- United States

- /

- Consumer Durables

- /

- NasdaqGS:IRBT

If You Had Bought iRobot (NASDAQ:IRBT) Shares Five Years Ago You'd Have Earned 140% Returns

It hasn't been the best quarter for iRobot Corporation (NASDAQ:IRBT) shareholders, since the share price has fallen 18% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 140% higher today. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today.

See our latest analysis for iRobot

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

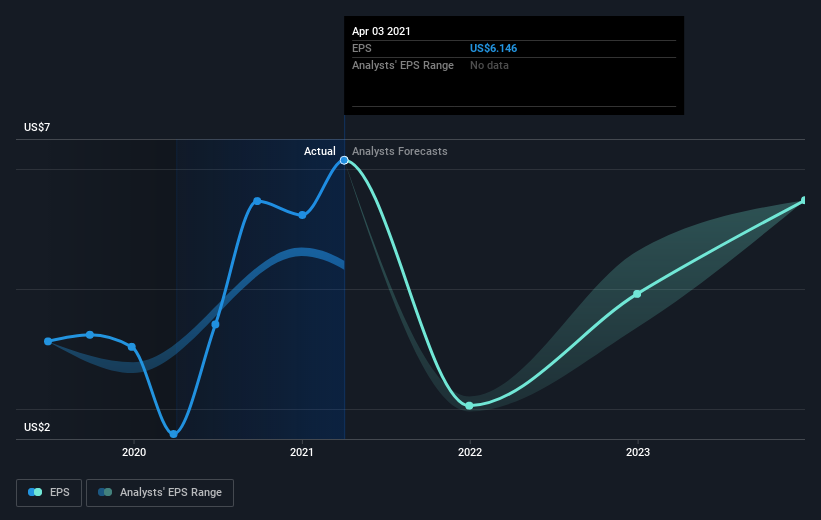

During five years of share price growth, iRobot achieved compound earnings per share (EPS) growth of 33% per year. This EPS growth is higher than the 19% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that iRobot has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at iRobot's financial health with this free report on its balance sheet.

A Different Perspective

iRobot provided a TSR of 16% over the last twelve months. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 19% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It's always interesting to track share price performance over the longer term. But to understand iRobot better, we need to consider many other factors. For example, we've discovered 2 warning signs for iRobot that you should be aware of before investing here.

Of course iRobot may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading iRobot or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if iRobot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:IRBT

iRobot

Designs, builds, and sells robots and home innovation products in the United States, Europe, the Middle East, Africa, Japan, and internationally.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.