- United States

- /

- Luxury

- /

- NasdaqGS:SHOO

Steven Madden (SHOO): Assessing Valuation After New Q3 Results and Upbeat Sales Guidance

Reviewed by Simply Wall St

Steven Madden (SHOO) just shared its latest quarterly numbers, revealing higher revenue compared to last year. However, profits took a step back. The company quickly followed up with upbeat expectations for the upcoming quarter and is projecting strong sales growth.

See our latest analysis for Steven Madden.

After a rocky start to the year, Steven Madden's momentum has picked up noticeably. The stock’s 41% share price gain over the past 90 days stands out, even though the 1-year total shareholder return remains at -11%. Positive revenue growth and confident guidance have helped re-energize sentiment, despite last quarter's profitability dip and earlier share price pressure.

If Steven Madden’s turnaround has you scanning for more compelling stories, it’s a great opportunity to broaden your scope and discover fast growing stocks with high insider ownership

The rapid share price rebound and bullish outlook raise a critical question: does Steven Madden’s recent run leave the stock looking undervalued, or has the market already factored in the accelerated growth ahead, leaving little room for upside?

Most Popular Narrative: 6.8% Overvalued

The most followed narrative sees Steven Madden trading about $2.44 above its fair value estimate, based on a fair value of $35.75 compared to the last close at $38.19. The gap has some investors questioning whether the recent rally is justified or if the price is running ahead of fundamentals.

Vertical integration efforts and ongoing supply chain diversification away from China (expecting U.S. imports sourced from China to drop from 71% to 30% year over year) provide a pathway to improve gross margin stability and working capital management, supporting future earnings recovery once tariff disruptions stabilize.

Want to know why this narrative places so much weight on changes behind the scenes? What bold margin and growth assumptions are supporting this price? Dig in to spot the crucial metric powering the story and find out if the outlook matches the market buzz.

Result: Fair Value of $35.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff headwinds and ongoing challenges integrating new acquisitions could undermine the company’s margin recovery and stall its growth trajectory.

Find out about the key risks to this Steven Madden narrative.

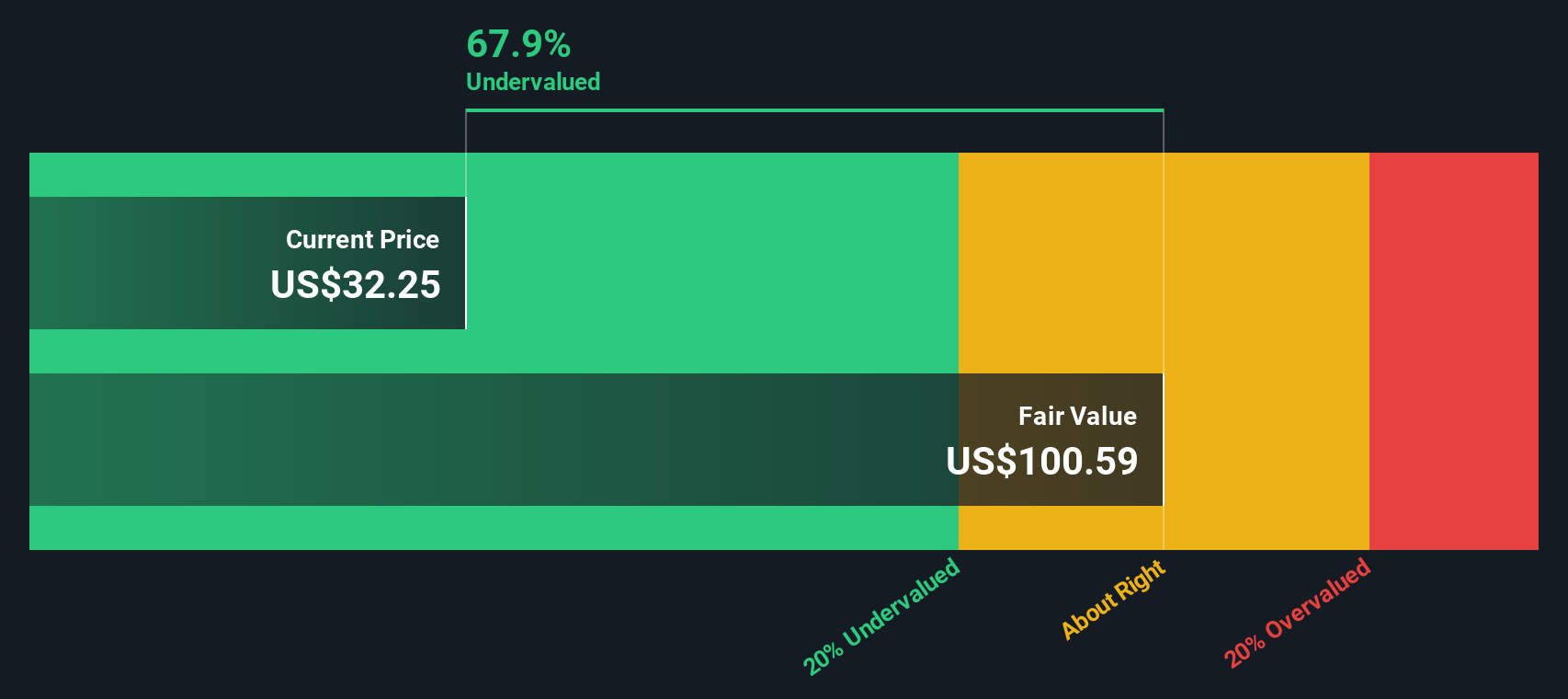

Another View: Discounted Cash Flow Tells a Different Story

While traditional valuation metrics suggest Steven Madden is trading at a premium to its fundamentals, our SWS DCF model presents a surprising contrast. Using long-term cash flow projections, this approach indicates the stock may actually be undervalued by a significant margin. However, can this optimistic scenario withstand real-world headwinds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Steven Madden for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Steven Madden Narrative

If you want to dig deeper or chart your own course, you can easily build a custom narrative in just a few minutes. Do it your way

A great starting point for your Steven Madden research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Set your sights on standout stocks shaping the future. Use these tailored picks to supercharge your watchlist and stay ahead of the next big trend.

- Capture outsize yields and consistent payouts by targeting these 15 dividend stocks with yields > 3% with strong track records and high dividend potential.

- Unlock future breakthroughs as you target these 31 healthcare AI stocks that are transforming health and medicine with artificial intelligence.

- Ride the momentum of fast-moving tech as you tap into growth stories like these 27 AI penny stocks powering tomorrow’s innovation surge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOO

Steven Madden

Designs, sources, and markets fashion-forward branded and private label footwear, accessories, and apparel in the United States and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives