- United States

- /

- Luxury

- /

- NasdaqGS:COLM

What Columbia Sportswear Company's (NASDAQ:COLM) P/E Is Not Telling You

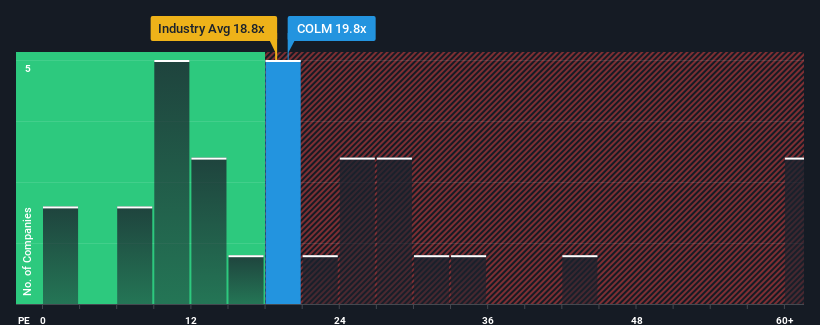

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Columbia Sportswear Company (NASDAQ:COLM) as a stock to potentially avoid with its 19.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Columbia Sportswear has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Columbia Sportswear

Is There Enough Growth For Columbia Sportswear?

In order to justify its P/E ratio, Columbia Sportswear would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. Even so, admirably EPS has lifted 69% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 8.3% each year as estimated by the nine analysts watching the company. With the market predicted to deliver 9.9% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's curious that Columbia Sportswear's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Columbia Sportswear's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Columbia Sportswear's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Columbia Sportswear with six simple checks.

If you're unsure about the strength of Columbia Sportswear's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COLM

Columbia Sportswear

Designs, develops, markets, and distributes outdoor, active, and lifestyle products in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives