- United States

- /

- Consumer Durables

- /

- NasdaqCM:XWIN

With A 28% Price Drop For Nova LifeStyle, Inc. (NASDAQ:NVFY) You'll Still Get What You Pay For

Nova LifeStyle, Inc. (NASDAQ:NVFY) shares have had a horrible month, losing 28% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

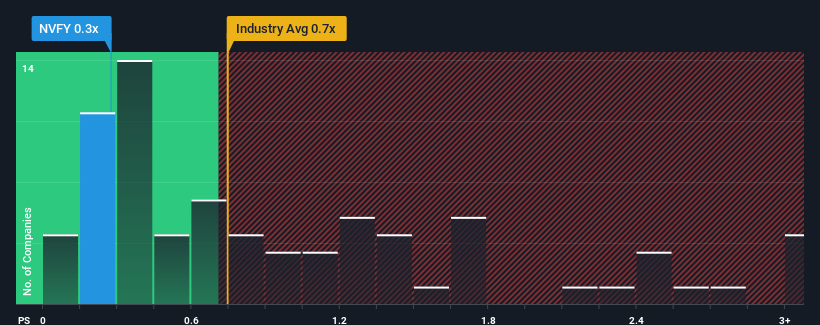

Although its price has dipped substantially, it's still not a stretch to say that Nova LifeStyle's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in the United States, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Nova LifeStyle

What Does Nova LifeStyle's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Nova LifeStyle over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nova LifeStyle's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Nova LifeStyle's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. Regardless, revenue has managed to lift by a handy 7.0% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 3.7% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Nova LifeStyle's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Bottom Line On Nova LifeStyle's P/S

With its share price dropping off a cliff, the P/S for Nova LifeStyle looks to be in line with the rest of the Consumer Durables industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears to us that Nova LifeStyle maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Nova LifeStyle (4 don't sit too well with us!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:XWIN

XMax

Through its subsidiaries, designs, manufactures, markets, and sells residential and commercial furniture for middle and upper middle-income consumers North America and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives