- United States

- /

- Leisure

- /

- NasdaqGS:MAT

Is Recent Momentum After New Partnerships a Sign Mattel Is Attractively Priced in 2025?

Reviewed by Bailey Pemberton

Thinking about whether now is the right time to make a move on Mattel stock? You’re not alone. With recent gains of 2.2% this week and an impressive 13.8% jump over the past month, investors are buzzing about what’s driving this momentum and where shares might be headed next. It is a sharp turnaround from the stock’s tepid performance over the last year, which saw Mattel dip 3.0%, even as the five-year return clocks in at a solid 37.7%. Long-term holders know that this kind of volatility is not unusual for industry leaders adapting to shifting market dynamics.

Recent headlines have added new fuel to the fire, as strategic product launches and expanded partnerships have reignited conversation around Mattel’s future growth. With classic brands getting a modern refresh and fresh tie-ins capturing the attention of families and collectors alike, it is no wonder investors are reassessing the company’s prospects. This sense of renewed optimism seems to be reflected in the way the market is pricing Mattel shares right now.

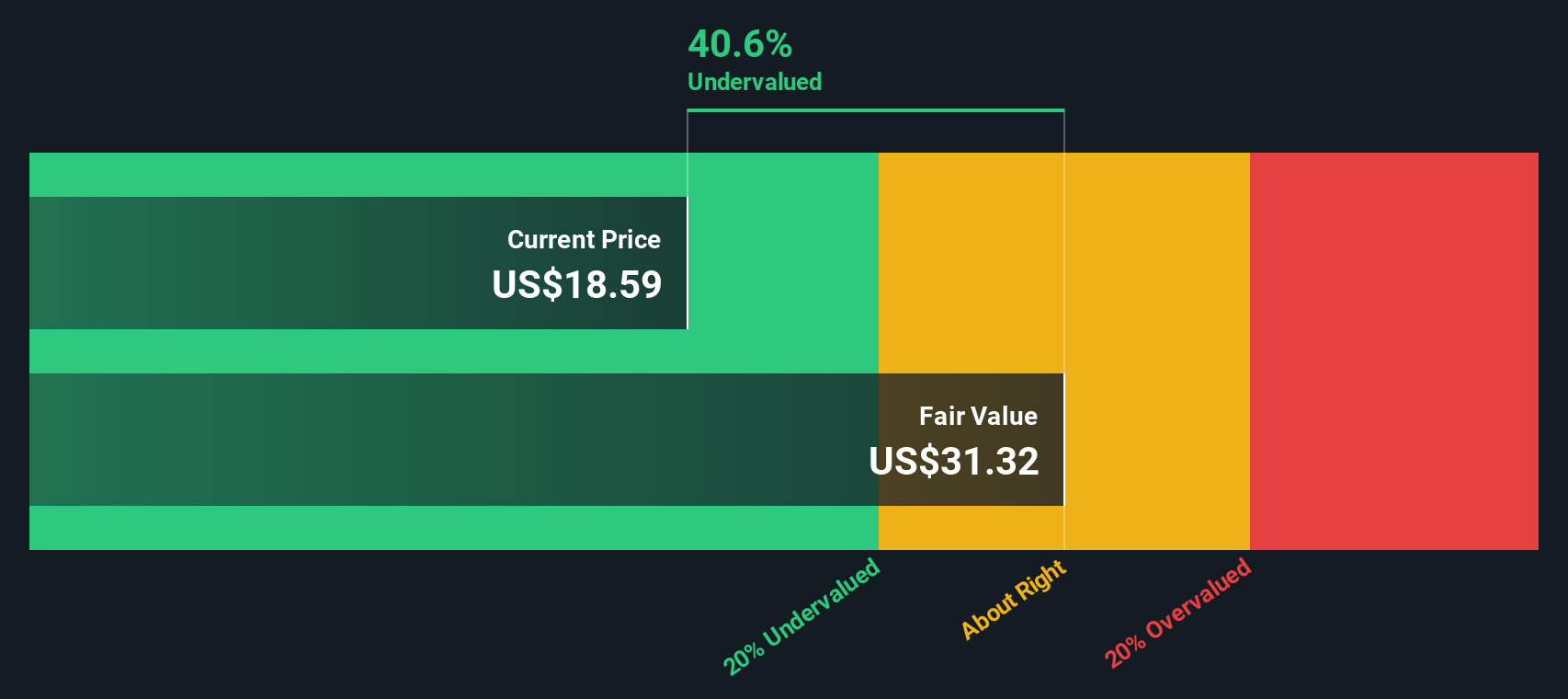

But what about valuation? That is the question savvy investors are asking. According to our quantitative checks, Mattel earns a value score of 6 out of 6, signaling that it is coming up undervalued across every metric we look at. In the sections ahead, we will break down the major valuation methods one by one, and also share a unique approach to understanding what those numbers really mean for your investment decision.

Why Mattel is lagging behind its peers

Approach 1: Mattel Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company’s expected future cash flows and then discounts them back to today’s value. This helps estimate what the company is really worth right now, based on its future earning potential.

For Mattel, the latest reported Free Cash Flow stands at $477.9 Million. Analysts forecast a modest rise, anticipating free cash flow of $520 Million in 2027. Although analyst estimates typically extend five years, further projections out to 2035 have been extrapolated by Simply Wall St, with free cash flow forecast to exceed $600 Million by then.

All of these projections are calculated in US dollars. The core idea is that these future cash flows, once discounted to reflect the time value of money, sum up to produce an intrinsic value for the company. Based on the 2 Stage Free Cash Flow to Equity model, Mattel’s intrinsic value is estimated at $31.12 per share.

Compared to the current share price, this suggests Mattel is trading at a noteworthy 38.2 percent discount to its intrinsic value. In other words, the DCF model indicates the stock is undervalued and may offer upside for investors focused on fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mattel is undervalued by 38.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

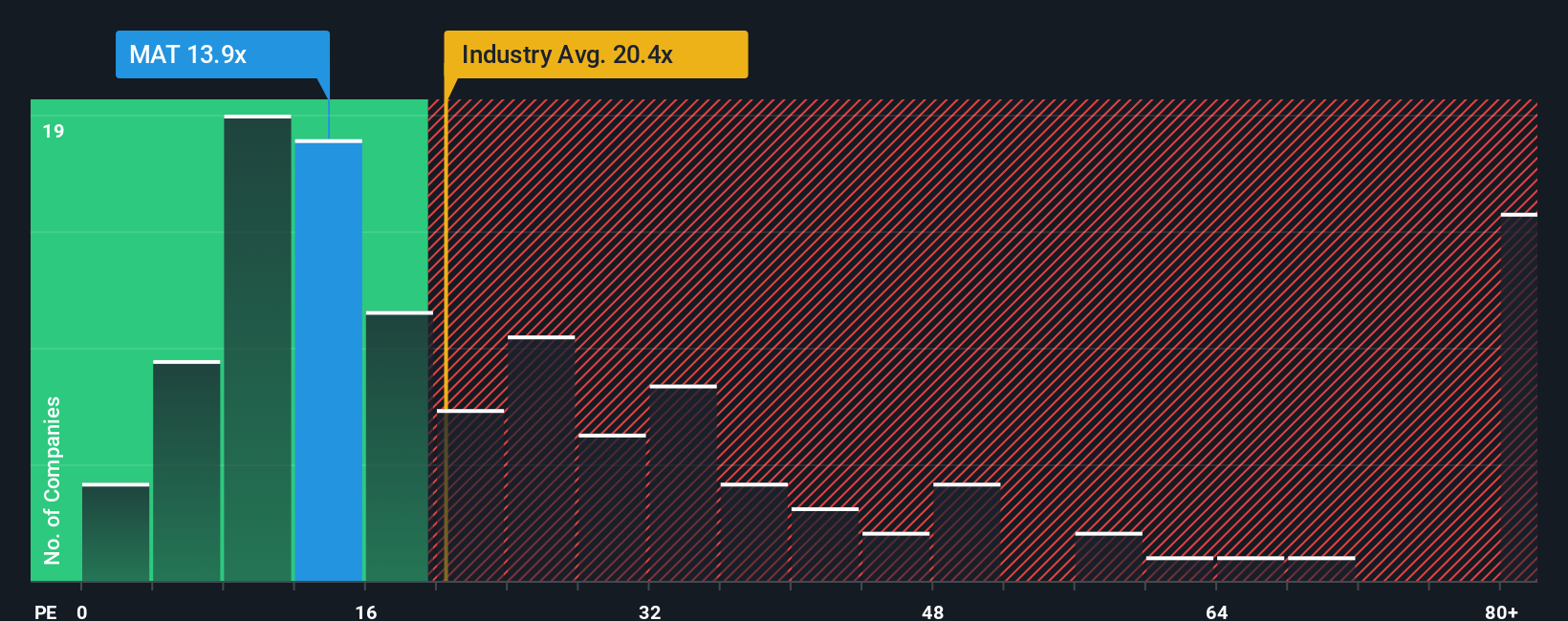

Approach 2: Mattel Price vs Earnings (PE)

The price-to-earnings (PE) ratio is a widely accepted valuation tool for profitable companies like Mattel, as it connects the stock price to the company’s current earnings. Since Mattel is solidly in the black, the PE ratio makes it easier for investors to compare its valuation not only with direct competitors but also across the broader leisure industry.

When setting a reasonable PE ratio, factors such as anticipated earnings growth and business risk come into play. Higher growth prospects and lower business risks often support loftier PE ratios, while slower growth and higher uncertainty usually call for a lower ratio. So, the “right” PE for Mattel is not just a number; it is a reflection of where the company stands today and where it is headed tomorrow.

Mattel’s current PE ratio sits at 14.3x. For context, this is well below the industry average of 21.1x and significantly under the average among peers, which stands at 51.9x. However, raw comparisons can mislead, as they do not account for each company’s unique earnings growth, profitability, and risk profile. That is where Simply Wall St’s proprietary Fair Ratio comes in. Calculated using a blend of factors like expected growth, market cap, profit margin, and risk specific to Mattel, the Fair Ratio represents a more tailored benchmark. In Mattel’s case, the Fair Ratio is 16.8x, slightly higher than the current PE, but not by much.

Because Mattel’s current PE is just 2.5x below the Fair Ratio and the difference is meaningful, the stock appears undervalued based on this approach. This implies that investors may be purchasing shares at a discount, relative to what would be justified by the company’s fundamentals and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mattel Narrative

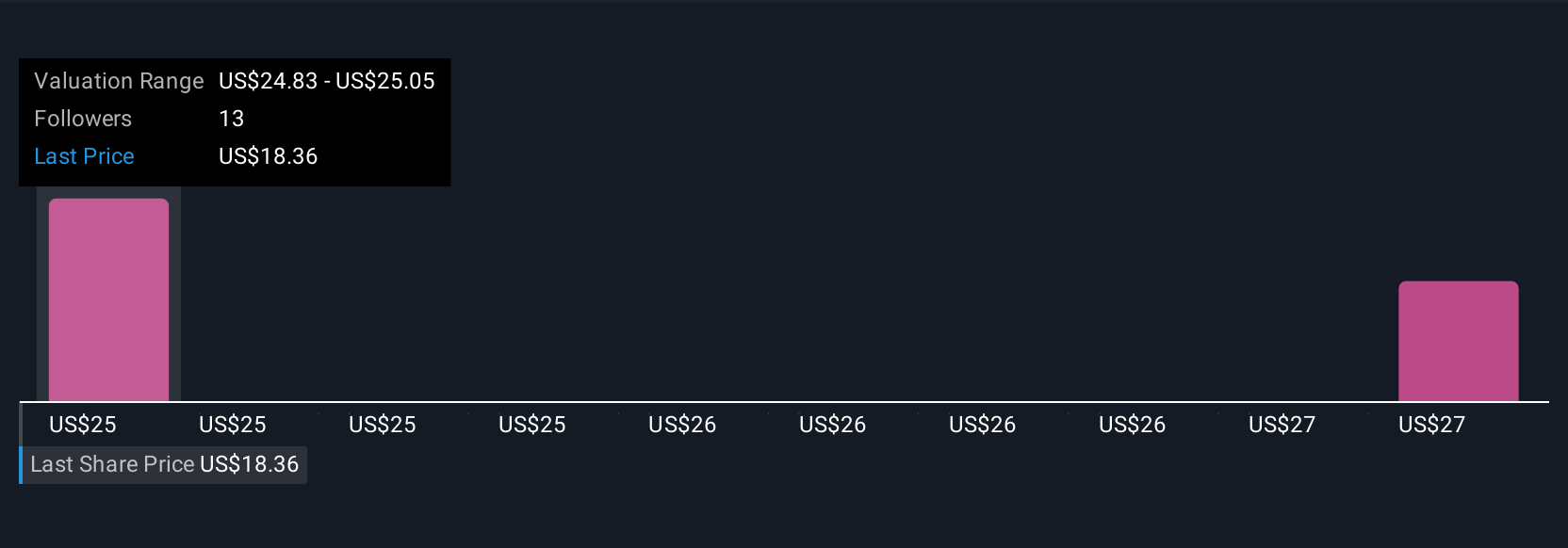

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. In simple terms, a Narrative is your personal story for a company—what you believe about its future and why—which you can build using your own estimates for things like fair value, future revenue, earnings, and margins.

With Narratives, you connect Mattel’s business story, such as bold new partnerships or challenges from digital competition, to custom financial forecasts and, ultimately, a fair value you think makes sense. This approach goes beyond just ratios or models, making investing less about static numbers and more about dynamic reasoning shaped by your research. Narratives are a unique and easy-to-use feature on Simply Wall St’s Community page, trusted by millions of investors.

By combining your Narrative with live market data, you can quickly see if the current price is above or below your personally calculated fair value, which can guide your decision to buy, hold, or sell. Narratives automatically update when new news or financial results arrive, so your view stays current. For example, some Mattel investors are optimistic and set a fair value at $30.00, while others are more cautious and land at $21.00. This lets you compare, sense check, and make your call with confidence.

Do you think there's more to the story for Mattel? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAT

Mattel

A toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives