- United States

- /

- Luxury

- /

- NasdaqGS:COLM

A Look at Columbia Sportswear’s (COLM) Valuation Following Leadership Changes and Fresh Growth Strategy

Reviewed by Simply Wall St

Columbia Sportswear (COLM) has announced fresh changes to its senior leadership team as part of an ongoing succession strategy, placing Peter J. Bragdon and Joseph P. Boyle in co-president roles. Investors are watching how these appointments may shape the company’s direction and response to industry headwinds.

See our latest analysis for Columbia Sportswear.

These leadership changes come at a challenging time for Columbia Sportswear's shares, with the stock down 35% year-to-date and a one-year total shareholder return of -33.7%. The recent leadership update and efforts to address industry risks signal a plan for future growth, but momentum has been fading and investors are watching for signs of a turnaround.

If you’re curious what else could be gathering steam right now, it might be the perfect moment to discover fast growing stocks with high insider ownership.

The question for investors now is whether Columbia Sportswear’s steep share price decline signals a compelling value, or if the market is already factoring in the company’s growth and succession plans, which may leave little room for upside.

Most Popular Narrative: 6.7% Undervalued

With Columbia Sportswear’s fair value estimate at $57.57 against a last close of $53.69, the most popular narrative points to a modest edge for value-focused buyers. This dynamic sets the scene for what is shaping analyst thinking right now.

International growth, strong digital transformation, innovation, operational efficiency, and successful emerging brand strategies signal improved revenue diversification and resilience beyond the core U.S. market.

Want to see what’s really powering this valuation? It’s not just recovery talk. Future profit margins, revenue expansion, and a surprising earnings projection are woven into the model. Get the story behind these drivers and discover the crucial assumptions before making your next move.

Result: Fair Value of $57.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong international growth and successful digital investments could accelerate sales and improve margins. This could quickly challenge the current conservative outlook.

Find out about the key risks to this Columbia Sportswear narrative.

Another View: Multiple-Based Valuation Paints a Different Picture

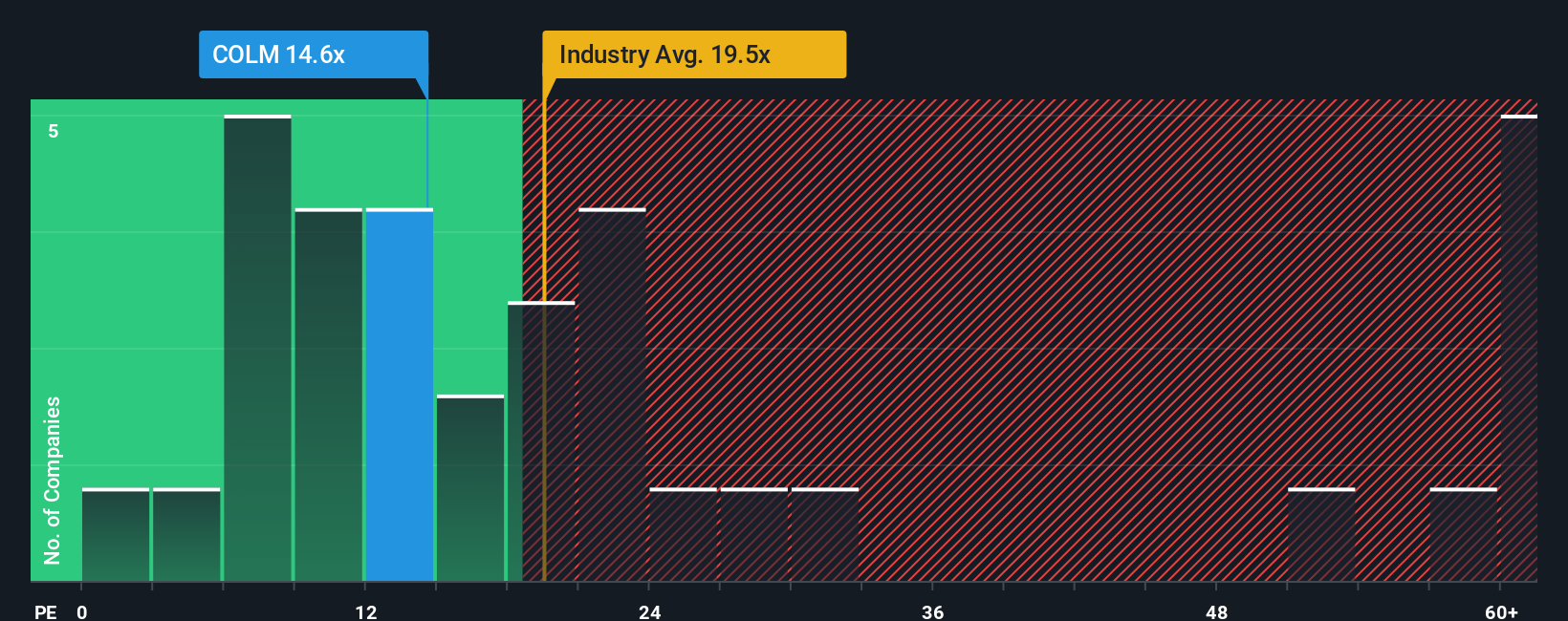

Looking through another lens, Columbia Sportswear trades at a price-to-earnings ratio of 15.5x. This is lower than the US Luxury industry average of 19.5x but higher than its peer group average of 13.6x. However, when compared to its fair ratio of 12.3x, the current valuation appears stretched. This opens up an important question for investors: Is the market pricing in too much optimism given recent challenges, or is there hidden value if the narrative shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Columbia Sportswear Narrative

If you’re looking to dig deeper or come to your own conclusions, you can build a data-driven narrative in just a few minutes. Do it your way.

A great starting point for your Columbia Sportswear research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that the best opportunities are not always in plain sight. Expand your reach and get ahead of the market by tapping into these targeted ideas:

- Uncover tomorrow’s big winners by searching for strong financials among these 3571 penny stocks with strong financials.

- Secure higher income potential by seeking out these 16 dividend stocks with yields > 3% and see which companies pay yields above 3%.

- Explore the future of healthcare innovation and find your edge with these 31 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLM

Columbia Sportswear

Designs, develops, markets, and distributes outdoor, active, and lifestyle products in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives