- United States

- /

- Consumer Durables

- /

- NasdaqCM:XWIN

Nova LifeStyle, Inc.'s (NASDAQ:NVFY) Shares Not Telling The Full Story

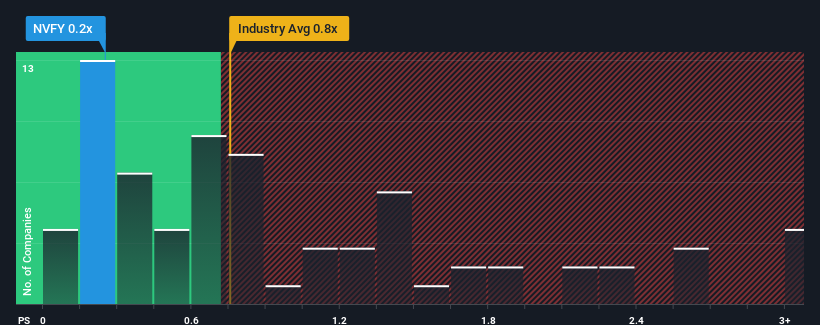

When close to half the companies operating in the Consumer Durables industry in the United States have price-to-sales ratios (or "P/S") above 0.8x, you may consider Nova LifeStyle, Inc. (NASDAQ:NVFY) as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Nova LifeStyle

What Does Nova LifeStyle's P/S Mean For Shareholders?

For example, consider that Nova LifeStyle's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nova LifeStyle's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Nova LifeStyle?

Nova LifeStyle's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.0% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 1.0% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Nova LifeStyle is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Nova LifeStyle's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Nova LifeStyle currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 5 warning signs for Nova LifeStyle (3 are potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:XWIN

XMax

Through its subsidiaries, designs, manufactures, markets, and sells residential and commercial furniture for middle and upper middle-income consumers North America and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives