- United States

- /

- Luxury

- /

- NasdaqGS:COLM

How Investors Are Reacting To Columbia Sportswear (COLM) Operating Loss and Lowered 2026 Outlook

Reviewed by Sasha Jovanovic

- In recent weeks, Columbia Sportswear reported softer consumer demand, inflation pressures, and increased competition have led to declining earnings, including an operating loss in Q2 2025 and a reduced outlook for 2026.

- An important insight is that these operational setbacks have led the company to face diminished investor confidence as it approaches its next earnings report.

- We'll now explore how Columbia Sportswear's lowered earnings outlook and operational challenges influence its overall investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Columbia Sportswear Investment Narrative Recap

To own Columbia Sportswear stock, one needs to be confident in the company’s ability to reinvigorate demand, control costs, and adapt to a tougher consumer and competitive environment. The recent news of declining earnings and a lowered 2026 outlook has clearly become the biggest near-term risk, with investor sentiment now heavily tied to any signs of stabilization or improvement in the next earnings report. Short term, the company’s performance and future strategy will likely be judged against its ability to reverse or contain these headwinds.

Among recent announcements, Columbia’s Q2 2025 results stand out: despite higher sales versus the prior year, the company posted an operating loss and reduced guidance for the second half of the year. The move to withdraw full-year financial guidance earlier in 2025, while aimed at addressing macro uncertainty, added to caution and placed even greater focus on management’s ability to address cost pressures and maintain profitability.

Yet, it is equally important to keep in mind that, despite strategic investments in digital and product innovation, new risks have arisen around...

Read the full narrative on Columbia Sportswear (it's free!)

Columbia Sportswear is projected to reach $3.7 billion in revenue and $184.1 million in earnings by 2028. This outlook assumes a 2.3% annual revenue growth and a decrease in earnings of $40.7 million from the current $224.8 million.

Uncover how Columbia Sportswear's forecasts yield a $56.12 fair value, a 5% upside to its current price.

Exploring Other Perspectives

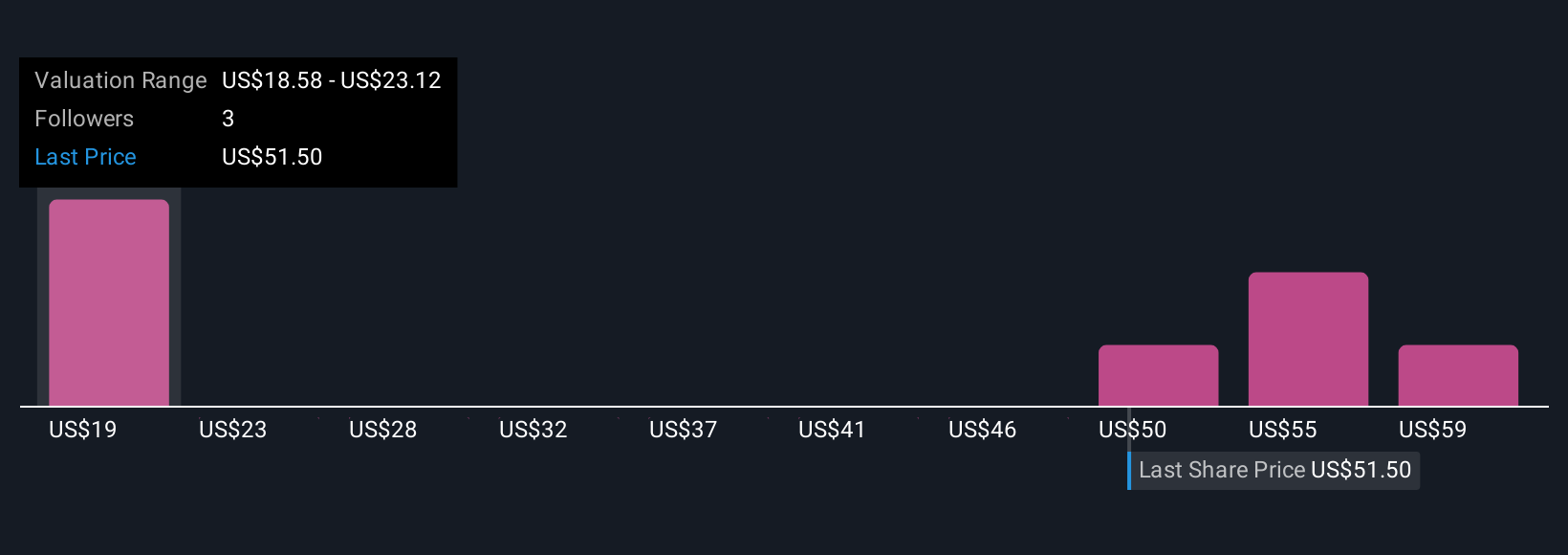

Four Simply Wall St Community estimates for fair value cluster from US$18.60 to US$64 per share. Persistent competition in digital and direct to consumer channels raises further questions about Columbia’s ability to recapture market share, inviting you to consider a range of opinions on its outlook.

Explore 4 other fair value estimates on Columbia Sportswear - why the stock might be worth less than half the current price!

Build Your Own Columbia Sportswear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Columbia Sportswear research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Columbia Sportswear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Columbia Sportswear's overall financial health at a glance.

No Opportunity In Columbia Sportswear?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLM

Columbia Sportswear

Designs, develops, markets, and distributes outdoor, active, and lifestyle products in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives