- United States

- /

- Luxury

- /

- NasdaqGS:VRA

Vera Bradley, Inc.'s (NASDAQ:VRA) Revenues Are Not Doing Enough For Some Investors

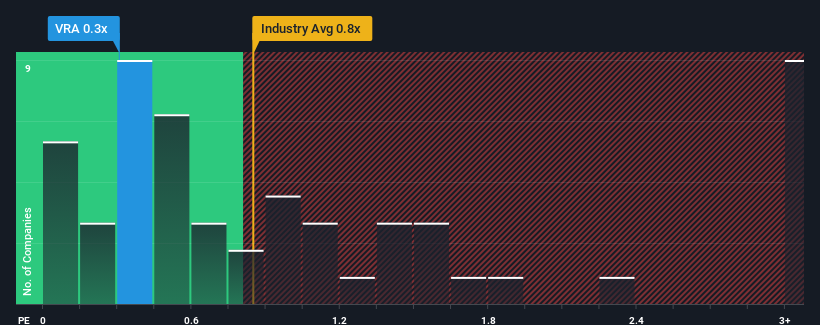

Vera Bradley, Inc.'s (NASDAQ:VRA) price-to-sales (or "P/S") ratio of 0.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Luxury industry in the United States have P/S ratios greater than 0.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Vera Bradley

What Does Vera Bradley's P/S Mean For Shareholders?

Vera Bradley could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Vera Bradley will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Vera Bradley's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.8%. The last three years don't look nice either as the company has shrunk revenue by 10% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 7.2% over the next year. Meanwhile, the broader industry is forecast to expand by 3.0%, which paints a poor picture.

With this information, we are not surprised that Vera Bradley is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Vera Bradley's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Vera Bradley's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Vera Bradley's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Vera Bradley, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Vera Bradley, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VRA

Vera Bradley

Designs and manufactures women’s handbags, luggage and travel items, fashion and home accessories, and gifts in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives