- United States

- /

- Consumer Durables

- /

- NasdaqGS:VIOT

Viomi Technology Co., Ltd's (NASDAQ:VIOT) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

With its stock down 9.7% over the past month, it is easy to disregard Viomi Technology (NASDAQ:VIOT). However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. Particularly, we will be paying attention to Viomi Technology's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Viomi Technology

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Viomi Technology is:

10% = CN¥153m ÷ CN¥1.5b (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.10 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Viomi Technology's Earnings Growth And 10% ROE

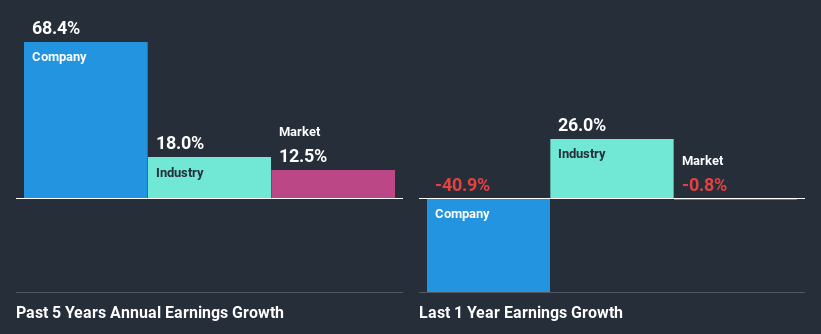

To start with, Viomi Technology's ROE looks acceptable. Yet, the fact that the company's ROE is lower than the industry average of 15% does temper our expectations. That being the case, the significant five-year 68% net income growth reported by Viomi Technology comes as a pleasant surprise. Therefore, there could be other causes behind this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio. Bear in mind, the company does have a respectable ROE. It is just that the industry ROE is higher. So this also does lend some color to the high earnings growth seen by the company.

Next, on comparing with the industry net income growth, we found that Viomi Technology's growth is quite high when compared to the industry average growth of 18% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for VIOT? You can find out in our latest intrinsic value infographic research report.

Is Viomi Technology Making Efficient Use Of Its Profits?

Conclusion

On the whole, we feel that Viomi Technology's performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

When trading Viomi Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:VIOT

Viomi Technology

Through its subsidiaries, develops and sells Internet-of-things-enabled (IoT-enabled) smart home products in the People's Republic of China.

Moderate growth potential with mediocre balance sheet.