- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Peloton (PTON) Valuation: Exploring Potential Upside After Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

Peloton Interactive (PTON) shares have seen their ups and downs lately, with investors watching closely as the company continues to adjust its business model in the shifting fitness market. Despite swings over the past month, curiosity remains high around Peloton’s outlook.

See our latest analysis for Peloton Interactive.

Peloton Interactive’s share price has been on a rollercoaster, with a steep 18.9% drop over the past week and a notable bounce of 8.1% in the past 90 days, even as its year-to-date share price return remains down 21%. Despite long-term setbacks such as a deeply negative five-year total shareholder return, the past year’s total return of 42% signals that some investors still see potential as Peloton adapts in a changing market.

If you’re weighing your next move, this might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Peloton’s shares rebounding from their lows, yet still trading at a sizable discount to analyst targets, the key question remains: Is there real value being overlooked here, or are future gains already priced in?

Most Popular Narrative: 31.7% Undervalued

Peloton Interactive’s most widely followed narrative points to a fair value of $10.18 per share, substantially higher than its recent close of $6.96. This sets up a debate about whether investors are missing a hidden turnaround story or if the price reflects justified caution in the marketplace.

Peloton is leveraging advanced technologies, including AI-powered personalized coaching and human-driven community features, to broaden its offerings from cardio into holistic wellness such as strength, sleep, stress, and nutrition. This aligns with growing global health consciousness and should support future subscription revenue growth and higher engagement or churn reduction.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is an aggressive pivot into digital wellness and recurring revenue. There is a bold bet on expanding offerings, boosted margins, and a new era of profit growth. What numbers are baked into this turnaround story? Dive into the full narrative for the details and the tension points driving analyst confidence.

Result: Fair Value of $10.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent subscriber declines and increasing competition could undermine Peloton’s path to profitable growth and put the turnaround narrative at risk.

Find out about the key risks to this Peloton Interactive narrative.

Another View: Looking Through the Numbers

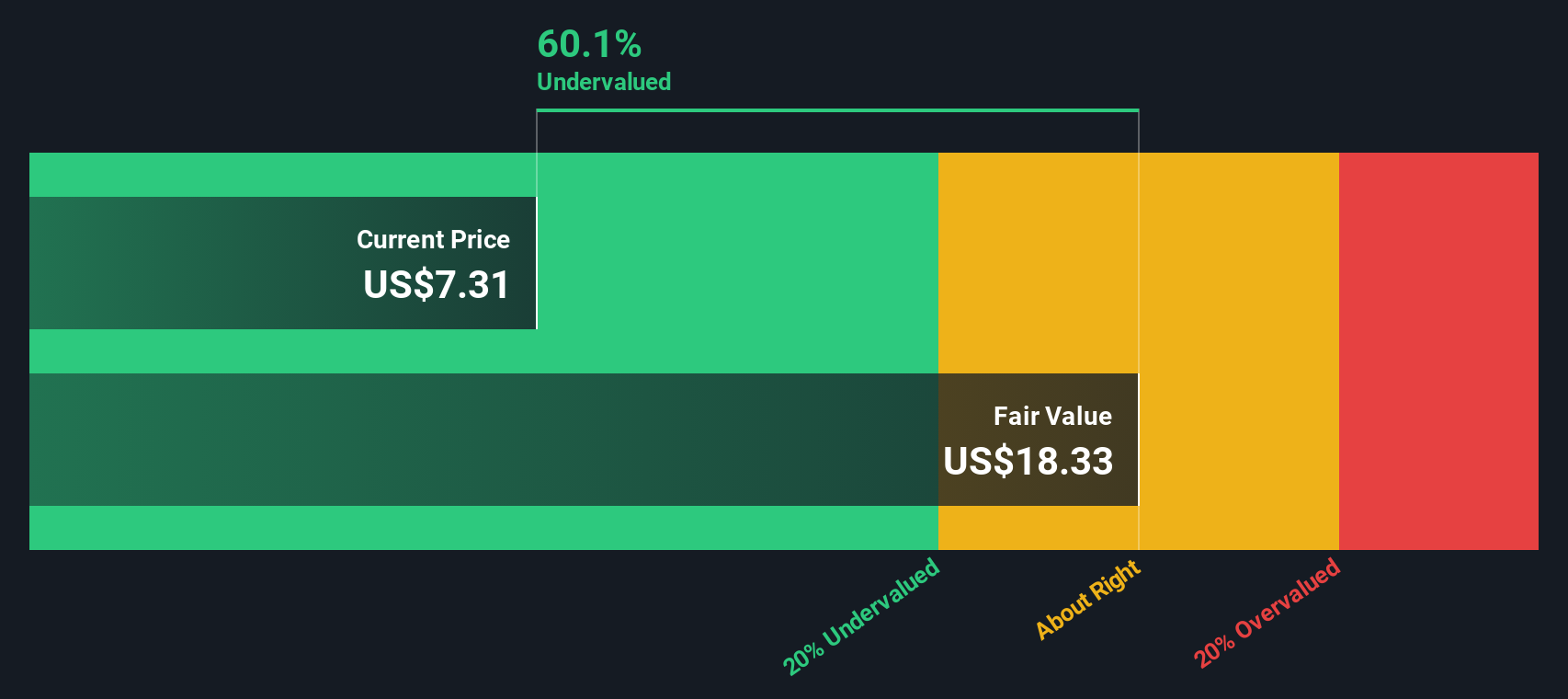

While the consensus fair value offers optimism, our DCF model paints an even stronger case. Based on cash flow projections, Peloton appears to be trading at a steep discount to its intrinsic value, approximately 60.7% below fair value. Could the market really be missing this much upside, or is this discount a sign of deeper risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Peloton Interactive Narrative

If you see things differently or want to chart your own course, it's quick and easy to analyze the data and build your personal perspective. Do it your way.

A great starting point for your Peloton Interactive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your strategy to just one stock. Take control and check out these unique opportunities right now, or you might miss tomorrow’s winning trend.

- Amplify your returns and tap into long-term growth with these 893 undervalued stocks based on cash flows built on strong cash flow trends and real market data.

- Uncover the future of medicine by spotting breakthroughs in artificial intelligence with these 33 healthcare AI stocks. This could transform global healthcare.

- Maximize your passive income and shield your portfolio from volatility by starting with these 19 dividend stocks with yields > 3% which offers robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026