- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Is Peloton’s (PTON) AI Push Enough to Revitalize Membership Growth and Brand Momentum?

Reviewed by Sasha Jovanovic

- In recent months, Peloton Interactive has continued to experience declines in sales and paid memberships, despite introducing new AI-powered fitness products and services following significant downsizing after the lockdown surge.

- An important insight is that even with product innovation and multiple new tactics, Peloton's key growth and engagement metrics have not rebounded as hoped.

- We'll examine how Peloton's ongoing membership decline, despite new AI initiatives, may impact the company's broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Peloton Interactive Investment Narrative Recap

To be a Peloton shareholder today, an investor needs to believe that recent advances in AI-powered coaching, expanded wellness content, and strategic partnerships can eventually restore membership growth and stabilize recurring revenue streams. The latest news, continued declines in sales and paid subscriptions despite new product introductions, is material, as it intensifies concerns around category saturation and highlights that new initiatives have not yet shifted the company’s most important short-term catalyst: a return to sustained subscriber growth. Ongoing risk stems from recurring subscriber losses and uncertainty over when, or if, engagement metrics will rebound.

Peloton’s October launch of the Cross Training Series and Peloton IQ, powered by artificial intelligence, is especially relevant here. While intended to diversify its user base and increase stickiness, recent results show these offerings have not reversed declining engagement or sales, underscoring how critical demonstrable user growth will be for any positive catalyst in the near term. Yet, the company continues to focus on content and hardware innovation in hopes of sparking renewed interest and retention.

In contrast, investors should be aware that recurring losses in hardware and membership numbers may mean ...

Read the full narrative on Peloton Interactive (it's free!)

Peloton Interactive's narrative projects $2.5 billion in revenue and $113.2 million in earnings by 2028. This requires a 0.4% annual revenue decline and a $232.1 million increase in earnings from -$118.9 million today.

Uncover how Peloton Interactive's forecasts yield a $10.48 fair value, a 54% upside to its current price.

Exploring Other Perspectives

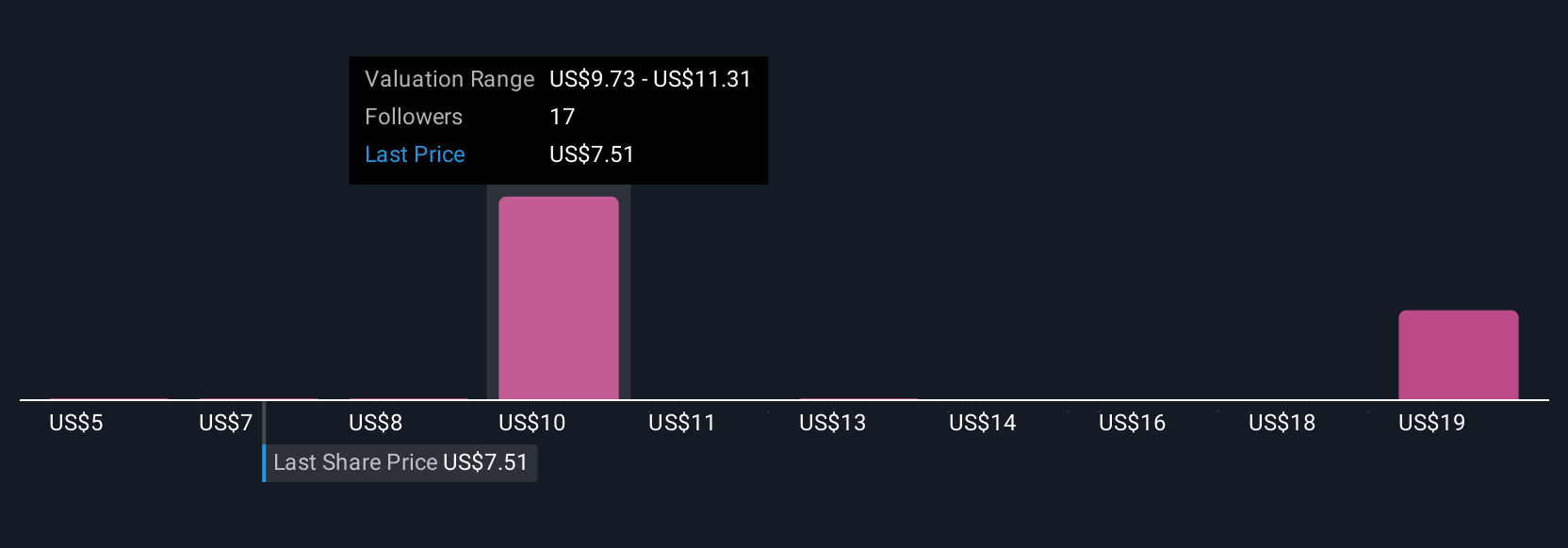

Simply Wall St Community members estimated fair values for Peloton between US$5 and US$20.22, with eight unique perspectives. Against this backdrop of wide opinion, ongoing subscriber declines continue to weigh on the company’s growth outlook, reminding you to consider a range of viewpoints before forming your own view.

Explore 8 other fair value estimates on Peloton Interactive - why the stock might be worth over 2x more than the current price!

Build Your Own Peloton Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peloton Interactive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Peloton Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peloton Interactive's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026