- United States

- /

- Professional Services

- /

- NYSE:TIC

Assessing Acuren (NYSE:TIC) Valuation as Shares Surge 21% on Earnings and Revenue Growth

Reviewed by Kshitija Bhandaru

See our latest analysis for Acuren.

Acuren’s share price momentum has really picked up lately, with the price climbing more than 20% over the past month as investors respond to steady annual revenue gains and a sharp turnaround in earnings. This recent run builds on cautious optimism and hints at possible longer-term improvement if these trends hold.

If you’re thinking about what other opportunities might be emerging, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With Acuren’s share price now close to analyst targets after a major run, the big question is whether there is still further upside or if the market is already factoring in the company’s growth story.

Most Popular Narrative: 5% Undervalued

The most widely followed narrative points to a fair value of $14.50 for Acuren, just above its last close of $13.75. This narrow difference signals cautious optimism about the stock’s future pricing and shines a light on the assumptions driving this target.

The combination with NV5 significantly broadens Acuren's end-market exposure (including faster-growth verticals such as data centers and infrastructure) and enhances cross-selling potential for turnkey, integrated inspection and engineering solutions, which is likely to drive higher future revenue and margin expansion.

This fair value is not built on guesswork. Beneath the surface, impressive revenue and profit transformation, amplified by bold integration synergies, shape this high-conviction projection. Want to know how aggressive growth and margin forecasts power this price target? Read on. The financial blueprint may surprise you.

Result: Fair Value of $14.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated leverage from the NV5 acquisition and recent margin compression could quickly change the outlook if anticipated synergies or revenue growth do not materialize.

Find out about the key risks to this Acuren narrative.

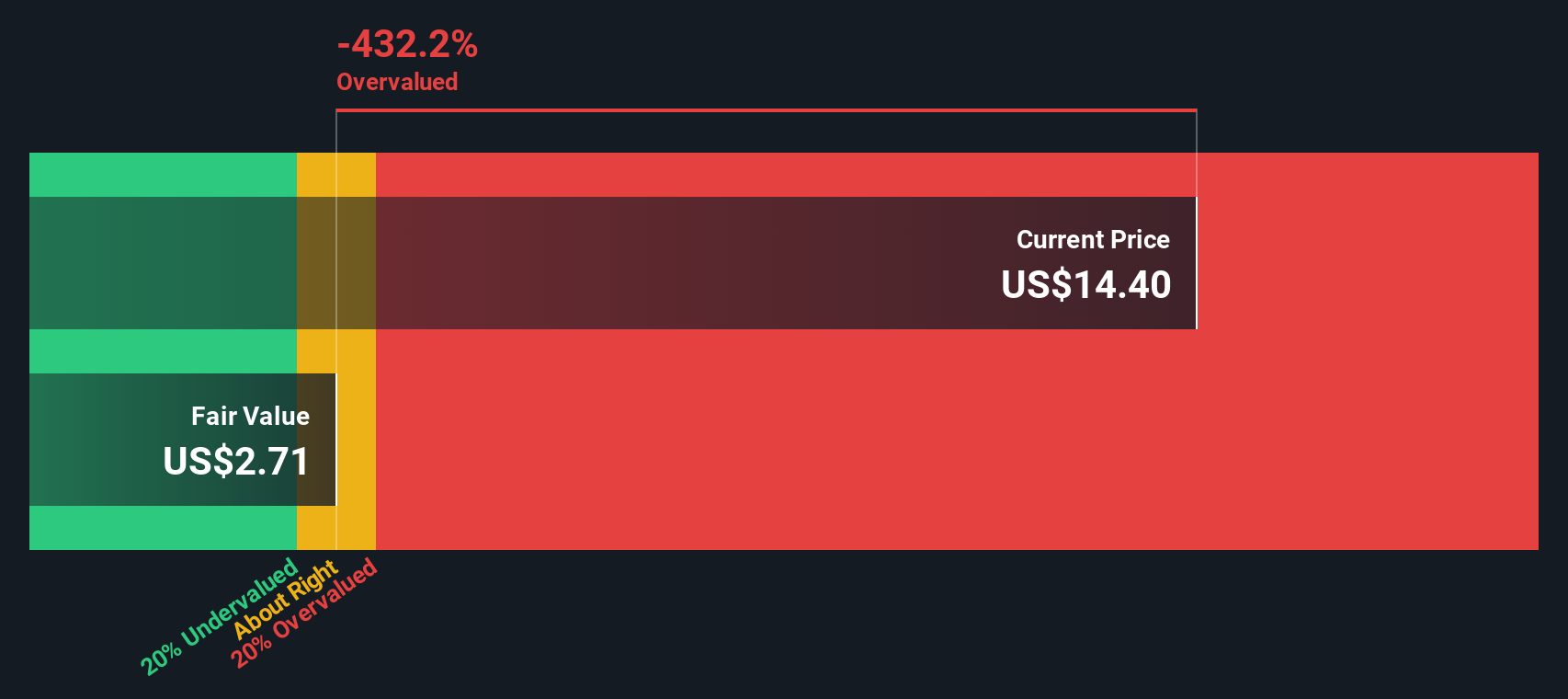

Another View: SWS DCF Model Suggests Overvaluation

While analyst forecasts paint Acuren as slightly undervalued, the SWS DCF model draws a different conclusion. Based on its future cash flow potential, the DCF model values the stock much lower than its current price. This implies it may be overvalued if reality falls short of those growth projections. Could the market be overlooking some risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Acuren Narrative

If you have your own perspective or want to dig deeper into the numbers, you’re free to run the analysis yourself in just a few minutes, and Do it your way.

A great starting point for your Acuren research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize your edge and expand your watchlist with high-potential stocks that many investors overlook to get ahead of the next wave in market trends.

- Boost your search for outsized returns by targeting these 3575 penny stocks with strong financials with robust financials and untapped upside.

- Position yourself in tomorrow’s technology by evaluating these 25 AI penny stocks that are transforming industries with AI breakthroughs and real-world application.

- Lock in potential bargains by selecting from these 892 undervalued stocks based on cash flows that meet strict value and cash-flow criteria.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TIC Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TIC

TIC Solutions

Provides critical asset integrity services in North America.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives