- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Can Crocs’ (CROX) Leadership Shift Revitalize the HEYDUDE Brand’s Recovery Strategy?

Reviewed by Sasha Jovanovic

- On November 17, 2025, Crocs, Inc. promoted Rupert Campbell to Executive Vice President and President of its HEYDUDE brand, adding him to the executive leadership team reporting directly to the CEO.

- This appointment brings to Crocs a leader with global footwear expertise, notably from his tenure as President of adidas North America, during a period when the HEYDUDE brand has faced recent sales challenges.

- We will examine how Campbell’s addition to the executive team could influence Crocs' narrative around leadership focus and brand recovery.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Crocs Investment Narrative Recap

To own Crocs stock today is to believe in the company's ability to reinvigorate both its core and HEYDUDE brands despite ongoing sales pressures and an uncertain consumer backdrop. The promotion of Rupert Campbell is a positive leadership development, but it alone may not materially change near-term results; the key catalyst remains successful stabilization of HEYDUDE's wholesale channel, while the biggest risk is persistent inventory and margin headwinds in a challenging market.

Among several recent updates, Crocs' latest earnings report is the most relevant to this leadership news. Falling Q3 sales and a soft revenue outlook frame the urgency for the new HEYDUDE president to deliver results, as investors closely watch whether leadership changes can reverse weakness in wholesale and improve profitability.

Yet, amid hopes for a turnaround, investors should also watch for lingering risks from inventory write-downs and ongoing reliance on promotions that...

Read the full narrative on Crocs (it's free!)

Crocs' narrative projects $4.0 billion revenue and $925.2 million earnings by 2028. This requires 1.0% yearly revenue decline and a $688.7 million earnings increase from $236.5 million today.

Uncover how Crocs' forecasts yield a $87.83 fair value, a 12% upside to its current price.

Exploring Other Perspectives

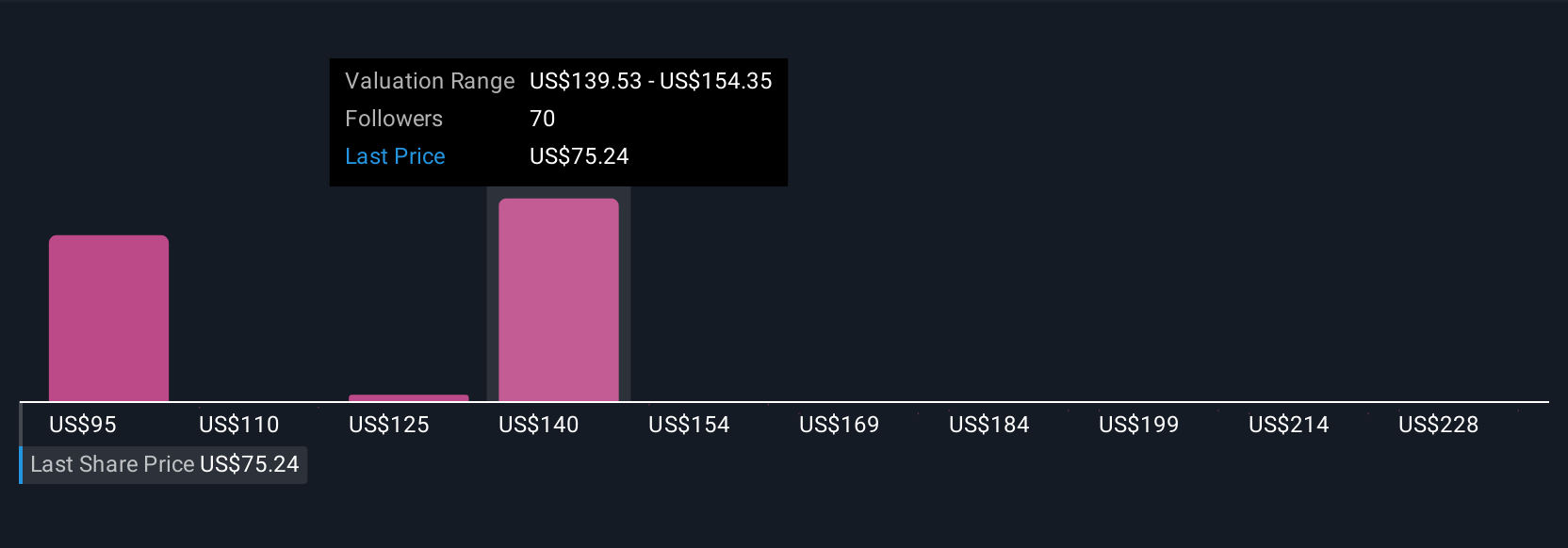

Eighteen members of the Simply Wall St Community estimate Crocs’ fair value between US$87.83 and US$168.11. While opinions range widely, persistent margin risks tied to HEYDUDE’s inventory and wholesale performance could shape future returns and valuation, explore multiple outlooks before making conclusions.

Explore 18 other fair value estimates on Crocs - why the stock might be worth just $87.83!

Build Your Own Crocs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crocs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crocs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crocs' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives