- United States

- /

- Commercial Services

- /

- NYSE:UNF

Should UniFirst's (UNF) Proxy Contest With Engine Capital Influence Investor Decision-Making?

Reviewed by Sasha Jovanovic

- On November 12, 2025, UniFirst Corporation filed a preliminary proxy statement with the SEC, urging shareholders to vote for management's board nominees and against those proposed by Engine Capital Management, LP, ahead of the company's Annual Meeting.

- This proxy contest underscores heightened investor activism at UniFirst, highlighting a potential shift in the company’s governance landscape that may attract further attention from shareholders and the market.

- We’ll now consider how this contested proxy vote and the resulting investor activism could affect UniFirst's investment case going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

UniFirst Investment Narrative Recap

To be a UniFirst shareholder, one needs to believe in the company’s ability to steadily grow through margin improvements, operational execution, and technological investments, despite a mature industry with modest growth. The recent proxy contest, while drawing attention to shareholder concerns, is not expected to materially affect the primary short-term catalyst, continued margin gains, nor does it substantially alter the most pressing risk: weakness in underlying customer demand as indicated by net wearer declines.

Of the recent company announcements, the latest quarterly earnings report stands out. While full-year results showed modest revenue and earnings growth, fourth-quarter figures reflected a dip in both sales and net income. These results serve as a reminder that fluctuations in customer demand and competitive pressures remain important near-term factors for UniFirst, even as longer-term investments continue.

However, investors should be aware that, as activist voices challenge management, the company’s ability to sustain customer levels could be tested by...

Read the full narrative on UniFirst (it's free!)

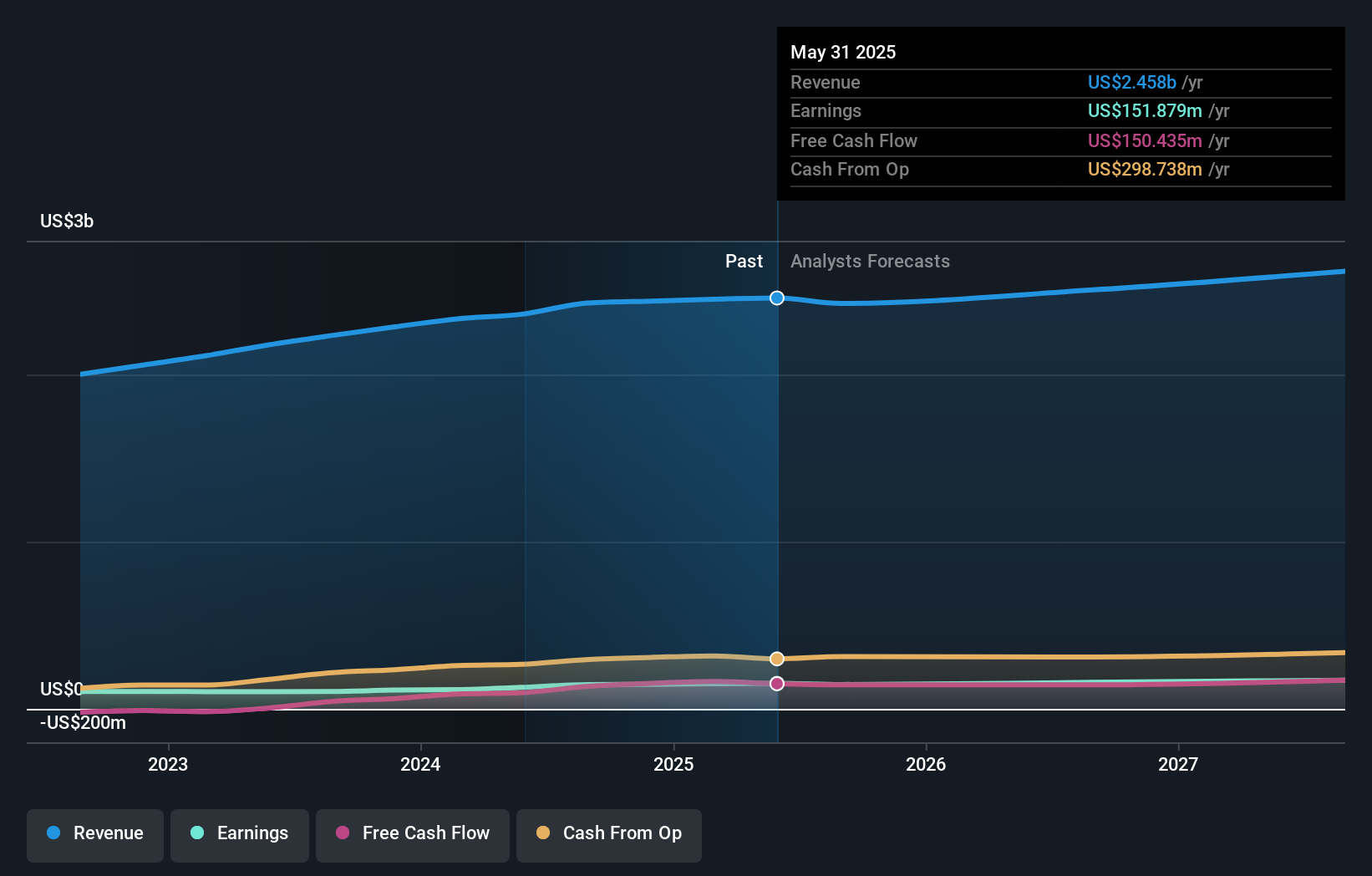

UniFirst's outlook anticipates $2.7 billion in revenue and $179.2 million in earnings by 2028. This is based on a 2.7% annual revenue growth rate and a $27.3 million increase in earnings from the current $151.9 million.

Uncover how UniFirst's forecasts yield a $165.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community contributed 2 fair value estimates for UniFirst ranging from US$165.50 to US$170.95 per share. Despite this tight spread, recent investor activism points to evolving governance challenges that could have broad implications for future performance, explore several viewpoints to inform your own perspective.

Explore 2 other fair value estimates on UniFirst - why the stock might be worth as much as 10% more than the current price!

Build Your Own UniFirst Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UniFirst research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free UniFirst research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UniFirst's overall financial health at a glance.

No Opportunity In UniFirst?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNF

UniFirst

Provides workplace uniforms and protective work wear clothing in the United States, Europe, and Canada.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives