- United States

- /

- Consumer Durables

- /

- NasdaqCM:LIVE

Does Live Ventures (NASDAQ:LIVE) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Live Ventures Incorporated (NASDAQ:LIVE) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Live Ventures

How Much Debt Does Live Ventures Carry?

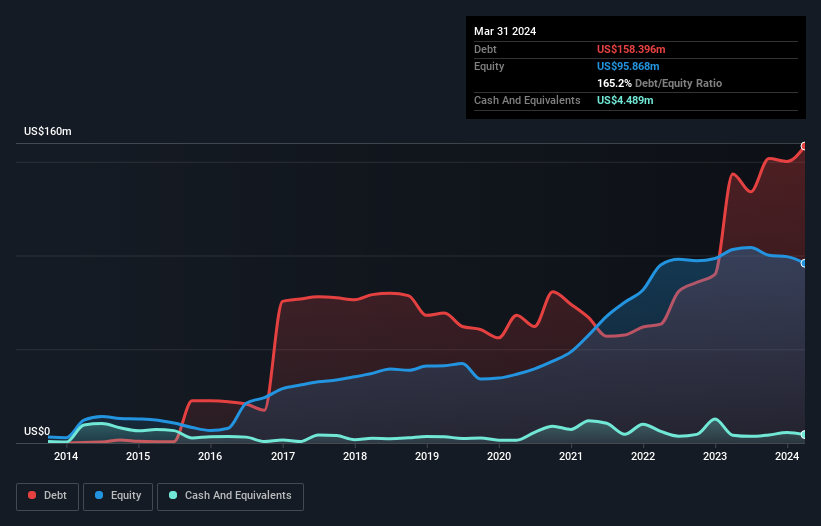

As you can see below, at the end of March 2024, Live Ventures had US$158.4m of debt, up from US$143.5m a year ago. Click the image for more detail. However, because it has a cash reserve of US$4.49m, its net debt is less, at about US$153.9m.

A Look At Live Ventures' Liabilities

We can see from the most recent balance sheet that Live Ventures had liabilities of US$106.4m falling due within a year, and liabilities of US$231.6m due beyond that. On the other hand, it had cash of US$4.49m and US$45.5m worth of receivables due within a year. So it has liabilities totalling US$288.0m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the US$71.2m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Live Ventures would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Live Ventures shareholders face the double whammy of a high net debt to EBITDA ratio (6.1), and fairly weak interest coverage, since EBIT is just 0.55 times the interest expense. The debt burden here is substantial. Even worse, Live Ventures saw its EBIT tank 60% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Live Ventures's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Live Ventures reported free cash flow worth 15% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

To be frank both Live Ventures's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. We think the chances that Live Ventures has too much debt a very significant. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Live Ventures (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LIVE

Live Ventures

Engages in the flooring and steel manufacturing, and retail businesses in the United States.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success