- United States

- /

- Consumer Durables

- /

- NasdaqGS:HOFT

Take Care Before Jumping Onto Hooker Furnishings Corporation (NASDAQ:HOFT) Even Though It's 27% Cheaper

To the annoyance of some shareholders, Hooker Furnishings Corporation (NASDAQ:HOFT) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

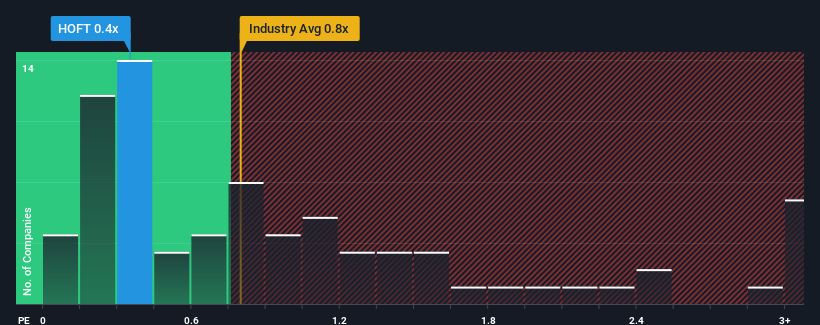

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Hooker Furnishings' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in the United States is also close to 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Hooker Furnishings

How Has Hooker Furnishings Performed Recently?

Hooker Furnishings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hooker Furnishings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hooker Furnishings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. As a result, revenue from three years ago have also fallen 32% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 8.7% each year during the coming three years according to the two analysts following the company. That's shaping up to be materially higher than the 6.2% per annum growth forecast for the broader industry.

In light of this, it's curious that Hooker Furnishings' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Hooker Furnishings' P/S Mean For Investors?

Hooker Furnishings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Hooker Furnishings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware Hooker Furnishings is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hooker Furnishings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOFT

Hooker Furnishings

Designs, manufactures, imports, and markets residential household, hospitality, and contract furniture products.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives