- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Is Peloton’s Formula 1 Las Vegas Grand Prix Partnership Shifting the Investment Case for PTON?

Reviewed by Sasha Jovanovic

- Peloton Interactive and the Formula 1 Las Vegas Grand Prix recently announced a collaboration to deliver exclusive fitness classes and experiences during the Grand Prix weekend, including onsite and virtual programming such as trackside workouts and scenic rides around the Las Vegas Strip Circuit.

- This partnership not only aligns Peloton with a global sports event but also extends the reach of its new Cross Training Series and leverages high-impact media exposure in a location known for its entertainment allure.

- We’ll explore how Peloton’s Formula 1 collaboration could bolster its audience reach and influence its long-term investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Peloton Interactive Investment Narrative Recap

To be a Peloton shareholder today, you need to believe that the company can broaden its reach, drive sustained member engagement, and reverse hardware and subscription declines with new offerings and partnerships. While the Formula 1 Las Vegas Grand Prix collaboration should boost Peloton’s brand visibility and highlight its Cross Training Series, this high-profile event alone is unlikely to materially affect near-term hardware sales or meaningfully offset ongoing demand risks for connected fitness equipment and subscriptions.

Of the recent company announcements, the launch of the Peloton Cross Training Series stands out as most relevant, as it directly ties into the Las Vegas Grand Prix programming and underscores Peloton’s ambitions to expand beyond cycling. This initiative complements efforts to diversify content and appeal to a broader wellness audience, which remains a critical catalyst for extending Peloton’s subscriber base over time, but the ability to turn these new product lines into meaningful, sustained subscription growth is still an open question.

But in contrast to media excitement, investors should be aware that ongoing declines in hardware sales and subscriptions...

Read the full narrative on Peloton Interactive (it's free!)

Peloton Interactive's narrative projects $2.5 billion revenue and $113.2 million earnings by 2028. This requires a -0.4% yearly revenue decline and a $232.1 million earnings increase from -$118.9 million today.

Uncover how Peloton Interactive's forecasts yield a $10.18 fair value, a 36% upside to its current price.

Exploring Other Perspectives

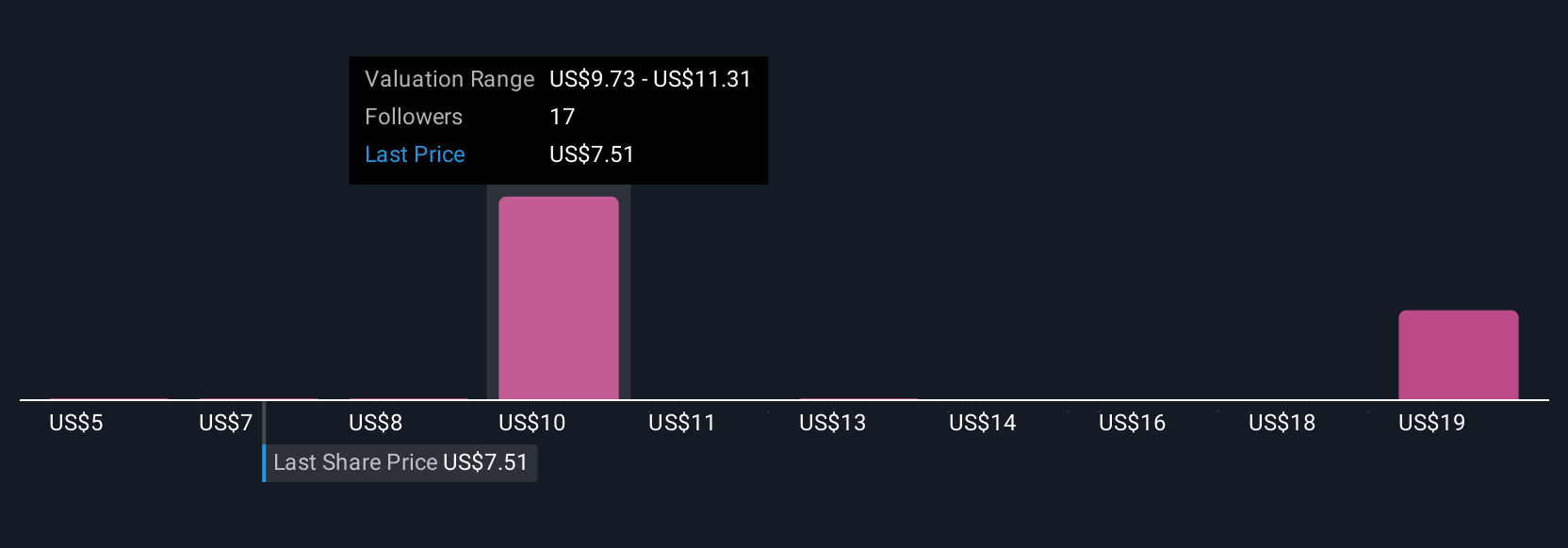

Eight fair value estimates from the Simply Wall St Community for Peloton range widely from US$5 to nearly US$21 per share. As subscribers consider these contrasting views, remember that the biggest risk remains weakening hardware and subscription demand, with potential impact on the stability of Peloton’s top line.

Explore 8 other fair value estimates on Peloton Interactive - why the stock might be worth over 2x more than the current price!

Build Your Own Peloton Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peloton Interactive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Peloton Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peloton Interactive's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives