- United States

- /

- Commercial Services

- /

- NYSE:UNF

UniFirst (UNF) Margin Improvement Reinforces Stable Profitability Narrative

Reviewed by Simply Wall St

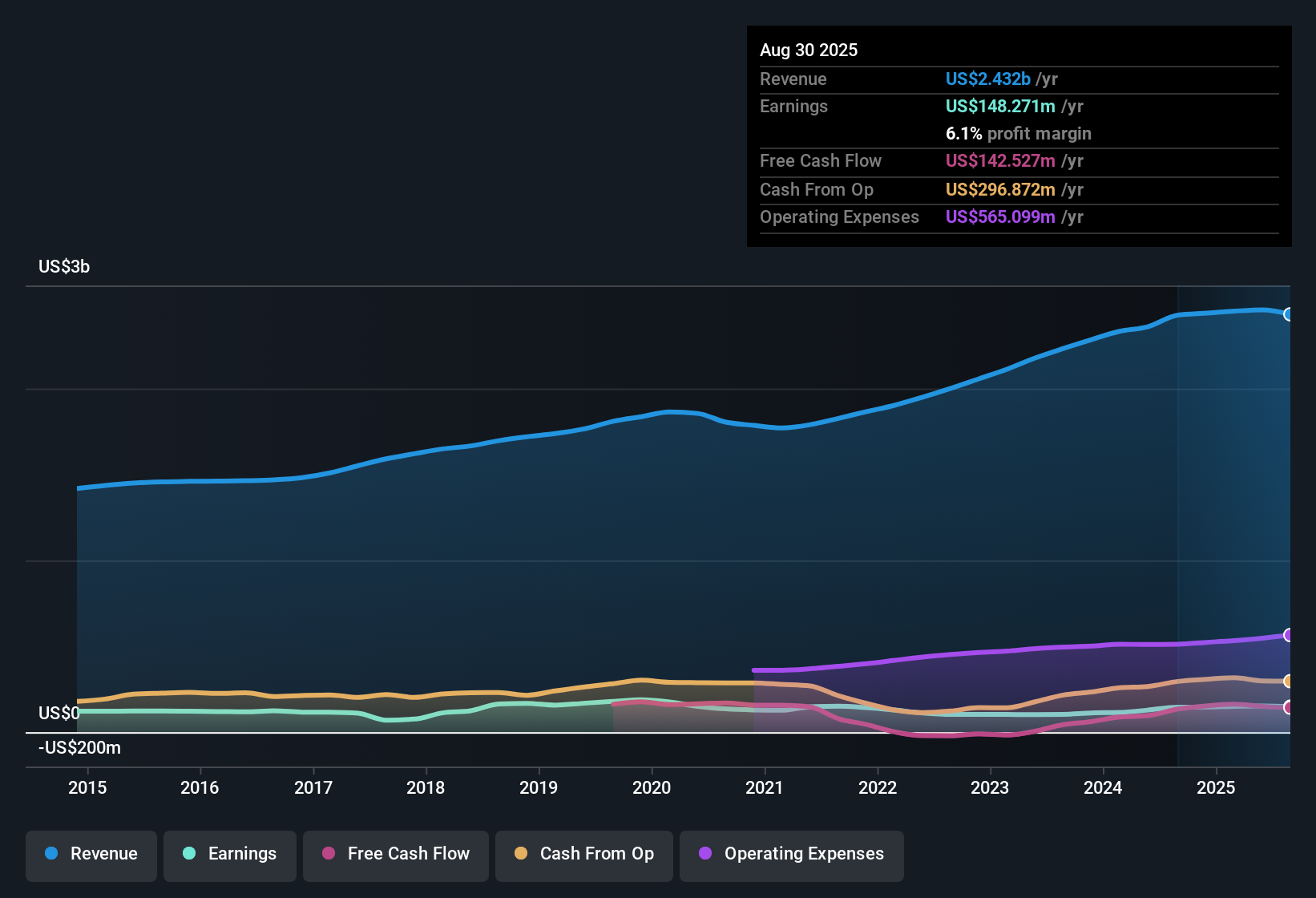

UniFirst (UNF) reported a current net profit margin of 6.1%, slightly higher than last year’s 6%. Earnings growth reached 2% over the past year, outpacing its five-year average increase of 1.4% per year. Looking ahead, the company is forecasting annual earnings growth of 2.4% and revenue growth of 3.2%, both of which remain well below broader US market expectations. With no notable risks flagged, investors may view this release as a sign of steady profitability and attractive value metrics within the sector.

See our full analysis for UniFirst.The next section puts these performance numbers in context, comparing them directly with the prevailing narratives investors follow most closely.

See what the community is saying about UniFirst

Tech Investments Aim to Boost Margins

- Analysts expect profit margins to rise from 6.2% today to 6.7% over the next three years, reflecting hopes that technology upgrades and operational changes will start to pay off.

- According to the analysts' consensus view, margin improvements in Core Laundry Operations and ongoing investment in ERP systems are set to drive future profitability gains, but those benefits may take time to fully materialize.

- Margin expansion is heavily reliant on ERP implementation, which is not projected to be fully realized until fiscal 2027.

- Consensus highlights that enhanced operational execution should help offset increased health care costs and competitive pricing pressure. However, the slow pace of benefit realization tempers near-term optimism.

- Bulls and bears find common ground on the need for patience. Recent investments may take years to lift UniFirst’s bottom line as much as expected. Want to see all the consensus arguments unpacked? 📊 Read the full UniFirst Consensus Narrative.

Price-to-Earnings Undercuts Industry

- UniFirst’s price-to-earnings ratio sits at 19.5x, noticeably lower than both its industry average of 26.8x and the peer group average of 37.1x. This suggests shares are valued more conservatively than many competitors.

- The analysts' consensus narrative points out that this P/E gap supports the valuation story: with a DCF fair value of $162.15 and a current share price of $155.90, the stock trades at a slight discount to estimated fair value, while the consensus analyst target of $165.50 projects a 6% upside from today’s price.

- This value gap draws attention to UniFirst’s potential as a sector outlier on pricing, especially for investors who believe operational improvements will lift earnings in coming years.

- However, the close proximity between current price and consensus target signals that the market sees the shares as reasonably valued right now, not deeply discounted or overvalued.

Revenue Growth Lags Market Hopes

- UniFirst's expected annual revenue growth of 3.2% trails the US market's 10% forecast, spotlighting a gap that persists even with efficiency and customer retention initiatives in place.

- The analysts' consensus view sees revenue growth headwinds despite internal improvements. While higher customer renewal rates and strategic pricing moves help retain existing business, softer new customer demand and delayed ERP implementation are expected to keep overall revenue growth behind market averages.

- Concerns remain that factors like declining net wearer levels and increased health care costs could further constrain sales momentum in the near term.

- Consensus thinks these challenges will require more than operational tweaks, pushing meaningful acceleration out several years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UniFirst on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different perspective on these results? Use your own insights to build a narrative in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding UniFirst.

See What Else Is Out There

UniFirst’s revenue growth is expected to remain sluggish and trails well behind broader market expectations, even with operational upgrades underway.

If you want to focus on companies delivering consistent revenue and earnings expansion, uncover steady performers with stable growth stocks screener (2089 results) right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNF

UniFirst

Provides workplace uniforms and protective work wear clothing in the United States, Europe, and Canada.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives