- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Does Hasbro’s AI-First Shift and Disney License Renewal Change the Bull Case for HAS?

Reviewed by Sasha Jovanovic

- In November 2025, Hasbro CFO Gina Goetter discussed the company's adoption of an AI-first strategy to optimize business processes such as demand planning while ensuring that creative and artistic areas remain protected from AI use.

- Alongside this operational shift, Hasbro extended its toy licenses with Disney for Star Wars and Marvel, and relaunched the Furby franchise with modern interactive features and new product lines targeting the holiday gift market.

- We'll now examine how Hasbro’s renewed focus on operational efficiency through AI adoption could impact its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Hasbro Investment Narrative Recap

To own Hasbro stock, investors need to believe in the company’s ability to harness its industry-leading brands, diversify its product and licensing portfolio, and achieve greater operational efficiency, especially in the face of a challenging consumer landscape. The recent “AI-first” strategy announcement is an incremental development; while it may support efficiencies in demand planning, it is unlikely to materially shift the most pressing catalyst, strength in digital gaming and licensing revenue, or solve the risk of traditional toy demand softness in the short term.

The extension of major licensing agreements with Disney for Star Wars and Marvel stands out among recent announcements, directly supporting Hasbro’s access to leading entertainment franchises. This remains highly relevant given ongoing royalty and franchise concentration risks, but also reinforces a key catalyst: the ability to leverage iconic properties to drive recurring high-margin revenue streams through toys, collectibles, and games.

However, investors should also keep in mind that while digital and IP-driven revenues show promise, substantial risk remains if demand for traditional toys continues to fall or if large licensing relationships change unexpectedly…

Read the full narrative on Hasbro (it's free!)

Hasbro's outlook forecasts $4.9 billion in revenue and $773.5 million in earnings by 2028. This assumes a 4.7% annual revenue growth and a $1.34 billion increase in earnings from the current level of -$568.3 million.

Uncover how Hasbro's forecasts yield a $91.54 fair value, a 11% upside to its current price.

Exploring Other Perspectives

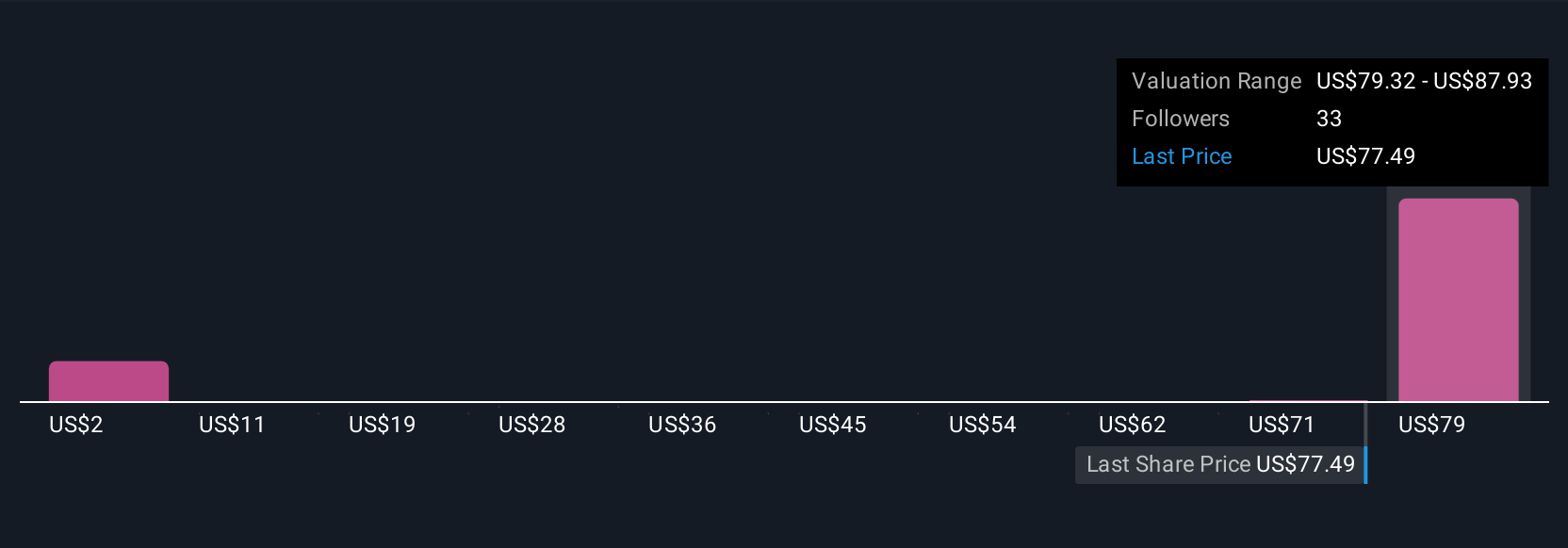

Six members of the Simply Wall St Community valued Hasbro between US$1.90 and US$149.68, reflecting sharply varied viewpoints. As digital and licensing revenues gain importance, it is clear that investors bring a wide spectrum of expectations about future performance, so make sure to explore different perspectives.

Explore 6 other fair value estimates on Hasbro - why the stock might be worth less than half the current price!

Build Your Own Hasbro Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hasbro research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hasbro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hasbro's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026