- United States

- /

- Consumer Durables

- /

- NasdaqCM:FEBO

Optimistic Investors Push Fenbo Holdings Limited (NASDAQ:FEBO) Shares Up 53% But Growth Is Lacking

The Fenbo Holdings Limited (NASDAQ:FEBO) share price has done very well over the last month, posting an excellent gain of 53%. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

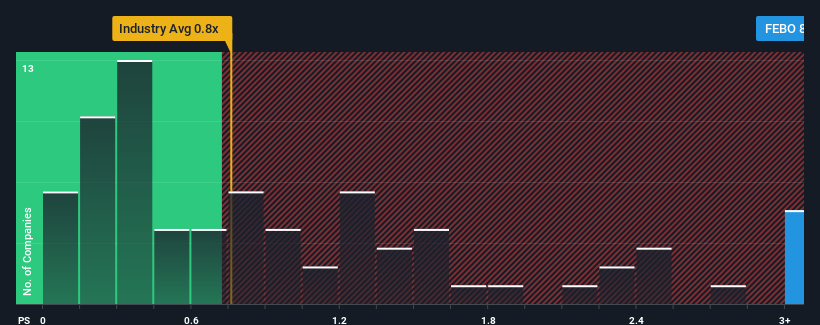

Since its price has surged higher, given around half the companies in the United States' Consumer Durables industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Fenbo Holdings as a stock to avoid entirely with its 8.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Fenbo Holdings

How Has Fenbo Holdings Performed Recently?

We'd have to say that with no tangible growth over the last year, Fenbo Holdings' revenue has been unimpressive. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Fenbo Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Fenbo Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Fenbo Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 17% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 4.2% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Fenbo Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Shares in Fenbo Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Fenbo Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Fenbo Holdings (1 is a bit unpleasant) you should be aware of.

If these risks are making you reconsider your opinion on Fenbo Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FEBO

Fenbo Holdings

Through its subsidiaries, manufactures, distributes, and sells personal care electric appliances and toys products in Europe, North America, Asia, and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives