- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Crocs (CROX): Evaluating Valuation After Leadership Shake-Up at HEYDUDE With adidas Veteran at the Helm

Reviewed by Simply Wall St

Crocs (CROX) has promoted Rupert Campbell, a footwear industry veteran with years of experience at adidas, to lead its HEYDUDE brand as Executive Vice President and President. This leadership shift could reshape the brand’s strategic direction and attract investor interest.

See our latest analysis for Crocs.

While Crocs’ decision to elevate Rupert Campbell comes at a pivotal time, the company’s recent share price momentum has been mixed. Despite a 3.7% share price gain in the last day and a 5.6% boost for the week, Crocs’ year-to-date share price return is down nearly 26%. The one-year total shareholder return also lags at -25%. Over the long haul, however, Crocs still boasts a robust five-year total shareholder return of 38%, which hints at underlying growth potential if management can re-ignite momentum.

If you’re interested in broadening your search beyond footwear, now is a great opportunity to see what’s happening with fast growing stocks with high insider ownership.

With shares still trading nearly 10% below analyst price targets and performance lagging the broader market, the real question now is whether Crocs is undervalued or if future growth is already included in the stock price.

Most Popular Narrative: 7% Undervalued

With Crocs closing at $81.44 and the narrative's suggested fair value at $87.83, there's a notable upside in the eyes of followers. The difference reflects optimism that recent leadership moves and long-term global growth initiatives could eventually be rewarded by the market.

Strategic innovation in sandals, personalization (Jibbitz), and product franchises, combined with a digitally enabled marketing approach and a stronger social commerce presence (such as TikTok Shop leadership), positions Crocs to capitalize on consumer shifts toward casualwear and self-expression. This enhances brand desirability, broadens customer demographics, and supports both sustained revenue growth and future gross margin expansion as average selling prices rise.

Beneath this valuation are bold projections for profit margins and ambitious earnings growth. Want to know which numbers fuel this thesis and what’s presumed for Crocs’s future profits? The real surprise might just be how aggressive these assumptions are. Only the full narrative reveals the analysis behind the price target.

Result: Fair Value of $87.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent North American weakness and rising global trade barriers could quickly challenge Crocs’ ability to deliver on these ambitious margin and growth targets.

Find out about the key risks to this Crocs narrative.

Another View: How Do Multiples Compare?

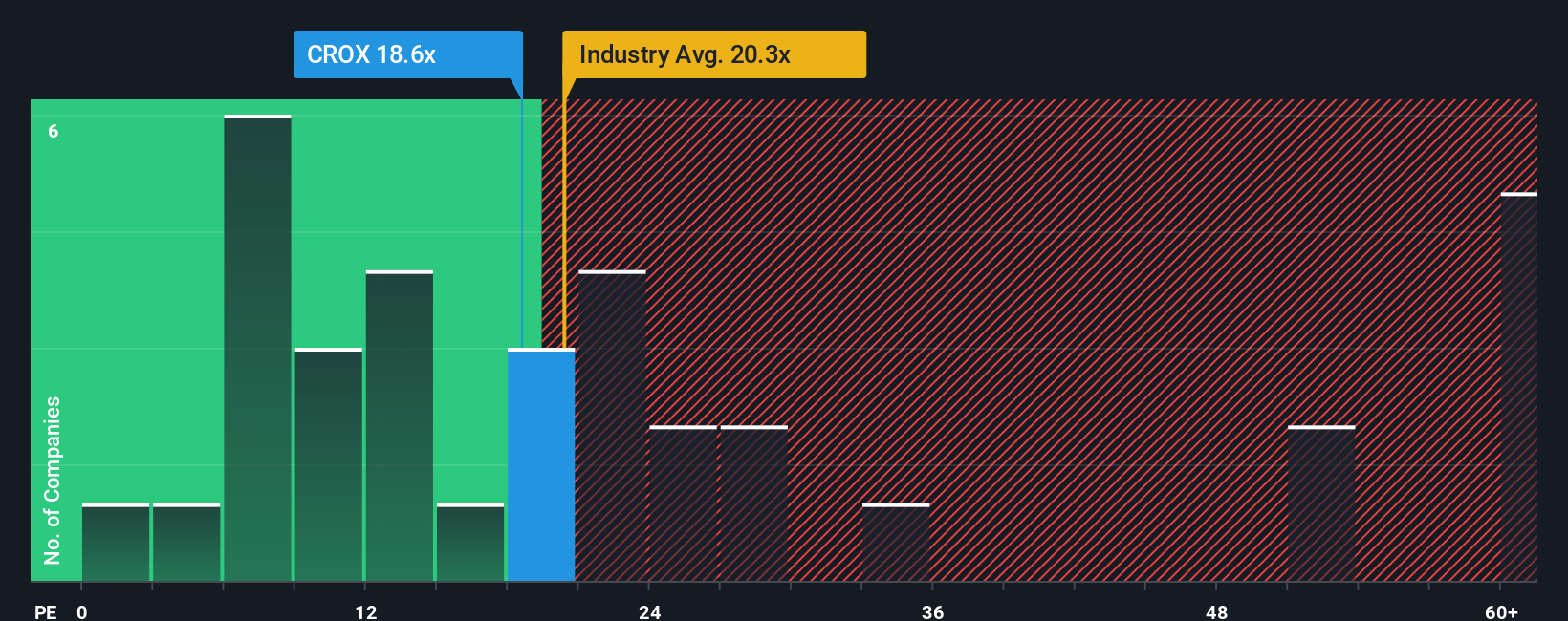

Looking at Crocs through the lens of its price-to-earnings ratio, the story shifts. Crocs trades at 23.2 times earnings, which is higher than the US Luxury industry average of 19.7x and above the peer average of 22.2x. However, its fair ratio is estimated at 58.7x, a much higher benchmark the market could eventually move toward. Such a gap might hint at opportunity, but also warns that current pricing leaves little room for disappointment. Is the market truly underestimating Crocs, or are expectations running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crocs Narrative

If you see these findings differently or want your own perspective in the mix, you can shape a personal narrative in just a few minutes your way. Do it your way.

A great starting point for your Crocs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game and seize new opportunities now. Don’t limit yourself to just one stock, as smarter choices could be waiting.

- Amplify your returns by targeting reliable income streams. Check out these 15 dividend stocks with yields > 3% with strong yields and consistent performance.

- Accelerate your portfolio's growth by exploring these 26 AI penny stocks, where AI-driven innovation is restructuring global industries.

- Capture untapped potential by reviewing these 917 undervalued stocks based on cash flows, spotlighting stocks the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives