The ZAGG (NASDAQ:ZAGG) Share Price Is Down 58% So Some Shareholders Are Wishing They Sold

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held ZAGG Inc (NASDAQ:ZAGG) over the last year knows what a loser feels like. The share price is down a hefty 58% in that time. On the bright side, the stock is actually up 43% in the last three years. Furthermore, it's down 20% in about a quarter. That's not much fun for holders.

Check out our latest analysis for ZAGG

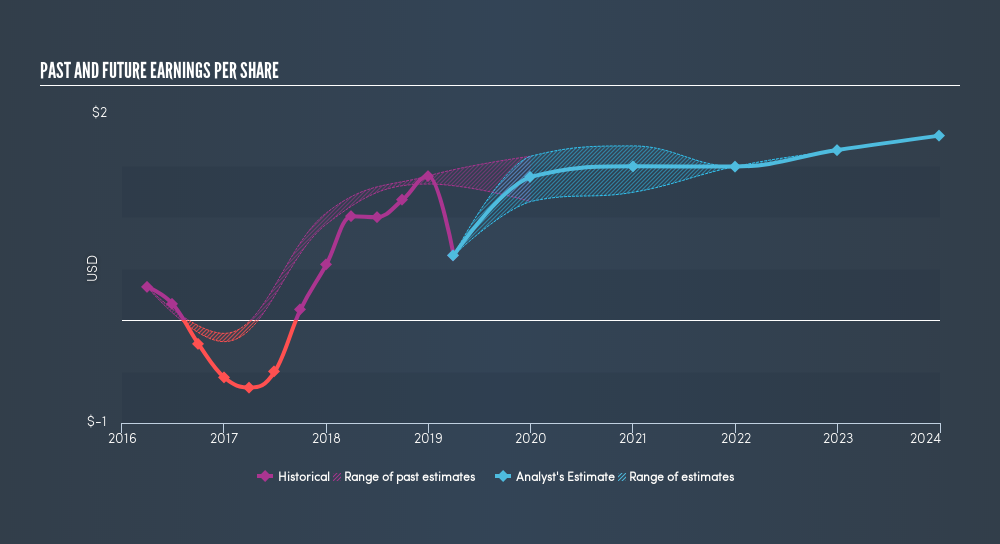

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately ZAGG reported an EPS drop of 38% for the last year. This reduction in EPS is not as bad as the 58% share price fall. So it seems the market was too confident about the business, a year ago. The less favorable sentiment is reflected in its current P/E ratio of 11.32.

Dive deeper into ZAGG's key metrics by checking this interactive graph of ZAGG's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 8.7% in the last year, ZAGG shareholders lost 58%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 4.3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how ZAGG scores on these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives