- United States

- /

- Consumer Durables

- /

- NasdaqGS:HOFT

The Market Lifts Hooker Furnishings Corporation (NASDAQ:HOFT) Shares 40% But It Can Do More

Hooker Furnishings Corporation (NASDAQ:HOFT) shareholders would be excited to see that the share price has had a great month, posting a 40% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 46%.

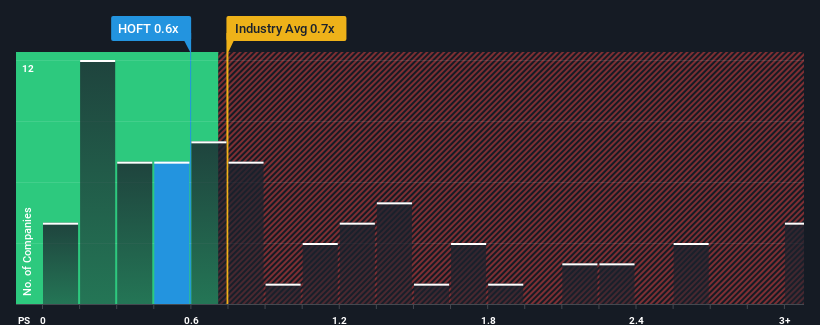

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Hooker Furnishings' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in the United States is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Hooker Furnishings

What Does Hooker Furnishings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Hooker Furnishings' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hooker Furnishings.Is There Some Revenue Growth Forecasted For Hooker Furnishings?

Hooker Furnishings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. The last three years don't look nice either as the company has shrunk revenue by 15% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 9.4% per year over the next three years. With the industry only predicted to deliver 4.1% per year, the company is positioned for a stronger revenue result.

In light of this, it's curious that Hooker Furnishings' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Hooker Furnishings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Hooker Furnishings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Hooker Furnishings you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hooker Furnishings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HOFT

Hooker Furnishings

Designs, manufactures, imports, and markets residential household, hospitality, and contract furniture products.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives