- United States

- /

- Luxury

- /

- NasdaqCM:DOGZ

Dogness (DOGZ) Losses Accelerate 13.9% Annually, High Valuation Raises Investor Caution

Reviewed by Simply Wall St

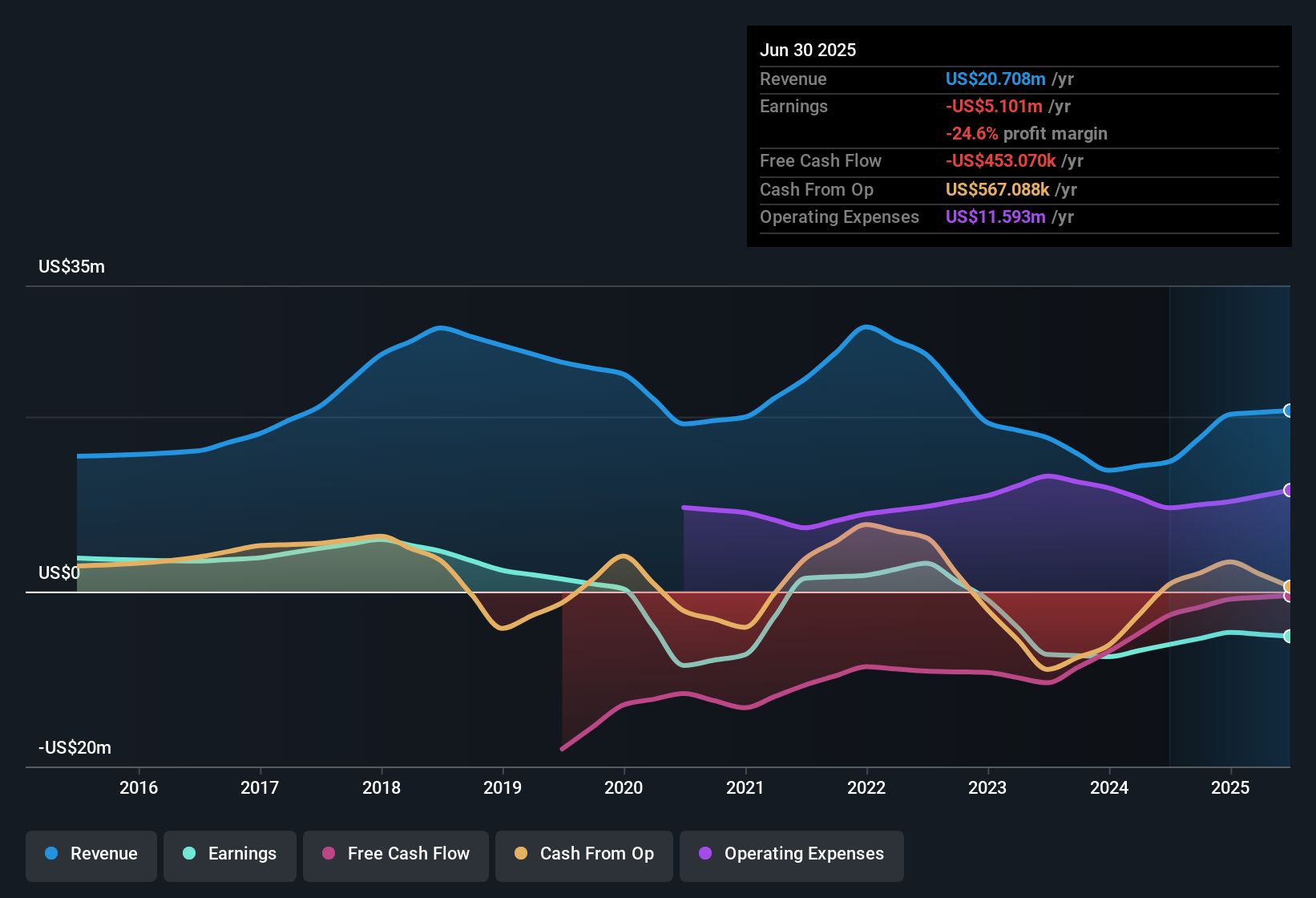

Dogness (International) (DOGZ) remains unprofitable, with losses having grown at a compounded rate of 13.9% annually over the past five years. The company’s net profit margin has failed to improve, and there are no signs of a turnaround or positive profit growth in recent periods.

See our full analysis for Dogness (International).Next, we will see how the latest numbers measure up against the key narratives followed by the market. We will also consider whether popular views on DOGZ are still holding up.

Curious how numbers become stories that shape markets? Explore Community Narratives

Premium to Peers Despite Losses

- Dogness (International) trades at a Price-To-Sales ratio of 9.3x, which is far above the US Luxury industry average of 0.7x and peer average of 0.6x. This highlights how investors are paying much more for each dollar of sales compared to similar companies.

- Despite this steep premium, current financials do not reflect the innovation-driven growth that would typically justify such a high multiple.

- The ongoing unprofitability and lack of profit margin improvement highlight a disconnect between valuation and business performance. This calls into question bullish claims that DOGZ could catch up to sector leaders.

- Bulls would typically cite sector strength as justification for paying up. However, without positive earnings or sales trends emerging in recent filings, the current multiple looks difficult to sustain.

Losses Escalate With No Sign of Turnaround

- Losses have grown at an annualized rate of 13.9% over the past five years, reinforcing concerns that operations are not moving towards profitability.

- Bears are likely to point to this ongoing trend as evidence that DOGZ remains a higher-risk bet with little momentum towards recovery.

- The net profit margin has failed to make any progress, so long-term bears are not seeing their concerns addressed by recent performance.

- No recent earnings or sales growth signals in the data mean bearish investors have yet to see a compelling case for a reversal.

Financial Uncertainties and Share Price Instability

- Risk indicators show a lack of stable share price over the past three months, paired with insufficient financial data and no guidance for future revenue or earnings growth.

- In light of these factors, prevailing market analysis notes that traders may continue to treat DOGZ as a speculative and event-driven stock. It appears more sensitive to short-term sentiment than underlying fundamentals.

- The absence of clear reward statements in filings means market participants have little concrete upside to anchor expectations, so price may remain volatile and unpredictable.

- No signs of near-term operational improvement set DOGZ apart from sector peers who enjoy steadier performance, heightening the risk profile for potential investors.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Dogness (International)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Dogness (International) faces ongoing losses, a high valuation despite weak fundamentals, and no signs of a turnaround or stable operating performance.

If you want steadier performance, use our stable growth stocks screener (2084 results) to spot companies consistently delivering reliable growth and avoiding these same pitfalls.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DOGZ

Dogness (International)

Through its subsidiaries, designs, manufactures, and sells fashionable products for dogs and cats worldwide.

Adequate balance sheet with low risk.

Market Insights

Community Narratives