- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Peloton (PTON): Evaluating Shareholder Value After Recent Losses and Strategic Shifts

Reviewed by Simply Wall St

Peloton Interactive (PTON) shares have been on investors' radar recently, stirring conversations about its latest quarterly performance and what it could signal going forward. The company’s shifting fundamentals raise some interesting questions about its longer-term outlook.

See our latest analysis for Peloton Interactive.

After a challenging year, Peloton Interactive’s share price has continued to drift lower, falling nearly 13% in the past month and bringing its year-to-date decline to almost 24%. Looking at the broader picture, the past twelve months have seen a 30.9% drop in total shareholder return. This signals fading momentum even as management pursues profitability and launches new products.

If recent moves in the fitness tech sector have you considering broader opportunities, this could be a great time to expand your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets and a history of sharp declines, the question now is whether Peloton is undervalued based on its recent improvements, or if the market has already accounted for any potential recovery.

Most Popular Narrative: 35.8% Undervalued

With Peloton Interactive’s most widely followed narrative assigning a fair value of $10.48, there is a notable gap to its last close at $6.72. This narrative’s valuation stands out given recent strategic pivots in products and pricing, but the driving logic behind this outlook is anything but simple.

Bullish analysts view Peloton’s comprehensive product overhaul, including AI-powered coaching and enhanced wellness content, as a meaningful step toward better user experience and long-term platform growth. Recent price hikes for both hardware and subscriptions, though potentially increasing short-term churn, are expected to drive a significant uplift in earnings. One major bank estimates a potential $180 million EBITDA increase from these changes.

Earnings power, AI-driven upgrades, and bold new pricing reveal a hidden formula fueling this big wedge between fair value and today’s price. Curious what profit and margin assumptions lie at the heart of this bullish narrative? Tap to uncover the financial leap analysts are banking on.

Result: Fair Value of $10.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in hardware sales and mounting competition from low-cost digital fitness providers could quickly undermine even the most optimistic outlooks for Peloton’s recovery.

Find out about the key risks to this Peloton Interactive narrative.

Another View: What About Multiples?

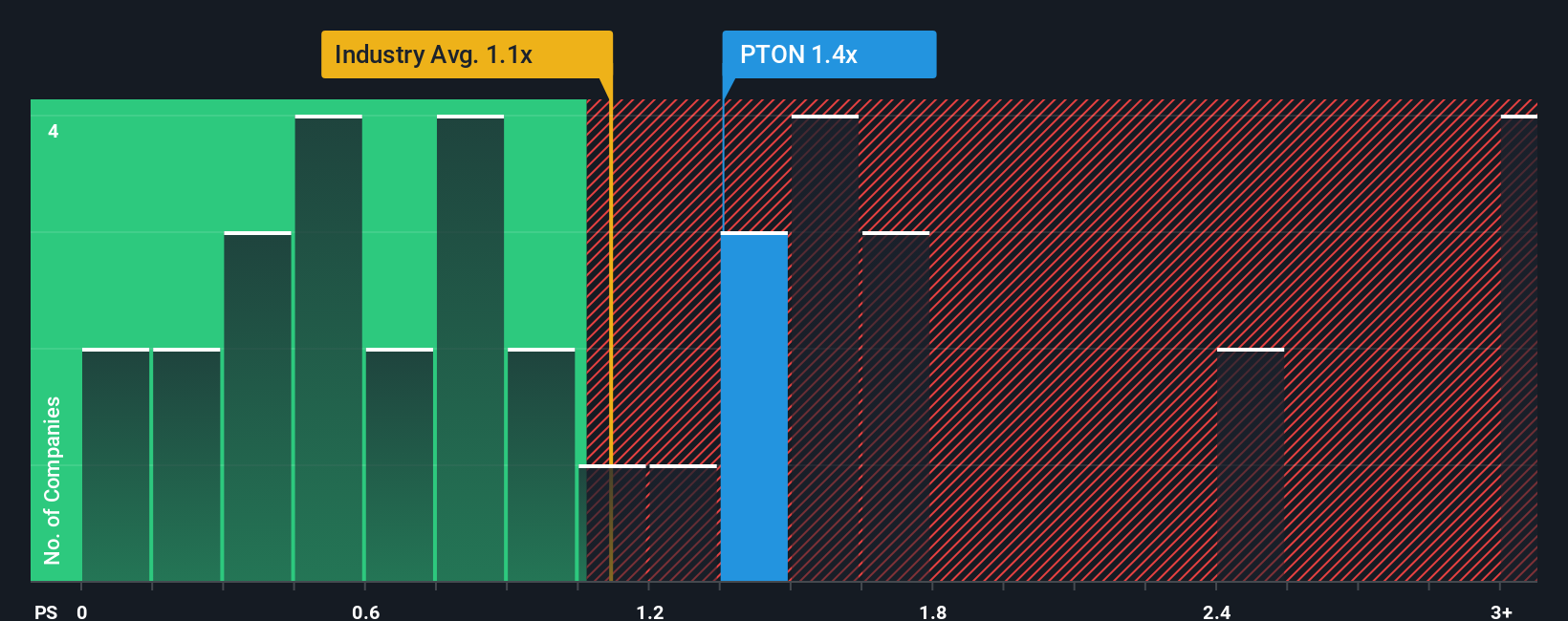

Looking at Peloton through the lens of price-to-sales ratios, the picture shifts. Shares trade at 1.1 times sales, a level above both the US Leisure industry average and its peer group, which both sit at 0.9 times. Even compared to its own fair ratio, Peloton looks pricey. Does this premium suggest investors are banking on a bigger turnaround than the numbers show?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Peloton Interactive Narrative

If you see the numbers differently or want to shape your own outlook, you can easily build a unique narrative in just a few minutes. Do it your way

A great starting point for your Peloton Interactive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities pass you by. Put your portfolio ahead of the curve by using tools designed to find exceptional stocks that match your style and interests.

- Tap into the explosive future of artificial intelligence with these 25 AI penny stocks, shaping innovative industries worldwide.

- Target overlooked bargains and boost your returns through these 932 undervalued stocks based on cash flows, identified as fundamentally stronger than their market prices suggest.

- Take advantage of high-yield opportunities by securing your seat with these 15 dividend stocks with yields > 3%, offering robust payouts and financial resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success