you build a stronger portfolio.

- Uncover high-potential technology innovators by checking out these 26 AI penny stocks that are driving advances in artificial intelligence.

- Strengthen your income strategy by evaluating these 17 dividend stocks with yields > 3% offering attractive yields above 3%.

- Stay ahead of deep value opportunities with these 878 undervalued stocks based on cash flows that are trading below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AS

Amer Sports

Designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives