- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Don't Buy Hasbro, Inc. (NASDAQ:HAS) For Its Next Dividend Without Doing These Checks

Hasbro, Inc. (NASDAQ:HAS) stock is about to trade ex-dividend in 4 days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Therefore, if you purchase Hasbro's shares on or after the 31st of January, you won't be eligible to receive the dividend, when it is paid on the 15th of February.

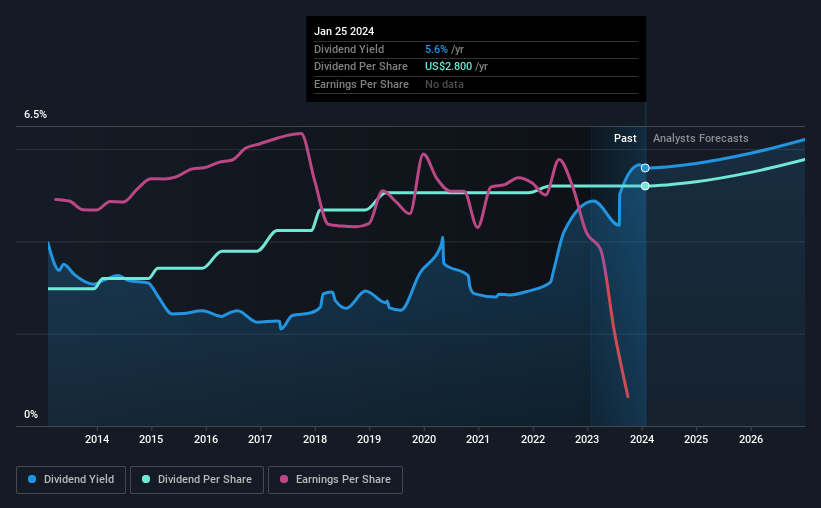

The company's next dividend payment will be US$0.70 per share, and in the last 12 months, the company paid a total of US$2.80 per share. Looking at the last 12 months of distributions, Hasbro has a trailing yield of approximately 5.6% on its current stock price of US$50.08. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Hasbro

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Hasbro lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If Hasbro didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Hasbro paid out more free cash flow than it generated - 160%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Hasbro reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last 10 years, Hasbro has lifted its dividend by approximately 5.8% a year on average.

Remember, you can always get a snapshot of Hasbro's financial health, by checking our visualisation of its financial health, here.

Final Takeaway

Should investors buy Hasbro for the upcoming dividend? We're a bit uncomfortable with it paying a dividend while being loss-making, especially given that the dividend was not well covered by free cash flow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Hasbro. Our analysis shows 2 warning signs for Hasbro and you should be aware of these before buying any shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion