- United States

- /

- Leisure

- /

- NasdaqGS:MAT

Will Mattel's (MAT) Formula 1 UNO Edition Strengthen Its Position in Branded Partnerships?

Reviewed by Sasha Jovanovic

- Mattel recently announced the expansion of its UNO Elite line with the officially licensed UNO Elite Formula 1 edition, featuring popular drivers, teams, and exclusive cards, available for pre-order with broader retail rollout planned for 2026.

- This collaboration brings together the global appeal of Formula 1 and the widespread popularity of UNO, creating new merchandising opportunities ahead of the holiday season.

- We’ll explore how Mattel’s Formula 1 partnership expands its brand portfolio and enhances its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Mattel's Investment Narrative?

To be a shareholder in Mattel, you need to believe in the power of global brands and licensing as essential drivers for long-term value. The launch of UNO Elite Formula 1 extends Mattel’s reach by combining popular toy franchises with sports partnerships, aiming to boost holiday season demand and add recurring licensing revenue. While the tie-in offers fresh merchandising opportunities and could energize sales in the near term, the most important catalysts, successful execution of licensed brand launches and broader international retail rollouts, remain intact, given the measured pace to full release in 2026. At the same time, earnings growth is modest and competition in the toy category remains fierce, so investors must stay mindful of execution risk and the impact of high debt levels following recent refinancing activities. This newest collaboration enhances Mattel’s investment story, but likely doesn’t fundamentally alter its key risks or near-term performance drivers unless it beats retailer adoption and consumer appetite expectations.

Yet, Mattel’s increased debt load from the new notes is a risk worth understanding in detail.

Exploring Other Perspectives

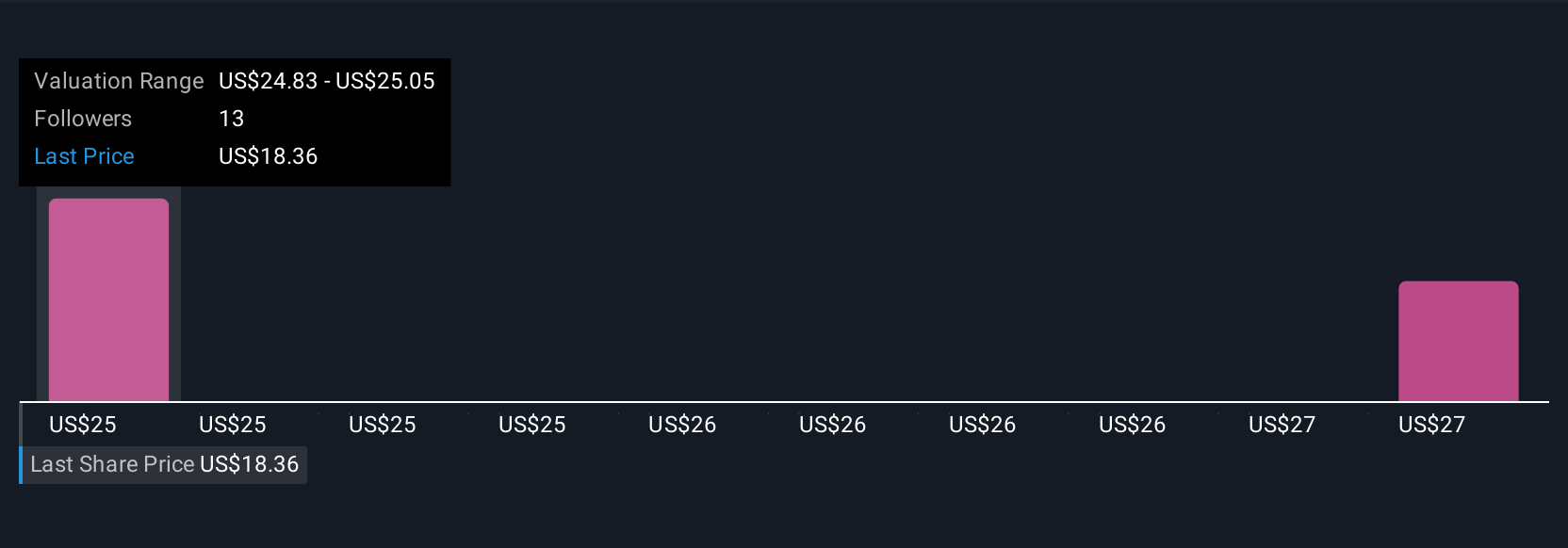

Explore 3 other fair value estimates on Mattel - why the stock might be worth over 2x more than the current price!

Build Your Own Mattel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mattel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mattel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mattel's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAT

Mattel

A toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives