- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Peloton (PTON): Valuation Insights Following Strong Earnings and Formula 1 Las Vegas Partnership

Reviewed by Simply Wall St

Peloton Interactive (PTON) recently grabbed attention with a double headline: first quarter earnings outperformed forecasts, and a high-profile partnership with the Formula 1 Las Vegas Grand Prix was unveiled. Both factors have shaped ongoing investor sentiment.

See our latest analysis for Peloton Interactive.

Peloton’s new Formula 1 partnership and stronger-than-expected earnings have energized investor sentiment, but recent momentum has not fully reversed the trend. Shares are still down nearly 15% year-to-date and the one-year total shareholder return remains slightly negative. Still, these high-profile moves suggest Peloton is aiming to reignite growth after a tough stretch.

If all this talk of big pivots and partnerships has you wondering what other companies are shaking things up, now's a smart time to discover fast growing stocks with high insider ownership

But with shares still trading well below analyst price targets and the brand ramping up new initiatives, the key question is whether Peloton is undervalued right now or if the market has already considered its plans for a turnaround in the current price.

Most Popular Narrative: 26.6% Undervalued

Peloton’s most popular narrative sets a fair value at $10.18, a full 36% above the last close of $7.48. This highlights a bold divergence between forward expectations and current market pricing. Rather than looking at short-term market moves, this narrative ties Peloton’s outlook directly to sweeping changes underway in its product mix and business model.

The company is investing in new, lower-cost accessibility initiatives (secondary market "Repowered" platform, student/military/first responder discounts), and expanding tiered digital offerings like Strength+, targeting broader demographics and making the premium Peloton ecosystem available to a wider customer base, potentially driving both hardware and digital subscriber growth over time.

Want to know what assumptions drive that high target? The real story is centered on profit margin turnaround, market expansion, and some aggressive growth forecasts. The numbers behind this fair value may surprise you, especially how much future earnings power analysts are betting on. Curious how the valuation stacks up? Dive in to see the catalyst for this price target.

Result: Fair Value of $10.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in hardware sales or rising subscriber churn could challenge this optimistic view, particularly given the fierce competition and changing customer preferences.

Find out about the key risks to this Peloton Interactive narrative.

Another View: What Does the SWS DCF Model Suggest?

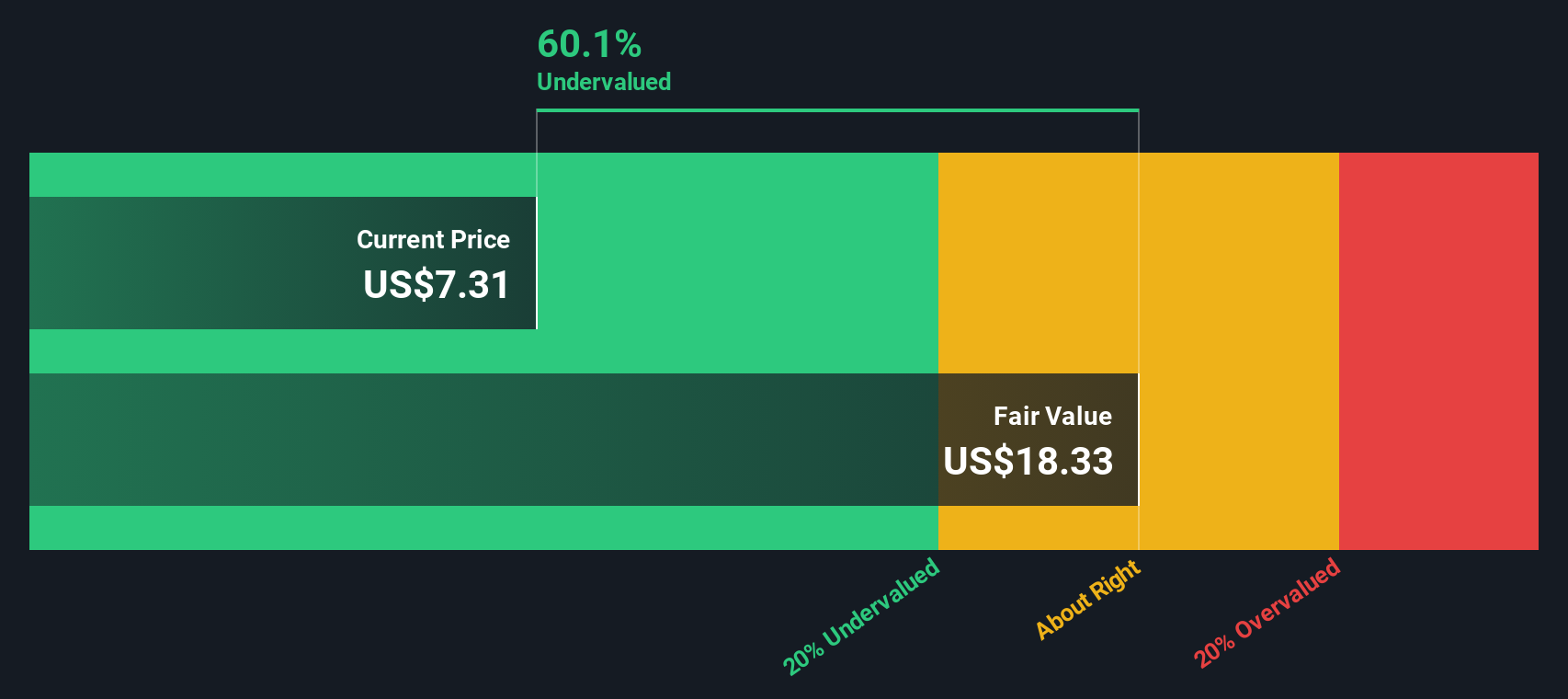

While Peloton appears expensive when compared to sales multiples of industry peers, our SWS DCF model takes a broader, cash-flow-based approach. It calculates Peloton’s fair value at $21.03, which is well above the current share price. Could the true value be hidden beneath market skepticism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Peloton Interactive Narrative

If you have a different perspective or want to dive deeper on your own, it only takes a few minutes to build your personal view. Do it your way

A great starting point for your Peloton Interactive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You don't want to miss the latest standouts and emerging themes across the market. Put your strategy to work with actionable opportunities right now.

- Unlock the growth potential of machine learning powerhouses and stay ahead by checking out these 25 AI penny stocks, which are driving tomorrow's digital landscape.

- Boost your search for reliable payouts and financial stability by scanning these 16 dividend stocks with yields > 3%, offering yields above 3% for income-focused portfolios.

- Capitalize on pricing inefficiencies and find companies trading below what their fundamentals suggest with these 886 undervalued stocks based on cash flows, based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives