- United States

- /

- Consumer Durables

- /

- NasdaqGS:CVCO

Cavco Industries (CVCO): Assessing Valuation After Standout Q2 Earnings and American Homestar Acquisition

Reviewed by Simply Wall St

Cavco Industries (CVCO) just released its second quarter results, and the numbers are turning heads. The company posted meaningful increases in both sales and net income, outpacing what most on Wall Street were expecting.

See our latest analysis for Cavco Industries.

Momentum around Cavco Industries has been picking up, thanks in part to impressive quarterly results, continued share buybacks, and the strategic addition of American Homestar to its portfolio. The stock currently trades at $535.42. While the past week saw a pullback, the year-to-date share price return is a robust 21.94%. Over the past three and five years, Cavco has delivered total shareholder returns of 162.5% and 181.7%, respectively, showing both short- and long-term investors strong performance and confidence in the company's growth story.

If Cavco’s growth streak has sparked your curiosity, now is a great time to see what else is out there and discover fast growing stocks with high insider ownership.

With Cavco’s valuation hovering near analyst targets after such strong results, the question shifts to whether the stock is trading at a bargain given its momentum, or if all that future growth is already factored into the price.

Most Popular Narrative: 8.7% Undervalued

Cavco Industries’ most widely followed narrative points to the stock trading below its calculated fair value of $586.67, with the last close at $535.42. This perspective weighs strong revenue expectations against slightly tighter margins, setting the stage for key drivers behind the valuation.

Ongoing investments in factory automation and facility modernization are raising operational efficiency and capacity utilization. Together with stable input costs, these improvements are likely to promote gross margin expansion and improved overall profitability. Growth and improvement in integrated offerings, notably Financial Services with recent margin turnaround from better underwriting and pricing, introduce higher-margin recurring revenues and greater earnings stability. These factors support long-term net margin and EPS growth.

Curious what bold assumptions drive this upbeat outlook? The valuation hinges on a set of aggressive growth forecasts and a future multiple the market rarely awards in this sector. Unlock the secrets behind this bullish price target and see why analysts think Cavco might be just getting started.

Result: Fair Value of $586.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors like rising tariffs on imported components, as well as persistent regional demand weakness, could quickly change the outlook for Cavco’s continued growth.

Find out about the key risks to this Cavco Industries narrative.

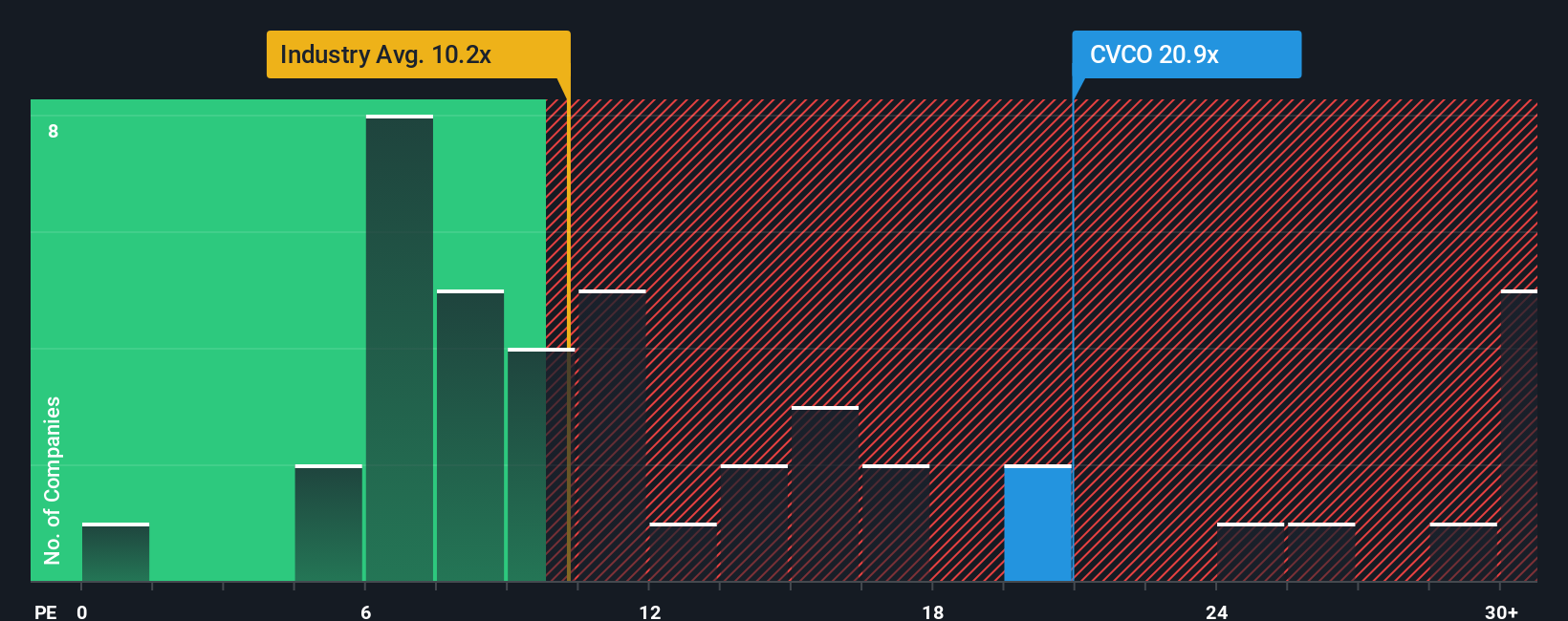

Another View: Multiple-Based Valuation Sends a Different Message

While analysts see Cavco Industries as undervalued based on future growth forecasts, a glance at its price-to-earnings ratio tells a different story. Cavco currently trades at 21.2 times earnings, which is much higher than both its peer average of 10.2 and the industry average of 10.6. Even compared to the fair ratio of 14.9, Cavco's valuation appears elevated. This significant gap raises questions about whether the market is pricing in too much optimism or if investors expect the company to keep outperforming for years to come.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cavco Industries Narrative

If you see things differently or want to dig deeper into the numbers, it only takes a few minutes to build your own outlook. Do it your way.

A great starting point for your Cavco Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make the smartest moves in your portfolio by acting now; there are powerful opportunities waiting that go beyond Cavco. Don't miss your chance to get ahead with these handpicked ideas.

- Tap into cutting-edge healthcare breakthroughs by scanning these 33 healthcare AI stocks focused on AI-driven medical advancements and rapid industry transformation.

- Amplify your search for income-generating potential by uncovering these 18 dividend stocks with yields > 3%, delivering attractive yields that can add stability to your returns.

- Stay one step ahead of the curve with these 27 AI penny stocks, your gateway to next-generation companies built on artificial intelligence and machine learning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVCO

Cavco Industries

Designs, produces, and retails factory-built homes primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives