- United States

- /

- Professional Services

- /

- NYSE:ULS

How Are Investors Responding to UL Solutions (ULS) Expanding Its Testing Facilities in Germany and Japan?

Reviewed by Sasha Jovanovic

- UL Solutions Inc. recently announced significant expansions, including a new laboratory in Neu-Isenburg, Germany, focused on advanced electromagnetic and wireless testing for industrial, medical, consumer, and automotive products, and a new motor energy efficiency laboratory in Japan serving the electric motor sector.

- These facility developments highlight UL Solutions' commitment to supporting evolving regulatory requirements and the energy transition, as well as enabling manufacturers in major markets to meet global standards with local testing resources.

- We'll examine how UL Solutions' expanded German facility for large-scale testing could alter its investment narrative and growth prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

UL Solutions Investment Narrative Recap

For those considering UL Solutions as a potential holding, the big picture reflects a business positioned to benefit from growing global regulatory complexity, energy transition demands, and the increasing need for local safety and compliance solutions. The recent laboratory expansion news spotlights their readiness to capture long-term growth, yet it does not materially change the most important short-term catalyst, robust recurring revenues from product certifications, nor does it reduce the biggest risk, which remains global macroeconomic uncertainty impacting customer budgets and innovation cycles.

Among the latest announcements, UL Solutions’ launch of a new motor energy efficiency laboratory in Japan stands out as closely related to their expansion efforts. This facility delivers localized support to Japanese manufacturers aiming to meet both local and international standards, enhancing UL Solutions’ global footprint and underscoring recurring revenue stability, the primary catalyst for continued financial strength.

In contrast, investors should be aware that even with expanded testing capacity, the unpredictability of global economic conditions could still affect demand for...

Read the full narrative on UL Solutions (it's free!)

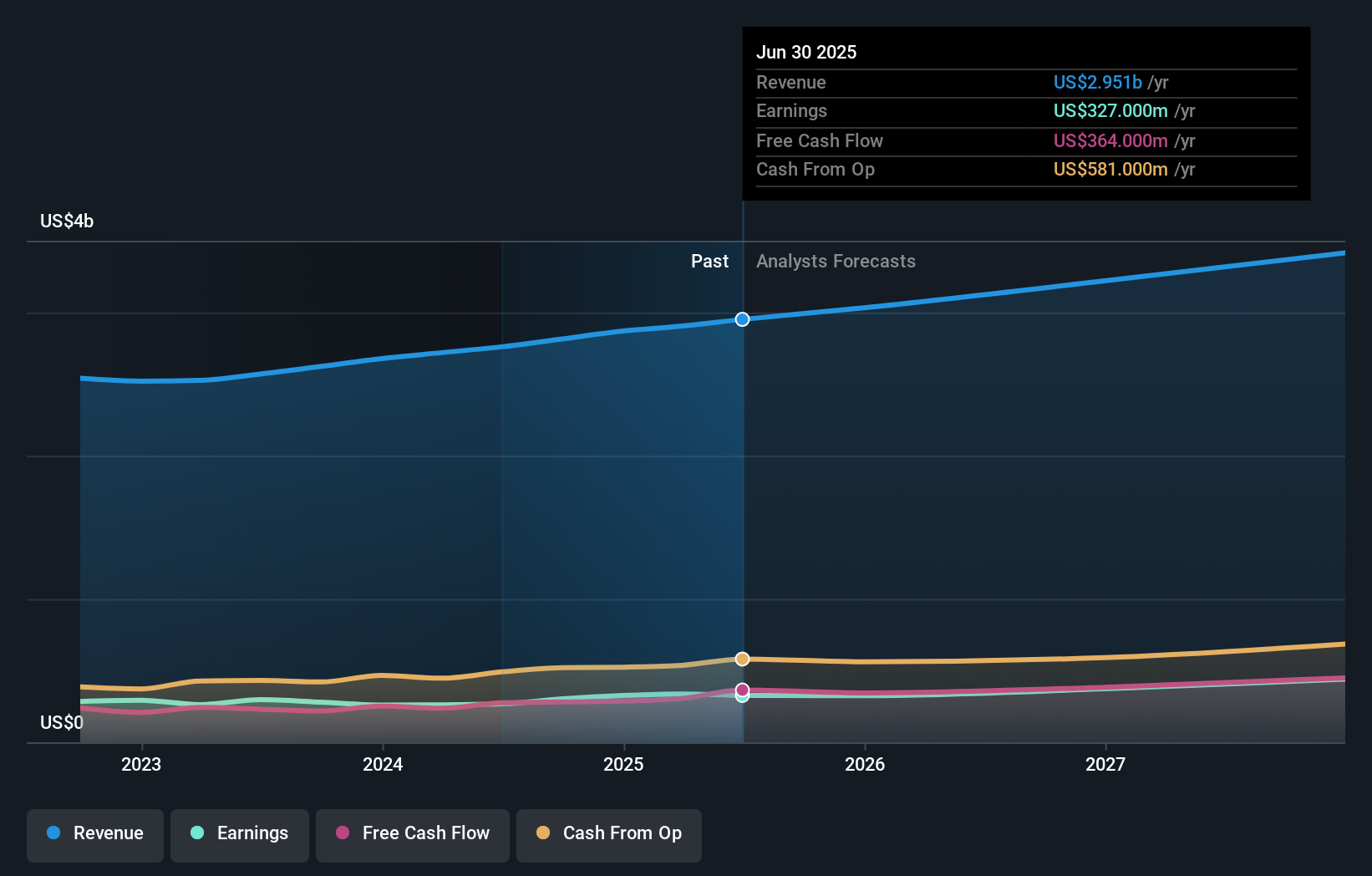

UL Solutions' outlook projects $3.5 billion in revenue and $477.8 million in earnings by 2028. This assumes 6.1% annual revenue growth and a $150.8 million increase in earnings from the current $327.0 million.

Uncover how UL Solutions' forecasts yield a $77.77 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for UL Solutions range from US$77.77 to US$80.89. While community views are tightly clustered, keep in mind that possible pressure on customer innovation and spend remains a factor for long-term performance and could prompt broad reassessment. Explore more views for balanced insight.

Explore 2 other fair value estimates on UL Solutions - why the stock might be worth 10% less than the current price!

Build Your Own UL Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UL Solutions research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free UL Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UL Solutions' overall financial health at a glance.

No Opportunity In UL Solutions?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ULS

UL Solutions

Provides testing, inspection and certification, and related software and advisory services worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives