- United States

- /

- Commercial Services

- /

- NYSE:WM

Is Waste Management Still Attractive After 118% Five Year Rally?

Reviewed by Bailey Pemberton

If you’re wondering what to make of Waste Management’s stock right now, you’re in good company. The company’s performance over the past few years has been impressive, with shares up a jaw-dropping 117.6% over the past five years and a robust 43% in the last three. Even during the past twelve months, with some market choppiness, the stock managed a 4.9% gain. More recently, it has added 1.3% in just the last week, though there was a slight dip over the last month. That sort of steady long-term growth always makes investors and market watchers stop and ask, “Am I missing something, or is Waste Management’s success already fully baked into the stock price?”

Part of the enthusiasm can be traced to mounting awareness around sustainability initiatives. Waste Management is often linked with this theme, thanks to new investments in recycling and advanced waste sorting technologies. Some headlines have also focused on the company's expansion push, as it acquires smaller waste service firms to broaden its national reach. While these moves have helped shape perceptions of lower risk and future growth, the all-important question remains: does the current price offer room for further appreciation, especially given recent momentum?

On the value front, things get even more interesting. Waste Management scores a 2 out of 6 on a popular valuation checklist, suggesting it is not deeply undervalued, at least not across the board. Next, let’s break down exactly how the main valuation methods stack up for Waste Management, and later on, I’ll share a smarter way to get clarity on what the price really means for long-term investors.

Waste Management scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Waste Management Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and discounts them back to today's value to estimate what the business is intrinsically worth. For Waste Management, this involves forecasting how much cash the company will generate over the next decade and then adjusting those numbers to reflect their present value, using a 2 Stage Free Cash Flow to Equity approach.

Currently, Waste Management generates an impressive $2.19 Billion in Free Cash Flow. Analysts supply estimates for the next five years, with projections rising to $4.27 Billion by 2029. After that, further ten-year projections rely on extrapolations, but all figures remain in the billion-dollar range. These robust cash flows signal strong underlying business fundamentals.

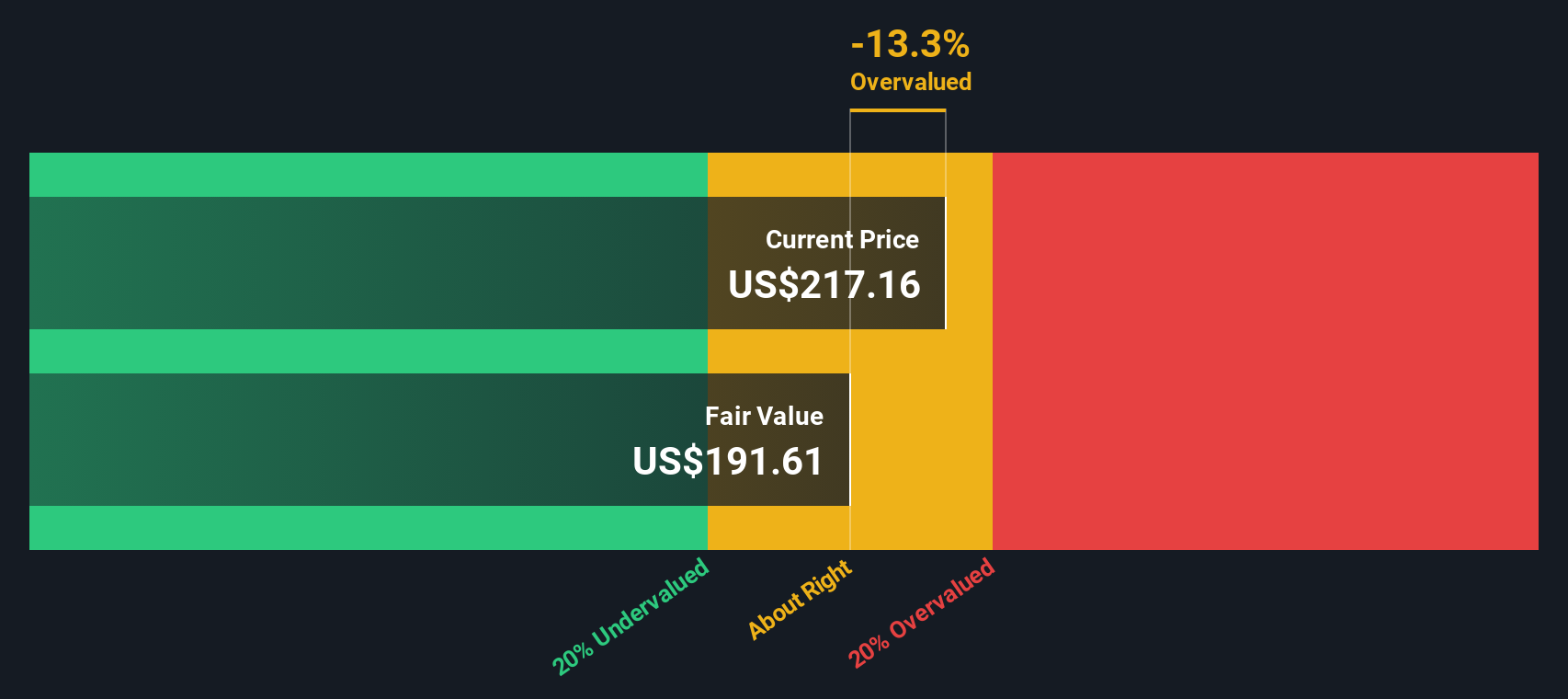

According to this DCF analysis, the resulting intrinsic value for Waste Management stands at $206.08 per share. However, with the stock currently trading around 4.9% above this estimate, the DCF suggests shares are slightly overvalued. This means that while the company’s long-term outlook is healthy, recent price momentum has actually pushed the shares just above fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Waste Management's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Waste Management Price vs Earnings

When valuing a well-established and profitable company like Waste Management, the Price-to-Earnings (PE) ratio is a go-to metric. PE ratios are particularly meaningful for mature businesses with stable, recurring profits, as they allow investors to gauge the price being paid for each dollar of earnings. This provides a direct measure of market expectations for future growth and risk.

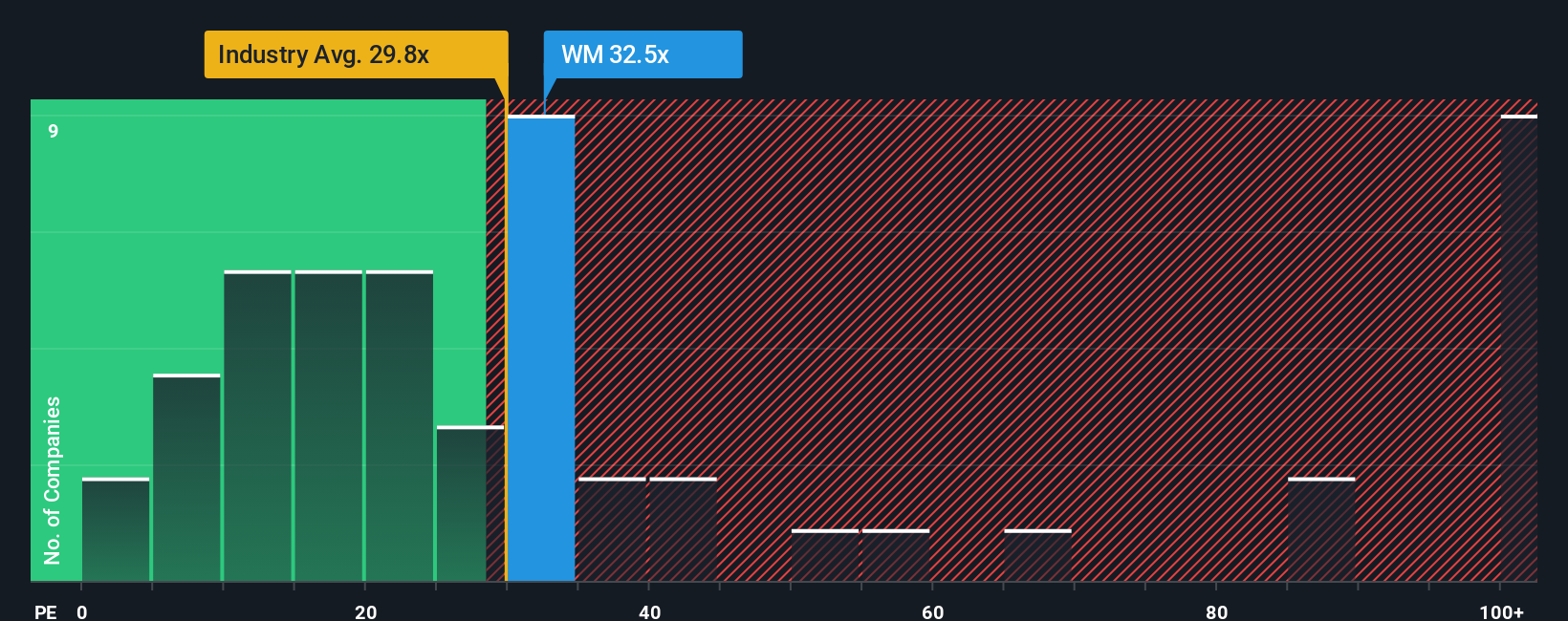

The “right” PE ratio for a company depends on its historic and expected growth, risk profile, and how it compares to similar businesses. Higher growth predictions and lower perceived risks typically warrant a richer multiple, while slower-growing or more volatile stocks tend to see lower ratios. Waste Management’s current PE ratio stands at 32x, which is above the Commercial Services industry average of 27.1x but sits well below the peer average of 47.7x. This suggests the market is pricing Waste Management at a moderate premium compared to its sector but not excessively so relative to other prominent players.

To get an even sharper sense of value, Simply Wall St’s “Fair PE Ratio” goes beyond these benchmarks. It considers unique factors for Waste Management, such as its underlying earnings growth, profit margins, business risks, and overall market cap, to determine what would be a reasonable multiple. This proprietary metric aims to provide a more tailored valuation, acknowledging that a straight comparison with peers or industry averages can overlook meaningful company-specific context. Waste Management’s Fair PE Ratio is estimated at 34.2x. Since the current PE ratio is just below this threshold, the stock appears appropriately valued based on its fundamental prospects and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Waste Management Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you link your perspective (the story you see unfolding for Waste Management) to a set of financial forecasts and your own estimate of fair value. Narratives transform complex financial models into approachable, story-driven insights, connecting your beliefs about the company’s future (like revenue growth, profit margins, or new risks and catalysts) directly to what you think the shares are worth.

Available right on the Simply Wall St Community page and used by millions of investors, Narratives make it easy to see how your outlook compares to others. As new information arrives, such as company news, fresh earnings announcements, or major industry updates, Narratives are dynamically updated, keeping you informed and agile. This means you can quickly sense-check whether Waste Management looks undervalued, fairly priced, or expensive for your story, and decide whether it feels like a time to buy, hold, or sell.

For example, right now the most optimistic investors set a Fair Value as high as $277.0, while the most cautious have it much lower at $198.0, so your Narrative can reflect your unique take based on the company’s prospects and recent developments.

Do you think there's more to the story for Waste Management? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives