- United States

- /

- Professional Services

- /

- NYSE:TIC

TIC Solutions (TIC): Assessing Valuation After Recent $256 Million Shelf Registration

Reviewed by Simply Wall St

TIC Solutions (TIC) has just closed a shelf registration amounting to $256 million, issuing over 20 million shares of common stock. Actions like this can reshape the company’s capital base and impact how the market values its shares.

See our latest analysis for TIC Solutions.

This new share issuance comes after a bumpy run for TIC Solutions, with the share price up more than 20% over the past 90 days but still down 10.6% year-to-date. Recent capital moves and price swings suggest investors are weighing both new opportunities and increased risks around the stock’s future.

If you’re curious where momentum and growth stories might be building next, now is a great time to discover fast growing stocks with high insider ownership

With shares still trading almost 30% below analyst targets and recent profits under pressure, the crucial question is whether TIC Solutions is trading at a bargain or if the market has already factored in all future growth potential.

Most Popular Narrative: 29.7% Undervalued

The latest narrative values TIC Solutions nearly 30% higher than its last close, signaling that current prices may not reflect the company's bullish outlook. To understand this premium, consider where the business is now positioned and what market tailwinds might be in play.

The combination with NV5 significantly broadens Acuren's end-market exposure (including faster-growth verticals such as data centers and infrastructure) and enhances cross-selling potential for turnkey, integrated inspection and engineering solutions. This is likely to drive higher future revenue and margin expansion.

Want to know what’s fueling this upside? Behind the headline is a bold forecast. Analysts expect breakout rates of growth and margin expansion rarely seen in established industries. The secret drivers behind that valuation might surprise you. Unlock the forecast details fueling this number.

Result: Fair Value of $15.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration challenges and rising debt levels remain key risks. These factors could quickly alter the current outlook for TIC Solutions.

Find out about the key risks to this TIC Solutions narrative.

Another View: Market Ratios Send Mixed Signals

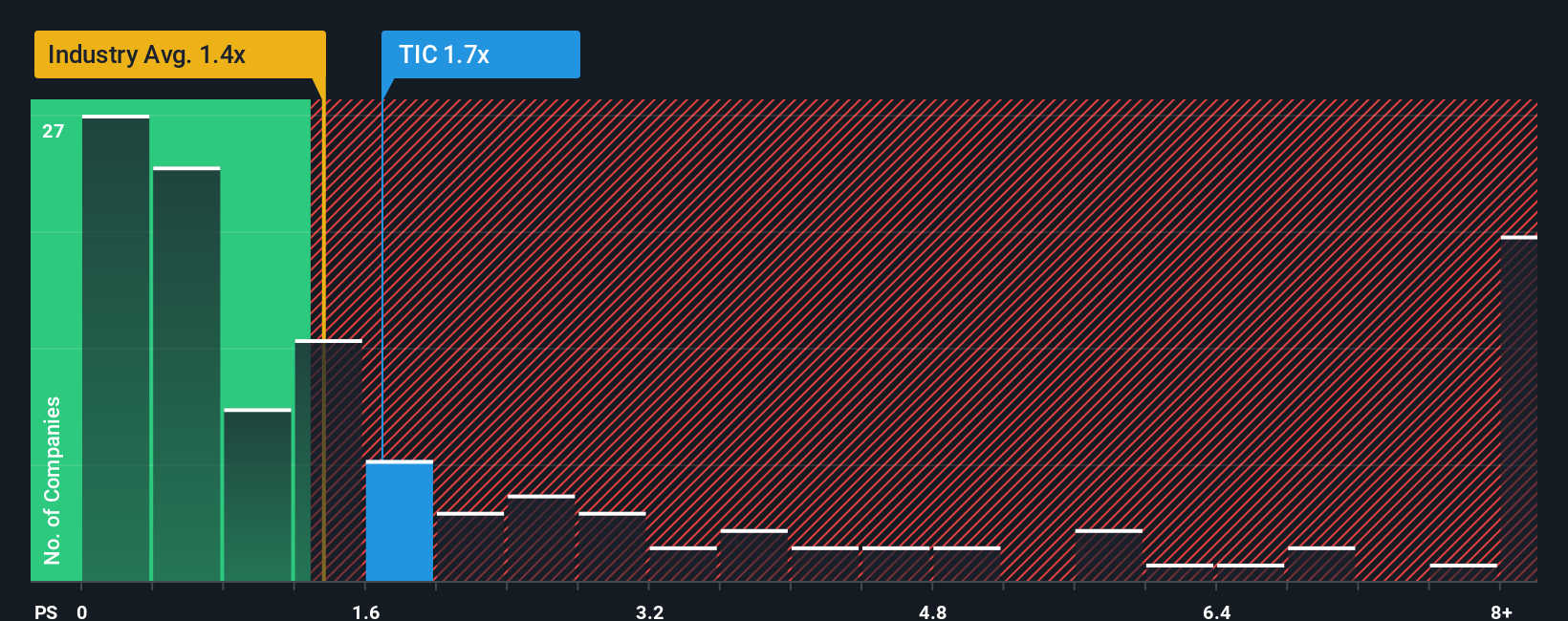

Taking a closer look through the lens of the price-to-sales ratio, TIC Solutions trades higher than both its industry and peer averages, at 2.2x versus 1.4x and 1.5x, respectively. Even so, its ratio is close to the fair ratio of 2.3x, hinting that the market might be catching up, or could swing further. Which signal should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TIC Solutions Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your TIC Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let momentum pass you by. Supercharge your watchlist with fresh opportunities by targeting unique corners of the market using these trusted tools.

- Tap into powerful growth stories and accelerate your search for top performers when you use these 25 AI penny stocks, which drive innovation in artificial intelligence and machine learning.

- Build stability into your portfolio by checking out these 16 dividend stocks with yields > 3%, which consistently deliver generous yields above 3%.

- Seize market mispricings and gain the edge by scanning these 876 undervalued stocks based on cash flows, based on proven cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TIC Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TIC

TIC Solutions

Provides critical asset integrity services in North America.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives