- United States

- /

- Commercial Services

- /

- NYSE:WCN

Waste Connections (WCN): Revisiting Valuation After a Steady Share Price Grind Higher

Reviewed by Simply Wall St

Waste Connections Stock Outlook After Recent Moves

Waste Connections (WCN) has been quietly grinding higher, and the latest uptick offers a good excuse to revisit what investors are actually paying for with this steady compounder.

See our latest analysis for Waste Connections.

At around $177, the share price has been edging higher as investors lean into its steady earnings profile, and that modest upward trend lines up with a solid 3 year total shareholder return of 35.6 percent, suggesting momentum is quietly building rather than fading.

If Waste Connections has you thinking about dependable compounders, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

Yet with the stock hovering near record highs and trading at only a modest discount to analyst targets, the key question now is whether Waste Connections is still mispriced or if the market has already factored in its next leg of growth.

Most Popular Narrative: 13.6% Undervalued

With Waste Connections last closing at $177 and the most followed narrative pointing to fair value near $205, the story rests on ambitious profit and multiple assumptions.

Analysts expect earnings to reach $1.7 billion (and earnings per share of $6.62) by about September 2028, up from $643.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.4 billion.

If you are curious how this waste hauler earns a valuation usually reserved for fast growing platforms, and what kind of margin reset and earnings ramp that implies, you will want to see the full playbook behind this fair value call.

Result: Fair Value of $205 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, severe weather disruption or misfired acquisitions could quickly erode volumes and margins, forcing analysts to revisit both growth assumptions and valuation multiples.

Find out about the key risks to this Waste Connections narrative.

Another Lens on Valuation

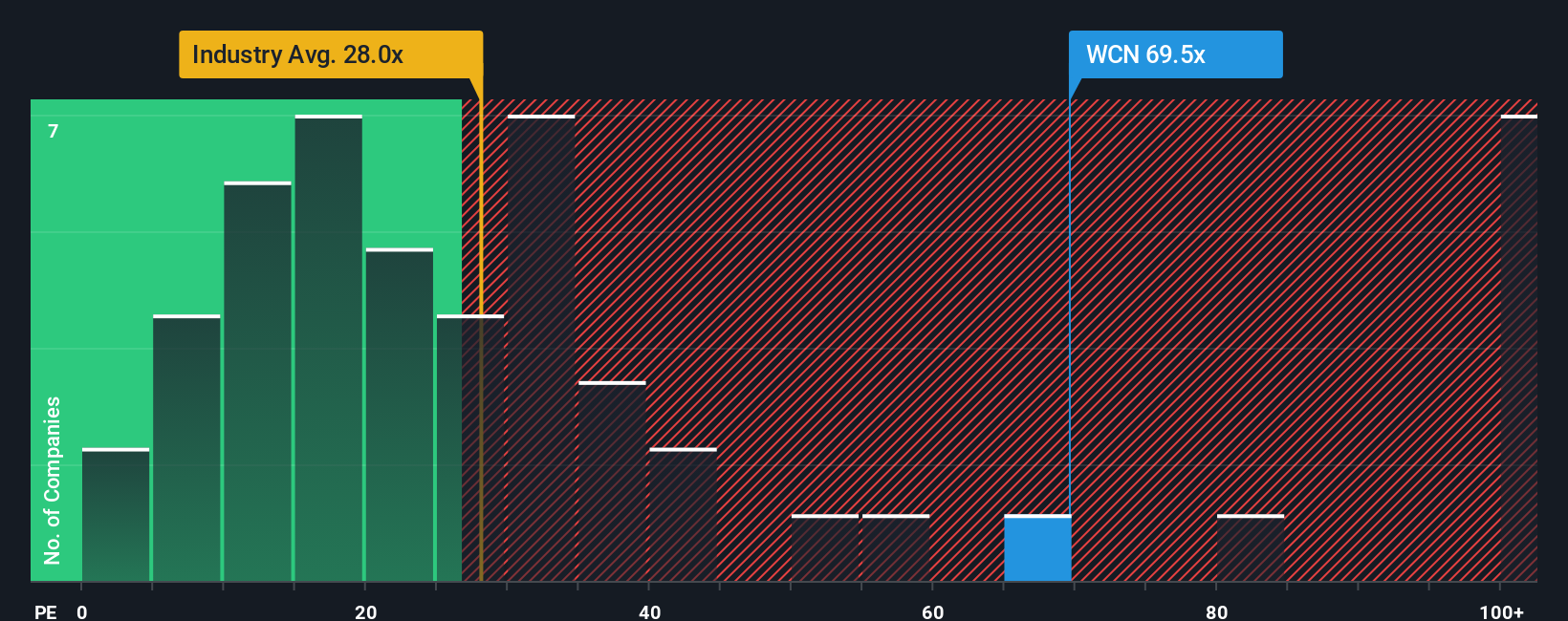

On simple earnings grounds, Waste Connections looks stretched. The stock trades on a price to earnings ratio of about 72.8 times, versus roughly 22.9 times for the US Commercial Services industry and 37.6 times for peers, well above a 35.5 times fair ratio our work suggests the market could gravitate toward. That gap signals meaningful de rating risk if growth or margins stumble. How comfortable are you paying up for this quality story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Connections Narrative

If you see the story differently or want to interrogate the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Waste Connections research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning targeted stock lists on Simply Wall St’s screener, where fresh ideas are already taking shape.

- Capture potential value rebounds by reviewing these 898 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Supercharge your growth watchlist by focusing on these 24 AI penny stocks positioned at the forefront of artificial intelligence adoption and innovation.

- Strengthen your income strategy with these 10 dividend stocks with yields > 3% that aim to deliver reliable cash payouts alongside solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waste Connections might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCN

Waste Connections

Provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada.

Low risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion