- United States

- /

- Professional Services

- /

- NYSE:TNET

Will TriNet (TNET) Board Appointments Accelerate Its Push for Innovation and Stronger Governance?

Reviewed by Sasha Jovanovic

- TriNet announced that Janet Kennedy, a former Google Cloud executive, and Madhu Ranganathan, the ex-CFO of OpenText, joined its Board of Directors effective September 30, 2025.

- The new directors bring significant experience in technology transformation and financial operations, potentially signaling enhanced focus on innovation and corporate governance at TriNet.

- To assess the impact of these board appointments on TriNet's long-term outlook, we'll explore how the infusion of tech and finance expertise shapes its investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

TriNet Group Investment Narrative Recap

To own TriNet Group stock, you need to believe in the company's ability to grow recurring revenue by helping businesses handle complex workforce regulations, even as pressures from healthcare cost inflation and client workforce trends create ongoing headwinds. The addition of Janet Kennedy and Madhu Ranganathan to the board may support TriNet’s long-term innovation and governance, but is unlikely to materially shift the near-term catalyst of margin improvement or address the most significant risk around slowing client hiring and retention right now.

Among TriNet’s recent announcements, the launch of new AI-powered HR products and enhanced onboarding solutions stands out as most relevant here. These initiatives align with a broader push towards technology-driven operating leverage, directly tied to the catalysts of margin expansion and efficiency that remain central for shareholders evaluating the impact of new board expertise.

However, with higher health plan costs still weighing on both new business and retention, investors should be aware that continued fee increases could threaten...

Read the full narrative on TriNet Group (it's free!)

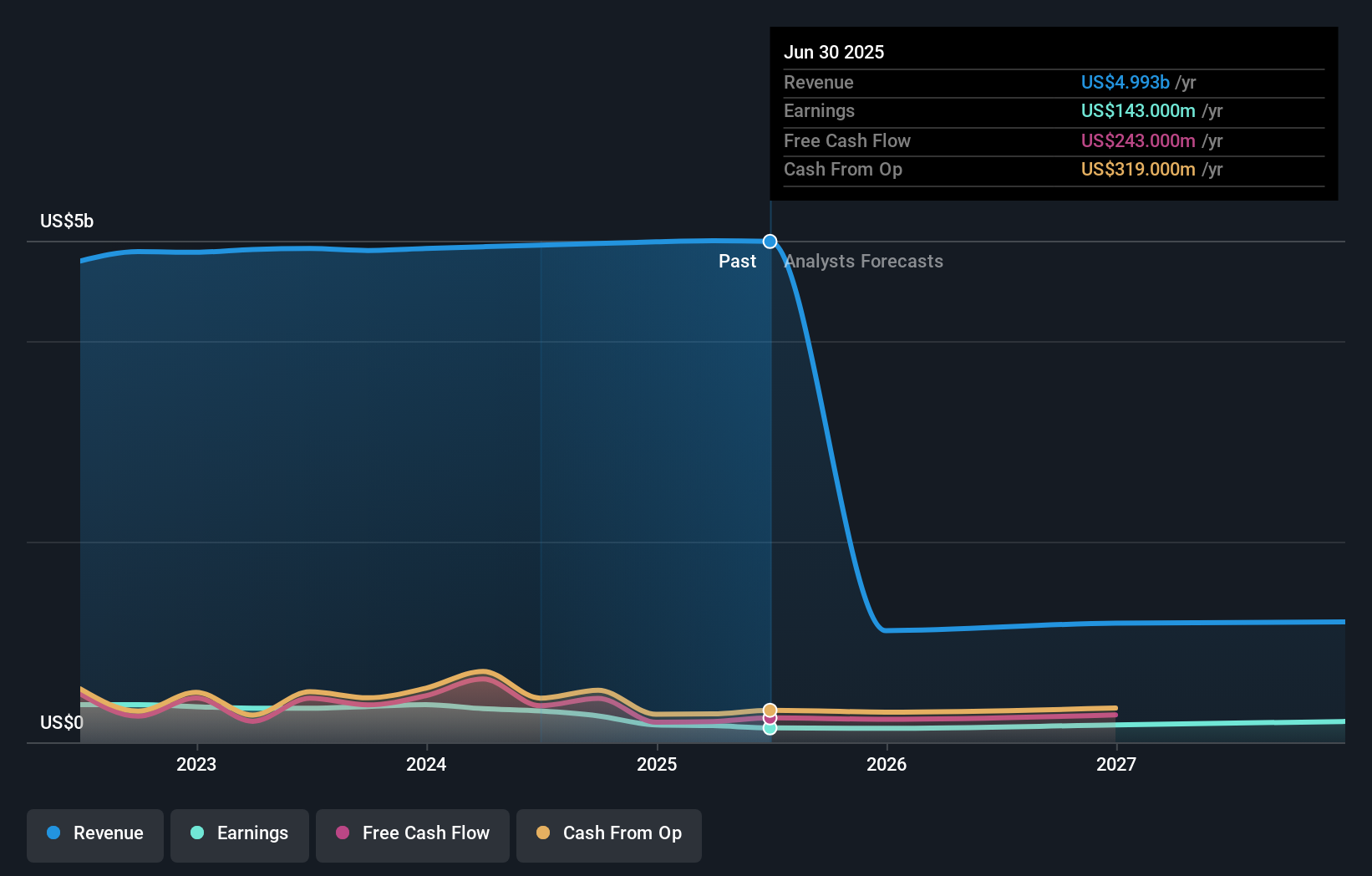

TriNet Group's narrative projects $408.0 million in revenue and $220.2 million in earnings by 2028. This requires a 56.6% yearly decline in revenue, but an increase of $77.2 million in earnings from the current $143.0 million.

Uncover how TriNet Group's forecasts yield a $78.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimated TriNet’s fair value between US$61.85 and US$78. Even with this range, customer retention concerns may shape long-term growth, so review different market viewpoints before making any decisions.

Explore 2 other fair value estimates on TriNet Group - why the stock might be worth as much as 25% more than the current price!

Build Your Own TriNet Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriNet Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TriNet Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriNet Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TriNet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNET

TriNet Group

Provides comprehensive and flexible human capital management services for small and medium size businesses in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion