- United States

- /

- Luxury

- /

- NasdaqGS:FOSL

Some Fossil Group (NASDAQ:FOSL) Shareholders Have Taken A Painful 88% Share Price Drop

We're definitely into long term investing, but some companies are simply bad investments over any time frame. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Fossil Group, Inc. (NASDAQ:FOSL) during the five years that saw its share price drop a whopping 88%. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Fossil Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

We know that Fossil Group has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics may better explain the share price move.

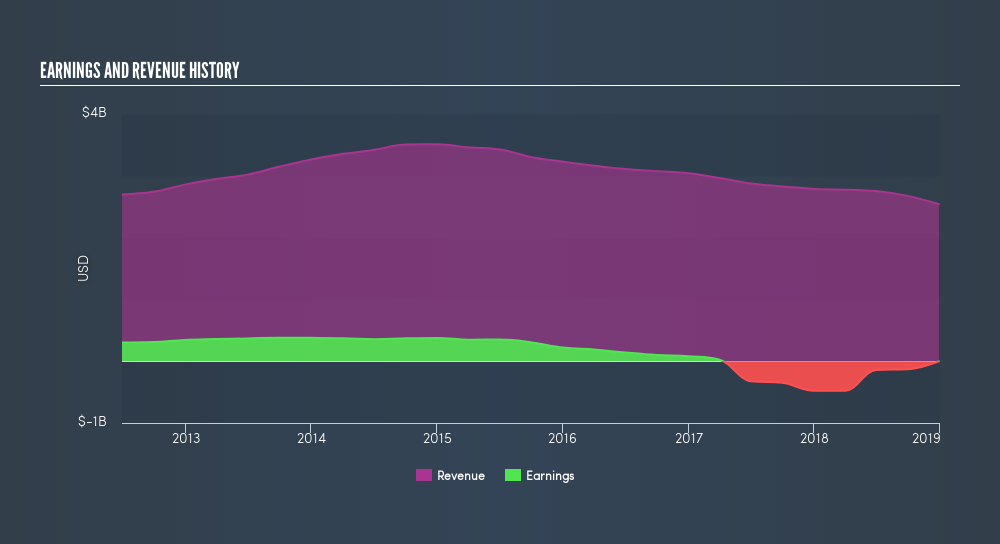

Arguably, the revenue drop of 5.9% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

If you are thinking of buying or selling Fossil Group stock, you should check out this FREEdetailed report on its balance sheet.

A Different Perspective

While the broader market gained around 8.2% in the last year, Fossil Group shareholders lost 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 35% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before spending more time on Fossil Group it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:FOSL

Fossil Group

Designs, develops, markets, and distributes consumer fashion accessories in the United States, Europe, Asia, and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives